Drowning in DDQs - Tanya Carmichael / ESGTree Podcast Interview

Share:

We had an insightful conversation with Tanya Carmichael, ESGTree’s Advisory Board Member, ex-Head of Global Funds Private Capital at Ontario Teacher’s Pension Plan (OTPP) and ex-Chair of the Institutional Limited Partners Association (ILPA). In our candid talk below, Tanya shares her thoughts about ESG integration, reporting and how LPs can prevent GPs from drowning in due diligence questionnaires (DDQs).

According to PwC and Harvard, 81% of institutional investors in the US plan to increase their allocations to ESG products over the next two years, almost on par with Europe (83.6%).

This would effectively more than double the ESG AUM in the US, over a five year period, from US$4.5 trillion in 2021 to US$10.5 trillion in 2026. This is forecasted despite the complexities of administrations changes and some state governments continuing to push back on ESG (https://corpgov.law.harvard.edu/2022/11/17/exponential-expectations-for-esg/)

So how can the friction between institutional investors (limited partners) and private equity firms (general partners) be reduced, while leveraging technology solutions to improve efficiency and reduce cost?

Tanya answers this question from her long-standing role as both investor and convener, offering a unique perspective on this prevalent problem.

ESGTree's Report on Limited Partner (LP) Due Diligence Questionnaires (DDQs)

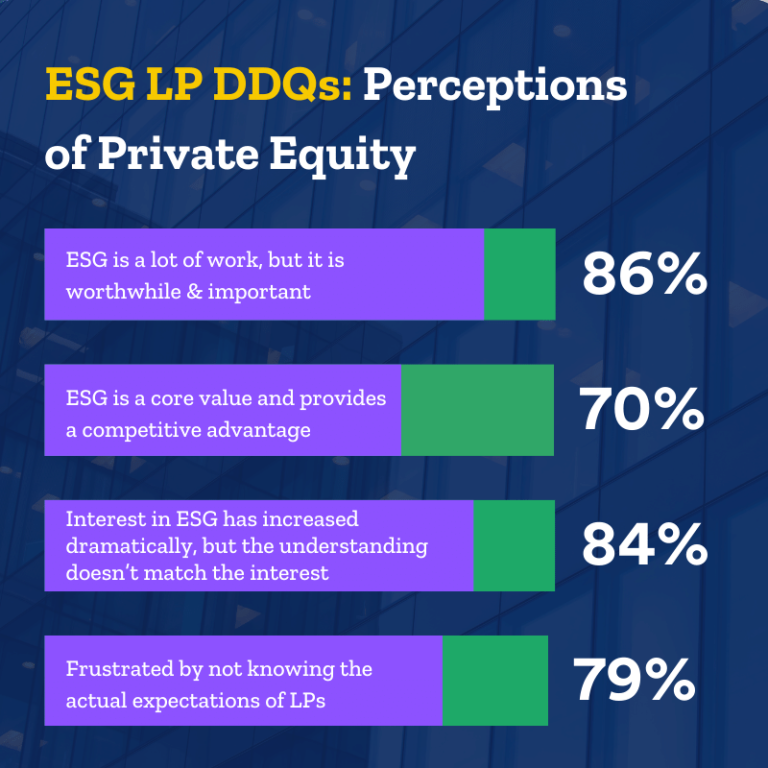

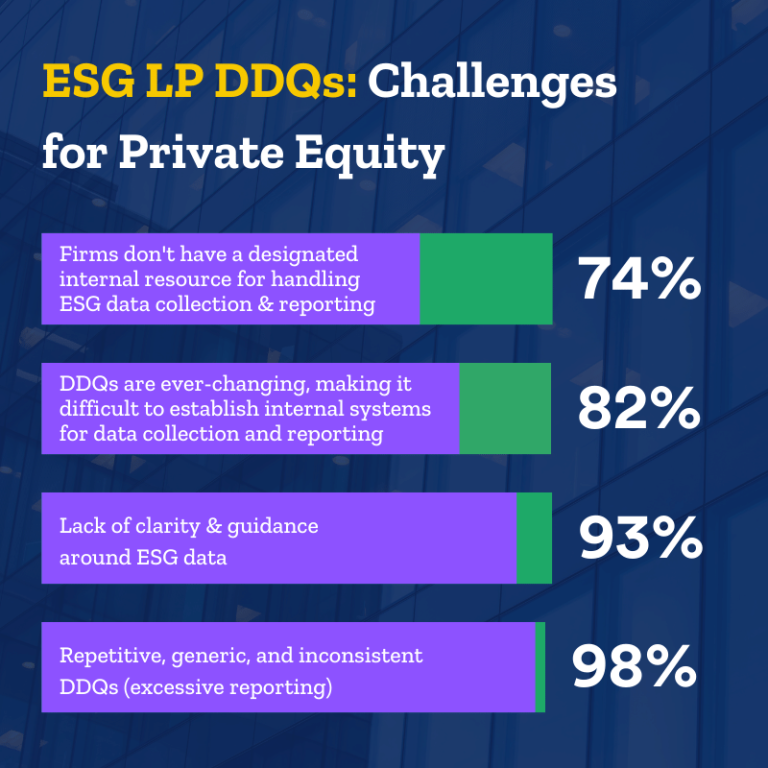

We interviewed General Partners (GPs) from several private equity firms & published a Report on the challenges they experience with LP DDQs. Opportunely, our proprietary software not only bridges the gaps that GPs experience, but its in-built collaboration tools allow for easy access to synthesized data across departments to drive the necessary organizational shifts to harness the power of ESG.

About ESGTree:

ESGTree provides powerful cloud-based data solutions to help private equity (PE) and venture capital (VC) firms gather, collect, analyze, benchmark and report their ESG data and that of their portfolio companies. Our carbon calculator, customizable and automated ESG frameworks, multi-level report viewing, trends analysis dashboard, and other features turn ESG into a value creation tool rather than a reporting burden.

Why ESGTree? – Differences that Make a Difference

Who Should the Economy Really Serve?

What We’ve Learned Automating the ESG Data Convergence Initiative (EDCI) for Clients

What Does the Rise of ESG Mean for Impact Investing?

Contact Us

Contact Us

Office Addresses

Canada: ESGTree, CPA 4th Floor, 140 West mount Rd N, Waterloo,

ON N2L 3G6, Canada

United Kingdom: ESGTree, 33 Queen Street, London EC4R 1AP, United Kingdom