Technology | Advisory | Automation

Automated ESG Reporting and Compliance for investors building a better world

Streamline sustainability workflows to facilitate investor relations and portfolio value creation

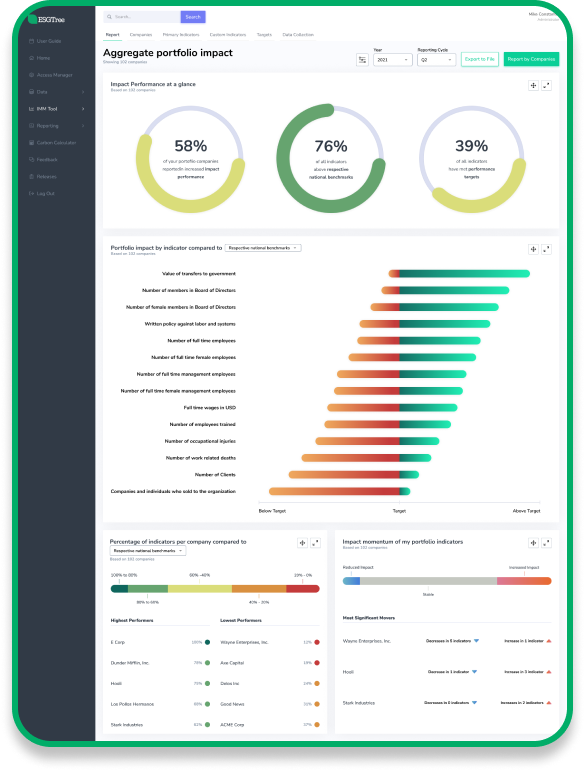

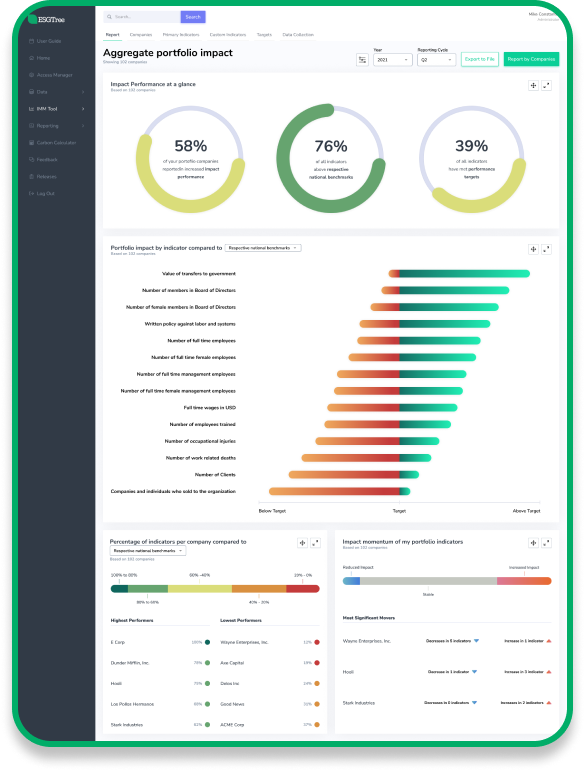

Collect data to get compliant, compare against benchmarks to assess performance, and create reports to satisfy investor needs

Collect data to get compliant, compare against benchmarks to assess performance, and create reports to satisfy investor needs

Data Collection

Automated data collection to avoid time wasted in followups

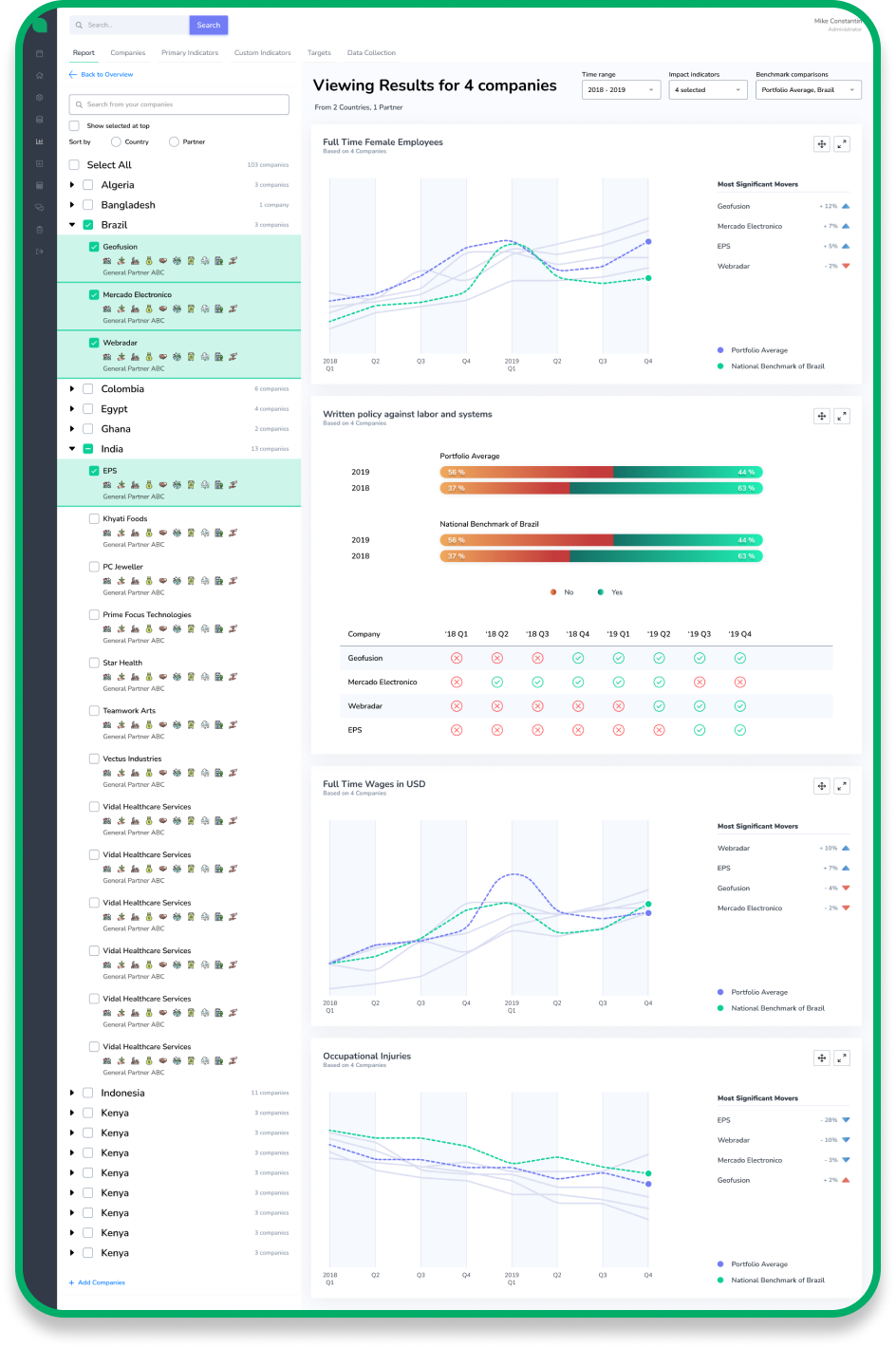

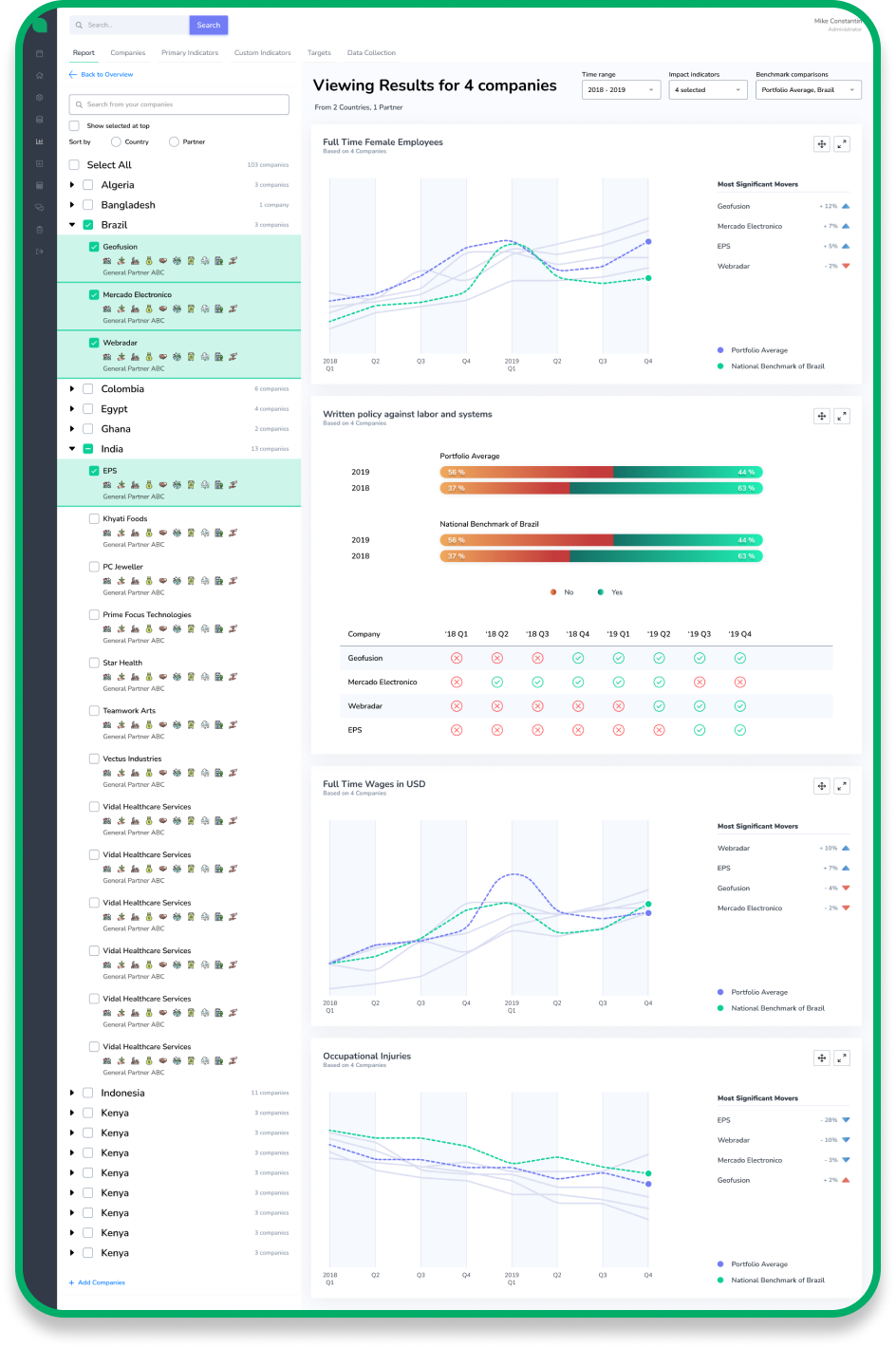

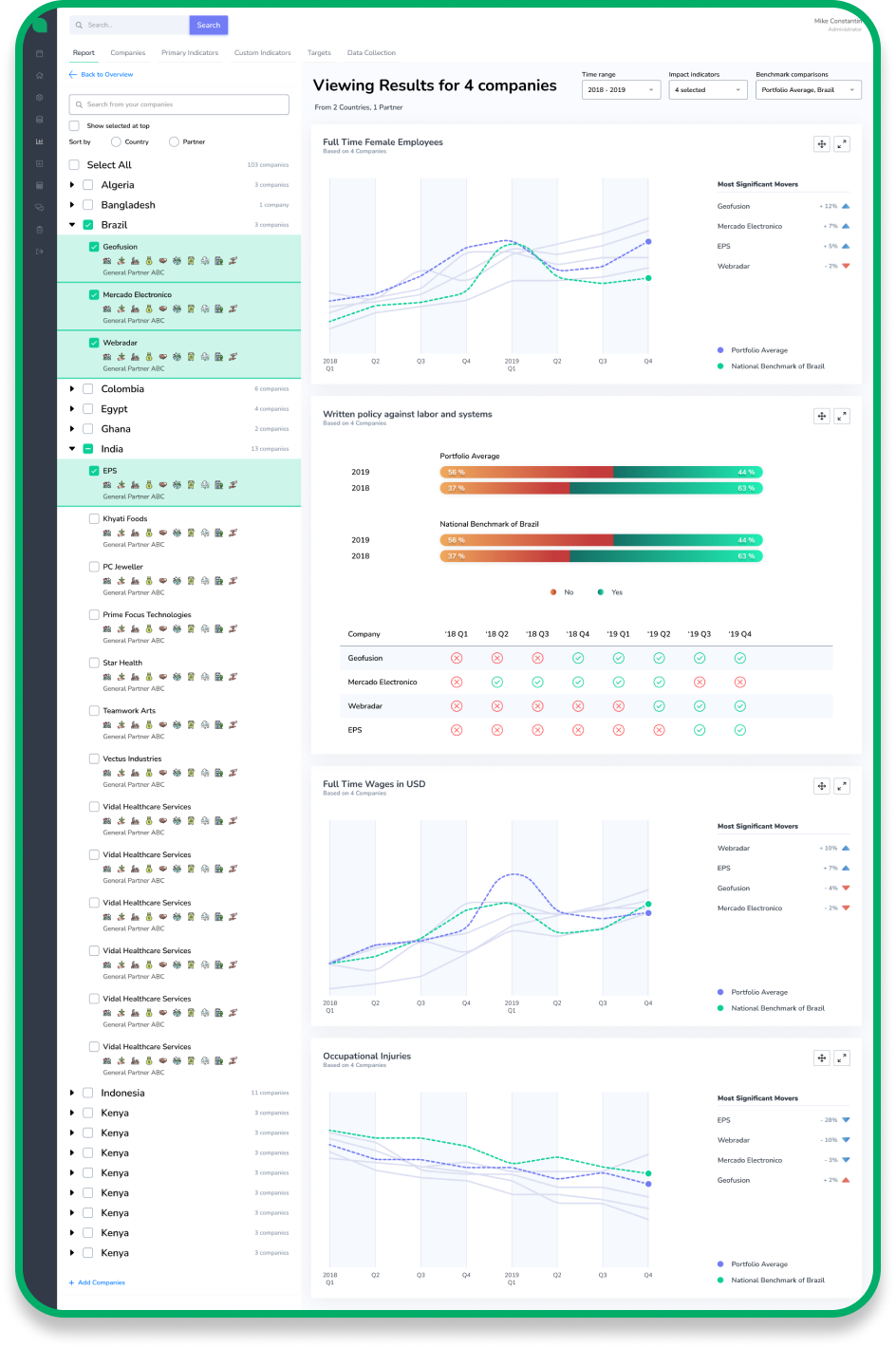

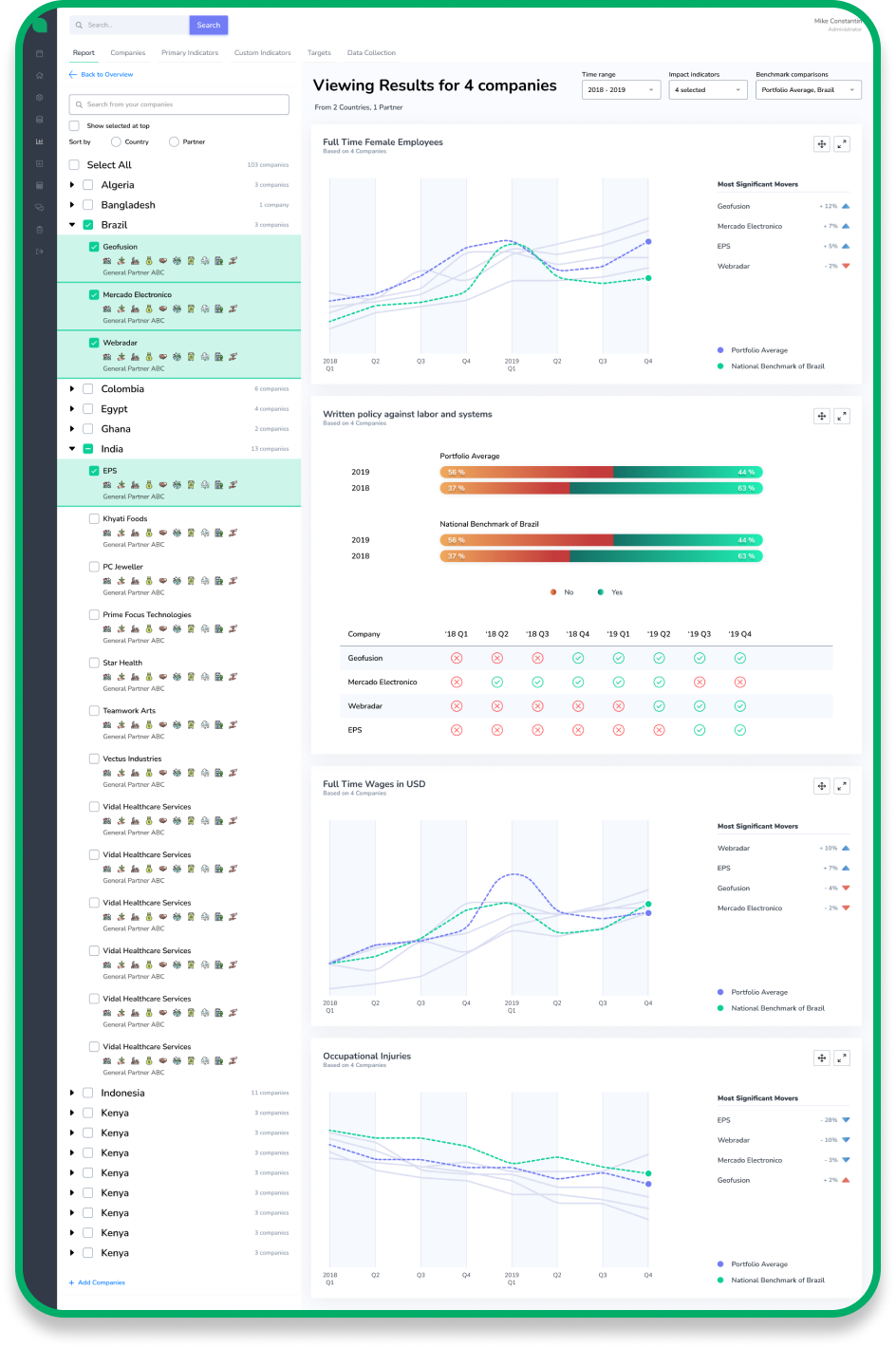

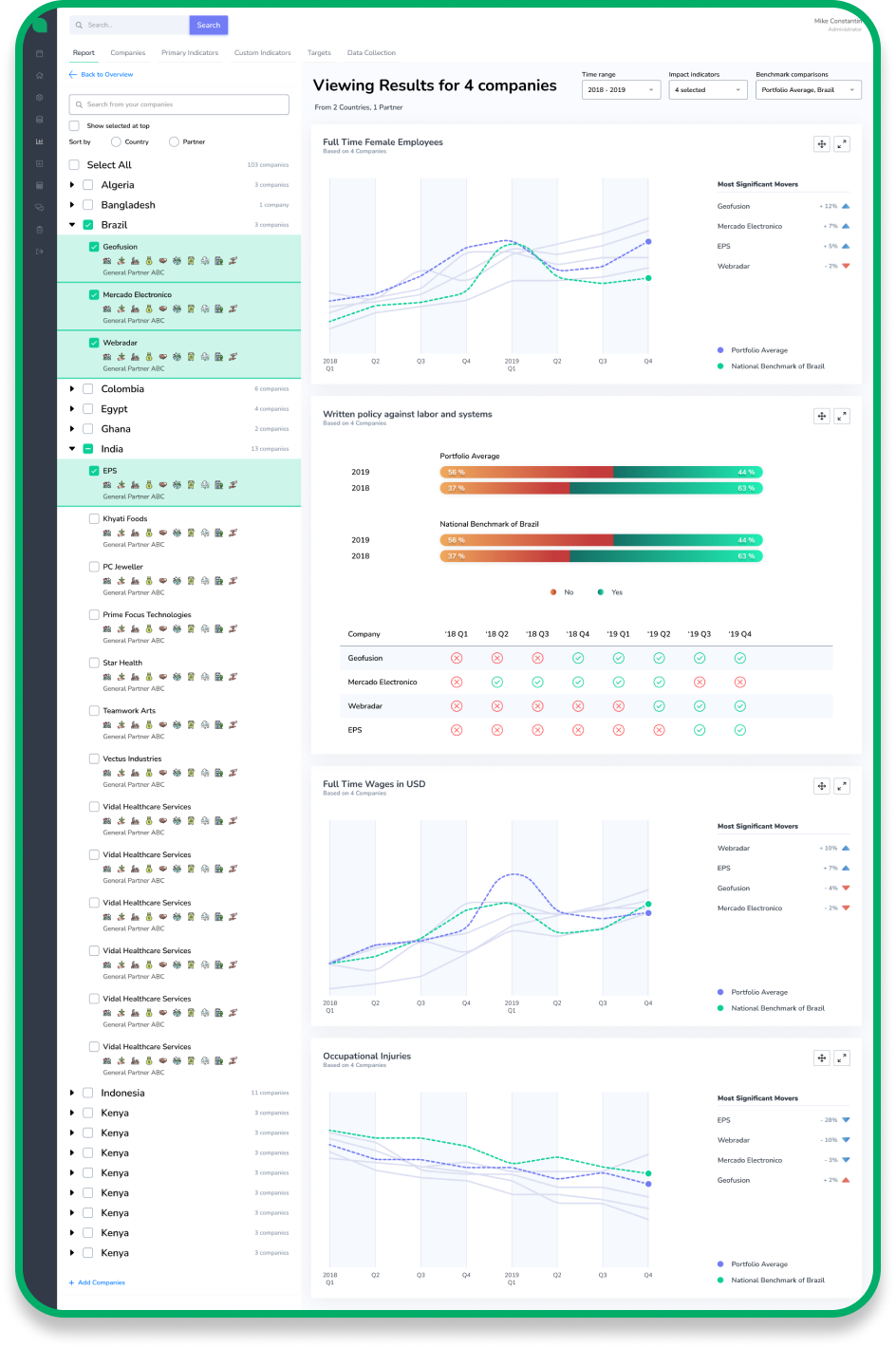

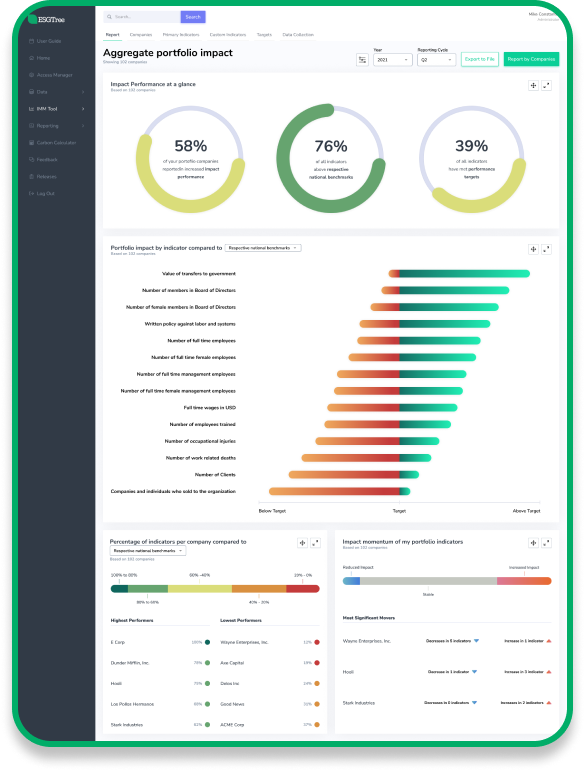

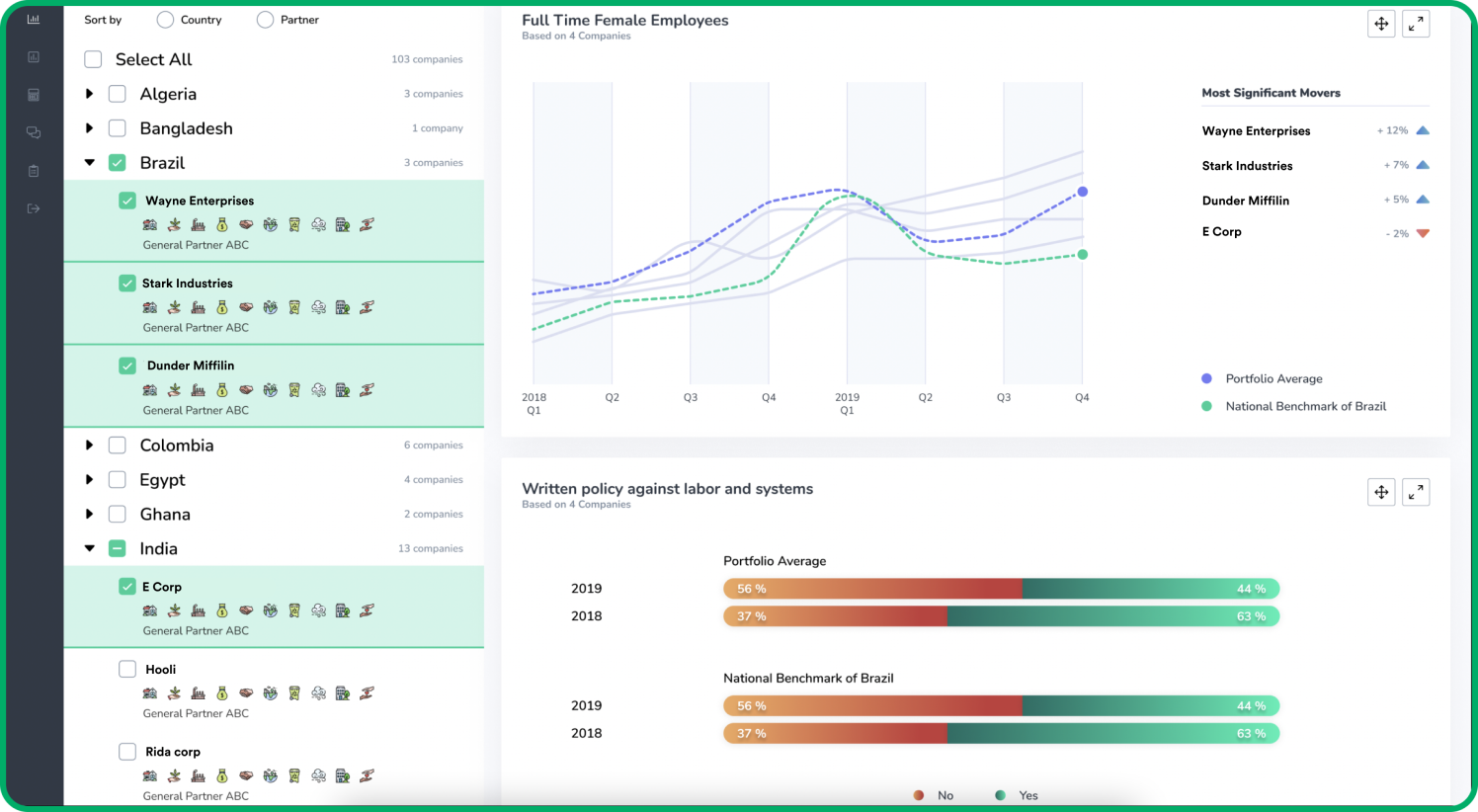

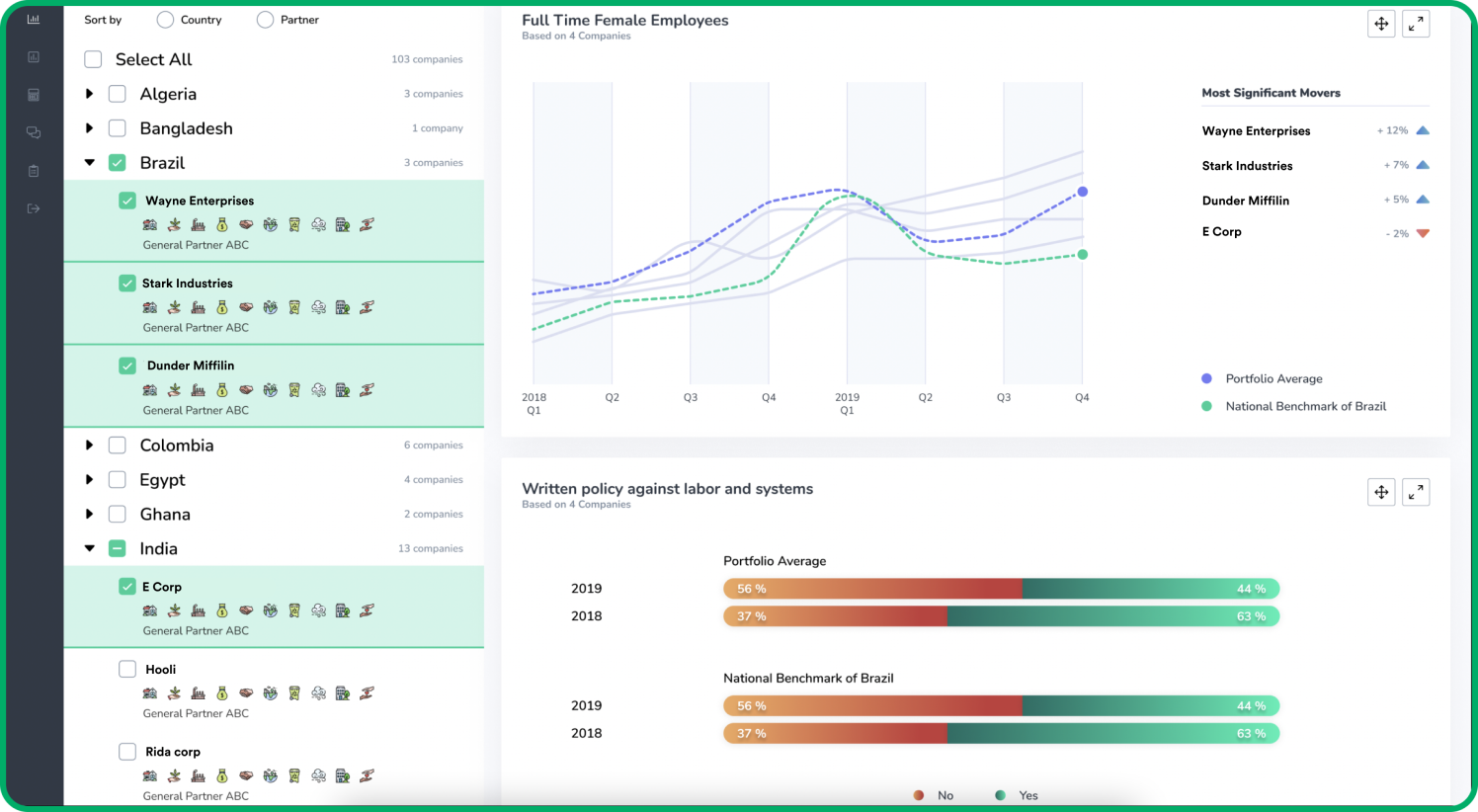

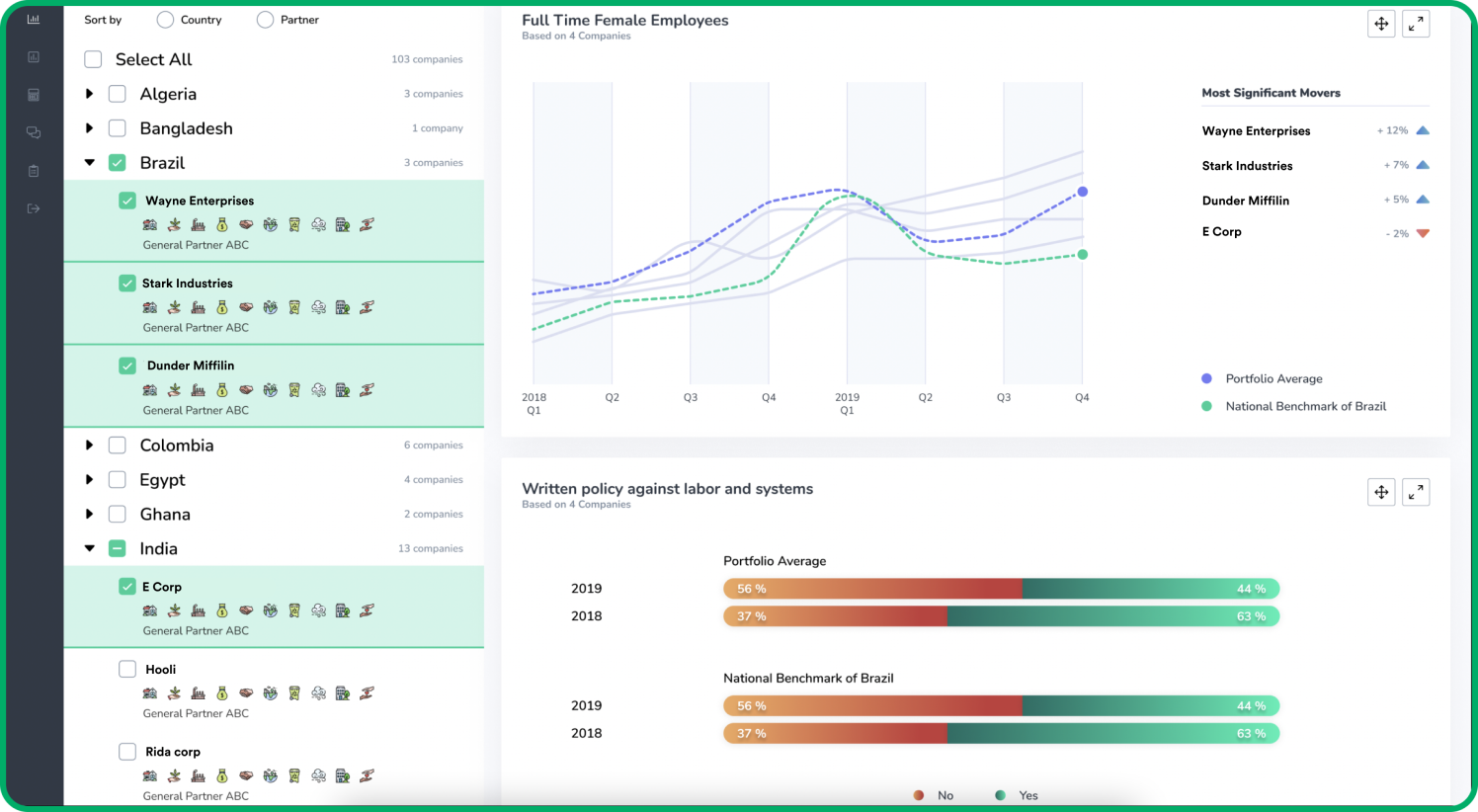

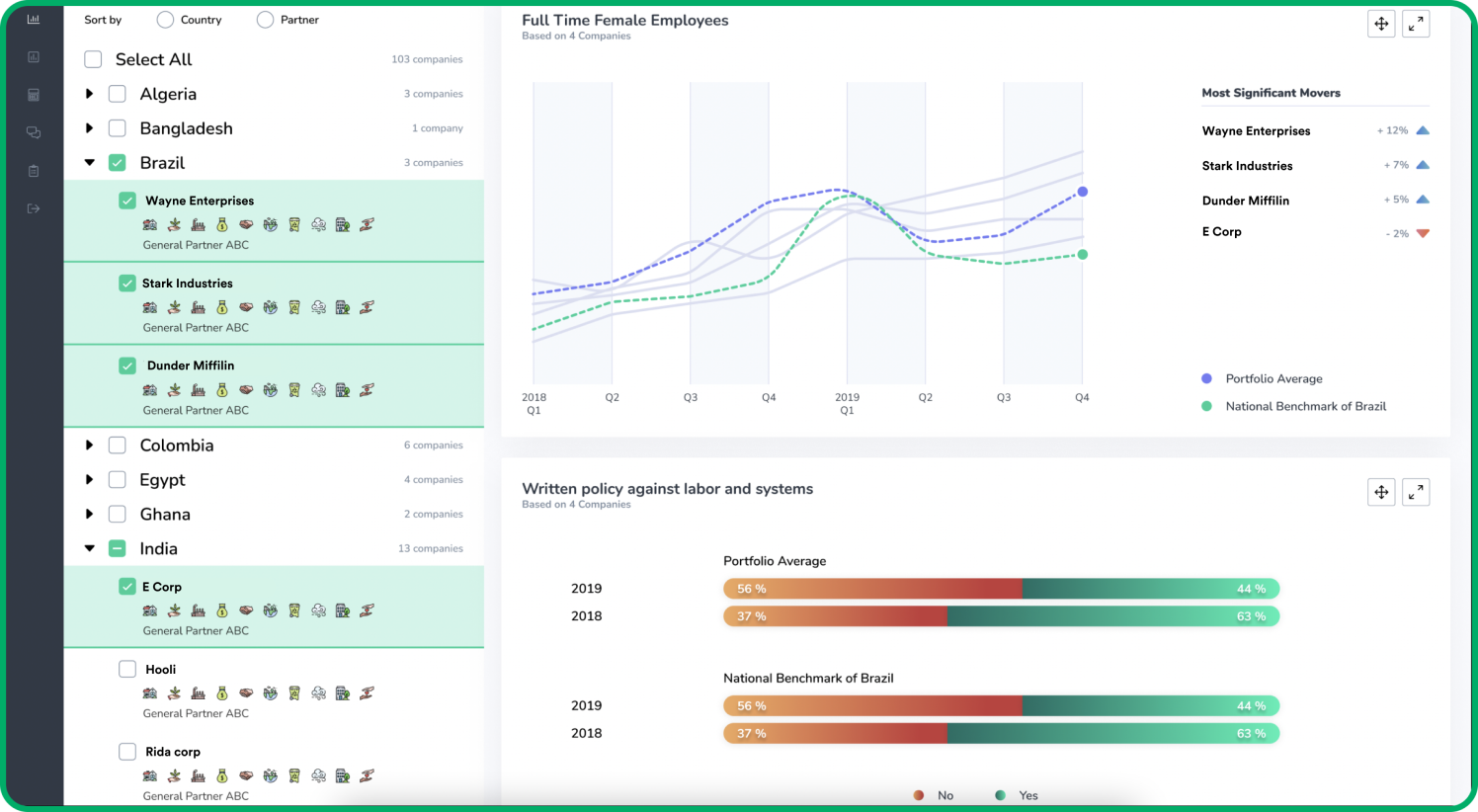

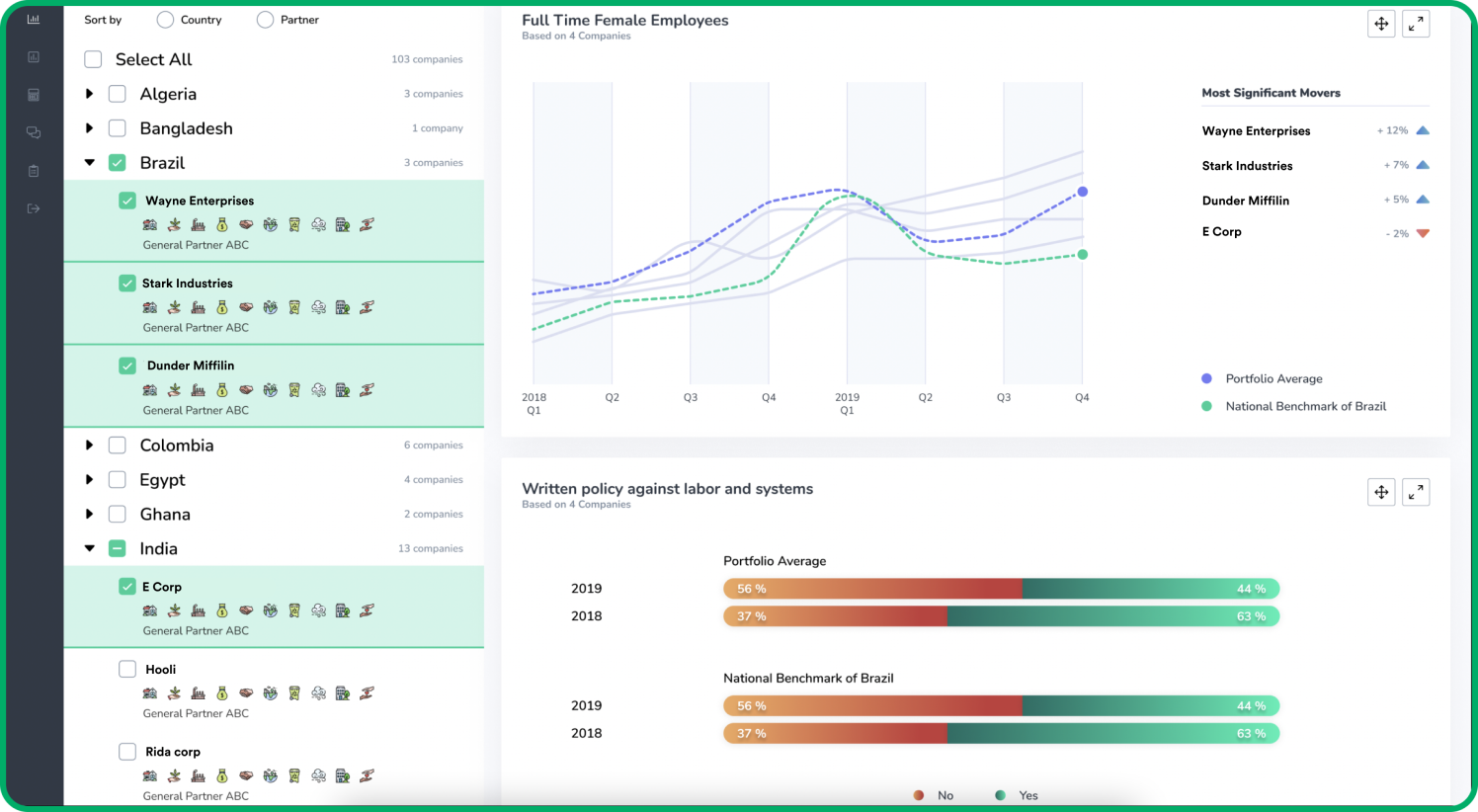

Trends Analysis

Track performance to ensure movement towards ESG goals

Materiality Mapping

Stay focused on the most financially material issues

Carbon Calculations

Emissions calculations aligned with GHG Protocol for global best practices

Industry Benchmarking

Save time for busy executives with key opportunities and risks

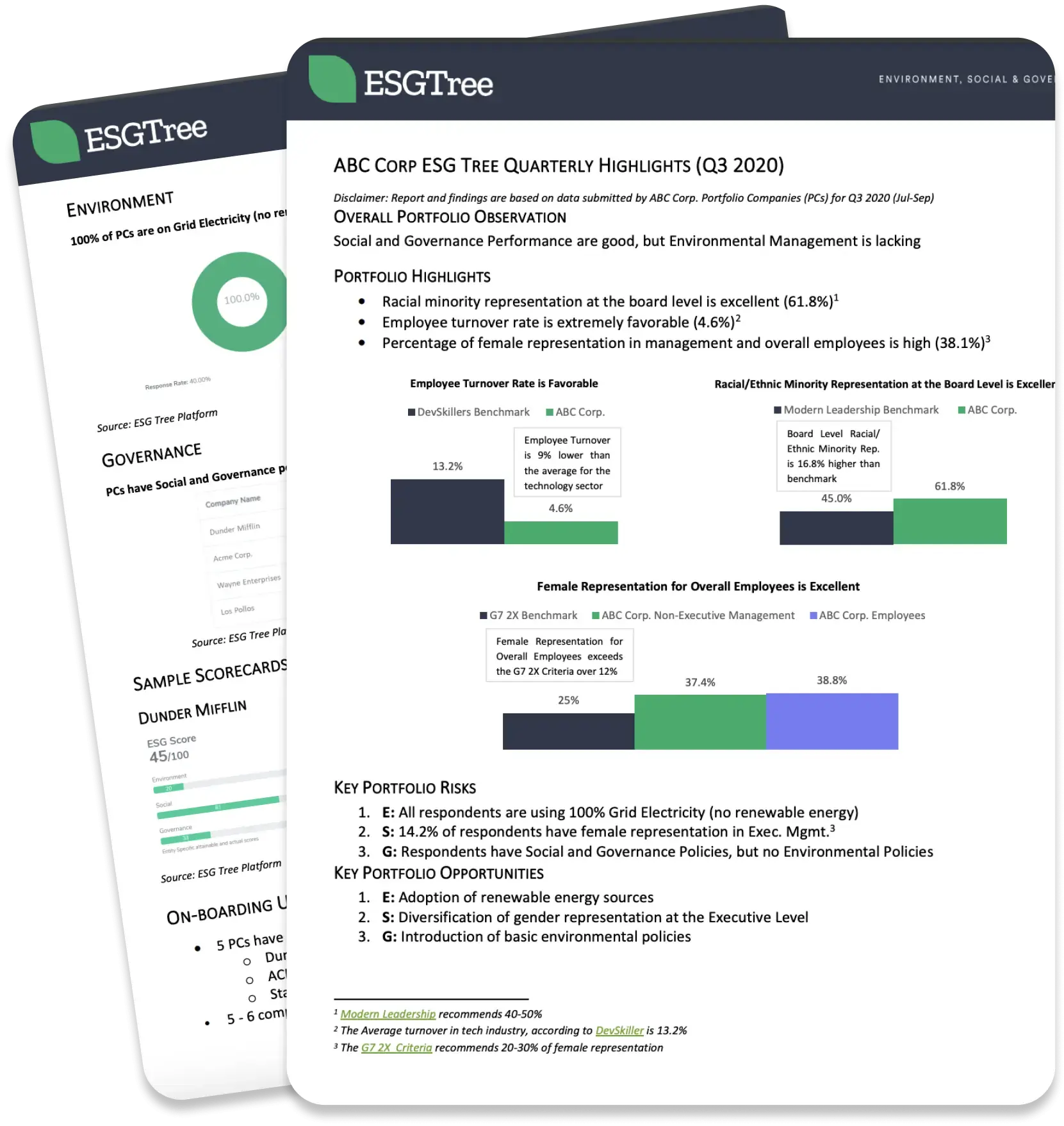

Highlights Reporting

Compare with over 10,000 companies to assess your portfolio against the market

Our Clients

We work with a range of financial institutions such as impact investors, private equity (PE) and venture capital (VC) firms, pension funds, development finance institutions (DFIs), banks and more. Contact us today to learn more about our customer references.

"ESGTree is great at helping to bring management teams on the same page. We view the ESGTree system and team as more of an extension of our company rather than a software provider."

Jessie Chen,

Senior Market Analyst at EmburseESGTree streamlines our ESG reporting to our investors. Most notably, the Carbon Calculator feature enables us to easily input numbers obtained directly from our utility bills and tally any other applicable carbon emitting activities. As a result, the time it takes to calculate carbon emissions is reduced by 70%. Kudos to the ESGTree team for providing such a seamless experience.

Adam Pries

Founder, Sarona Asset ManagementOur experience working with ESGTree has been great. They have all the things needed for great client care and a satisfaction. ESGTree is knocking it out of the ballpark!

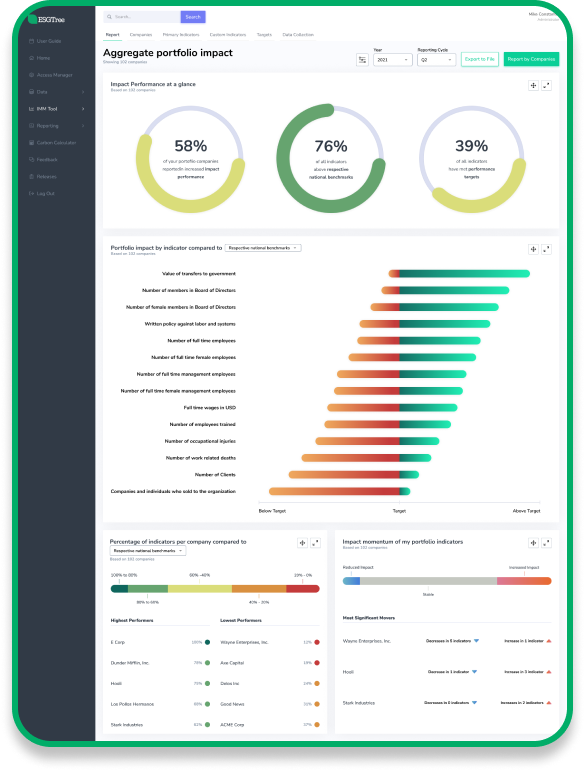

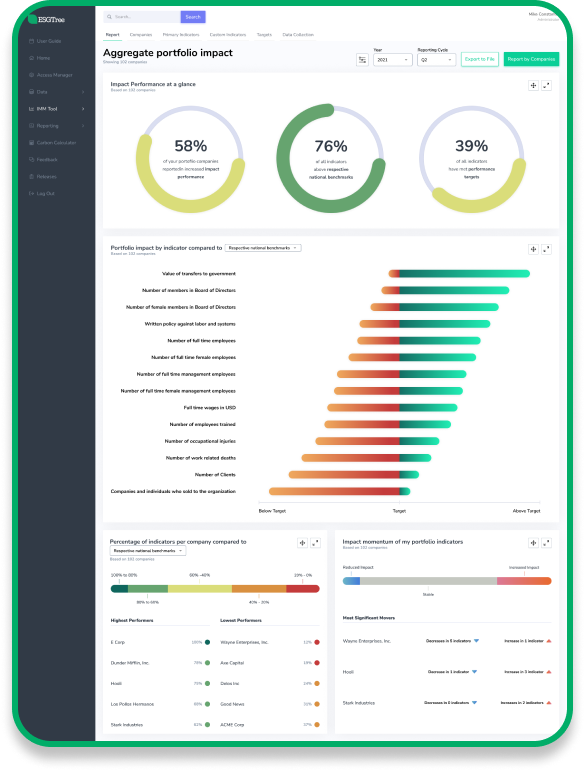

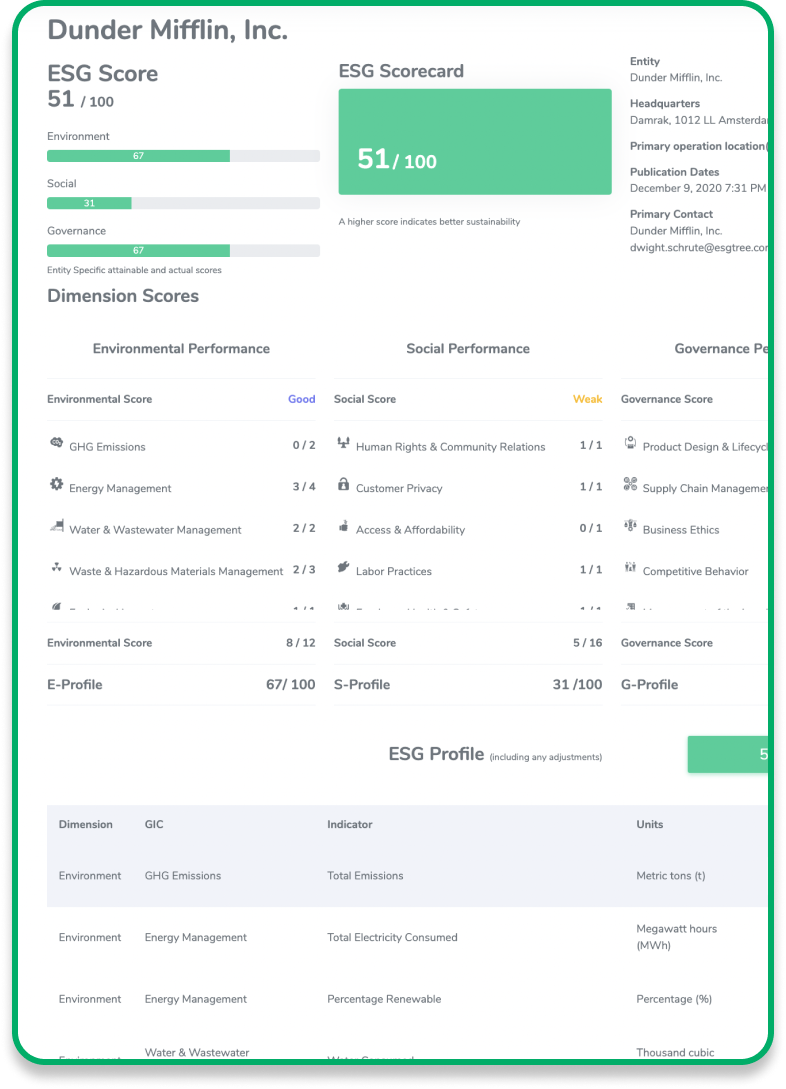

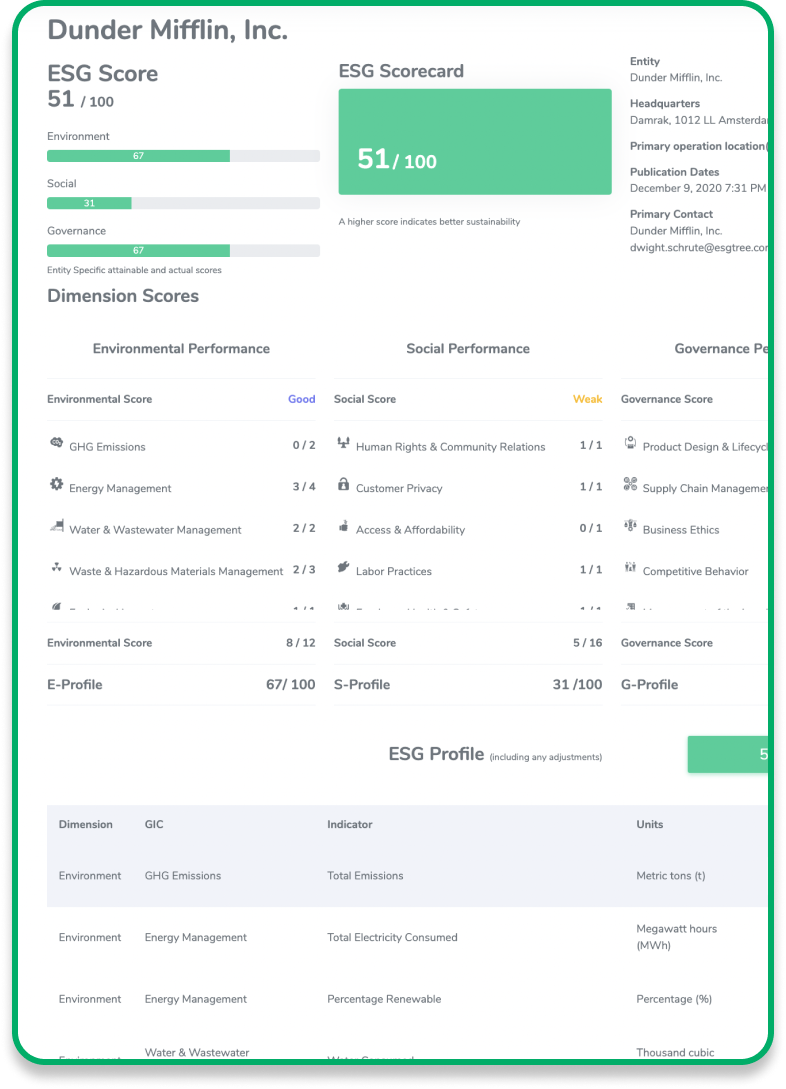

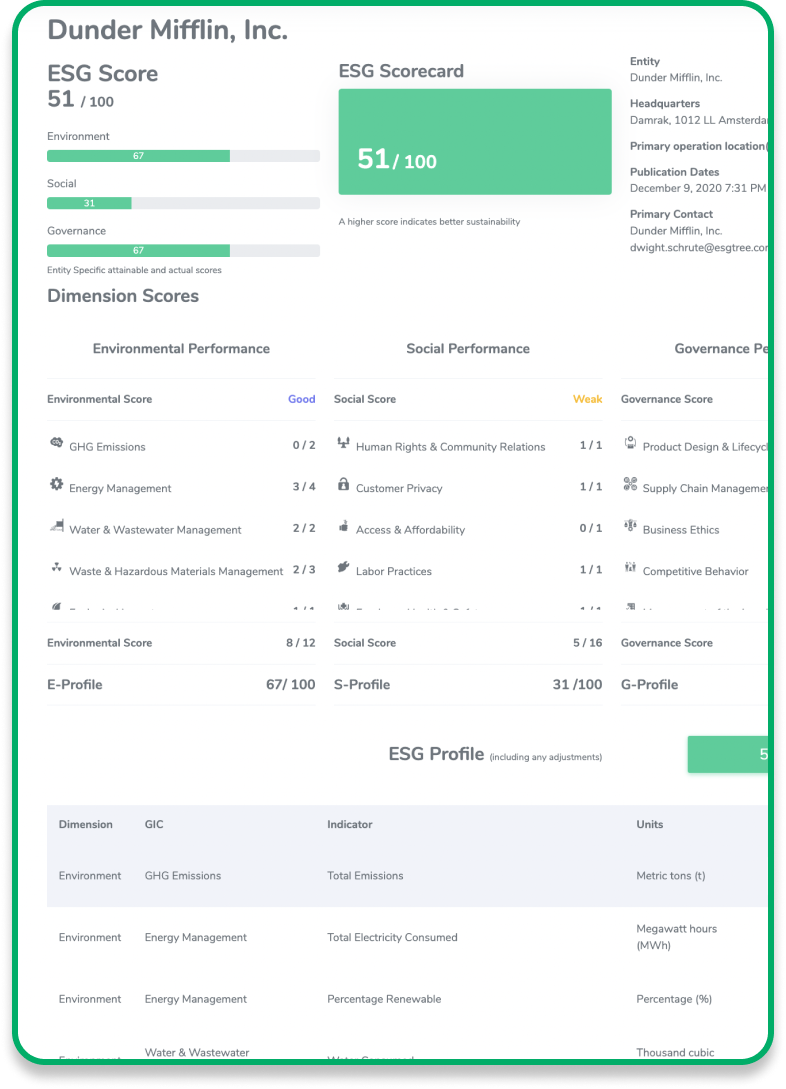

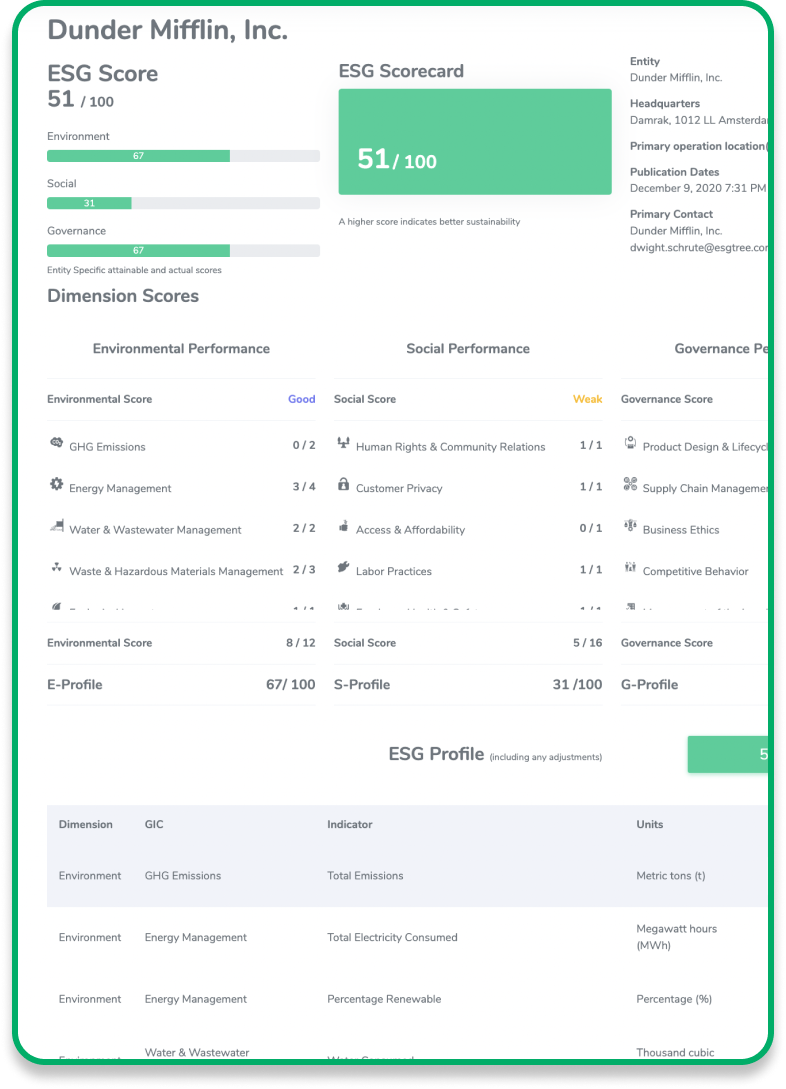

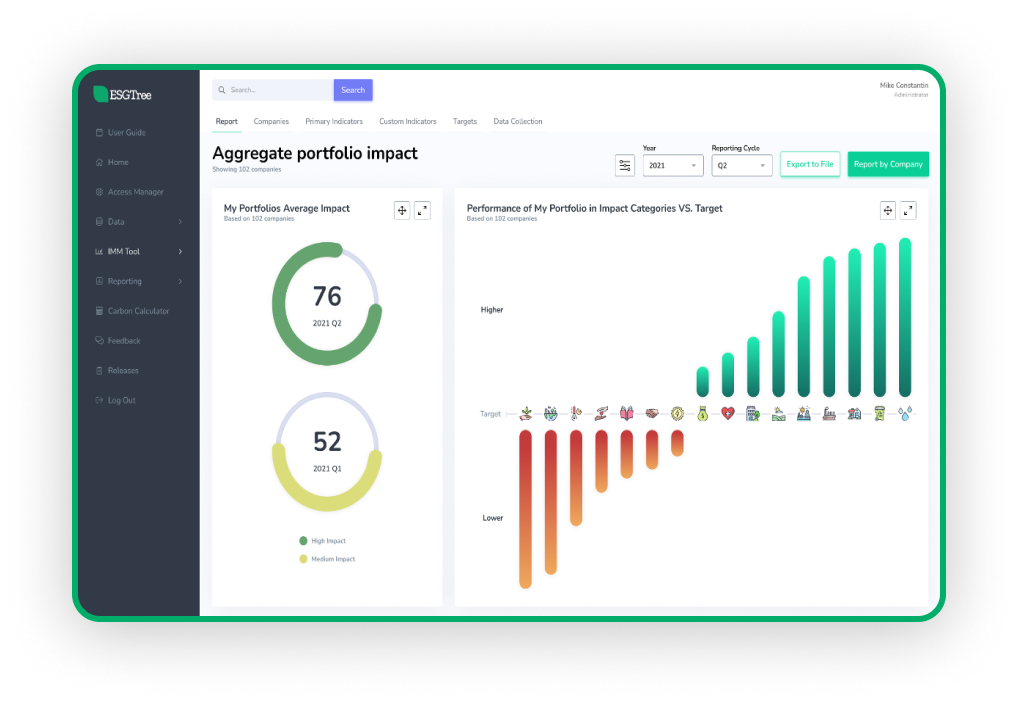

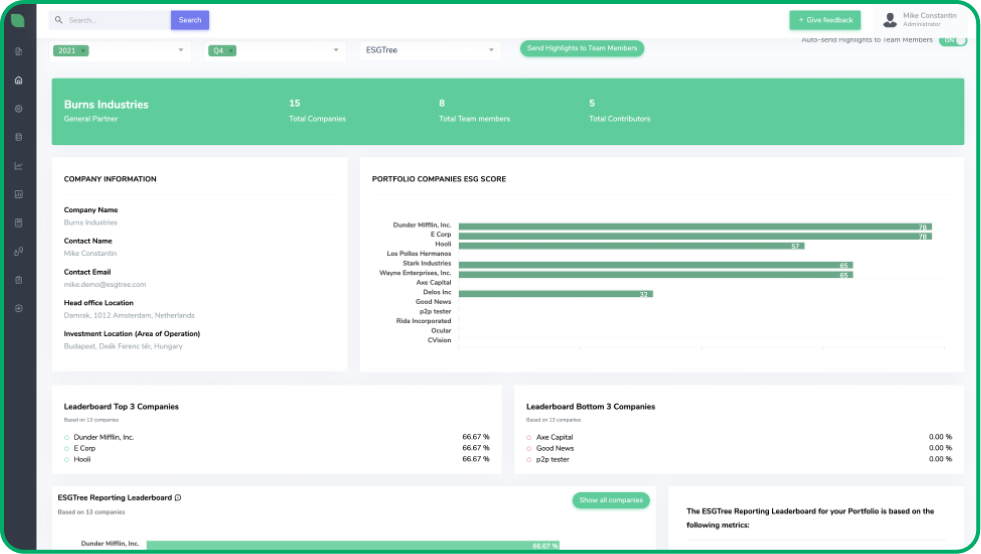

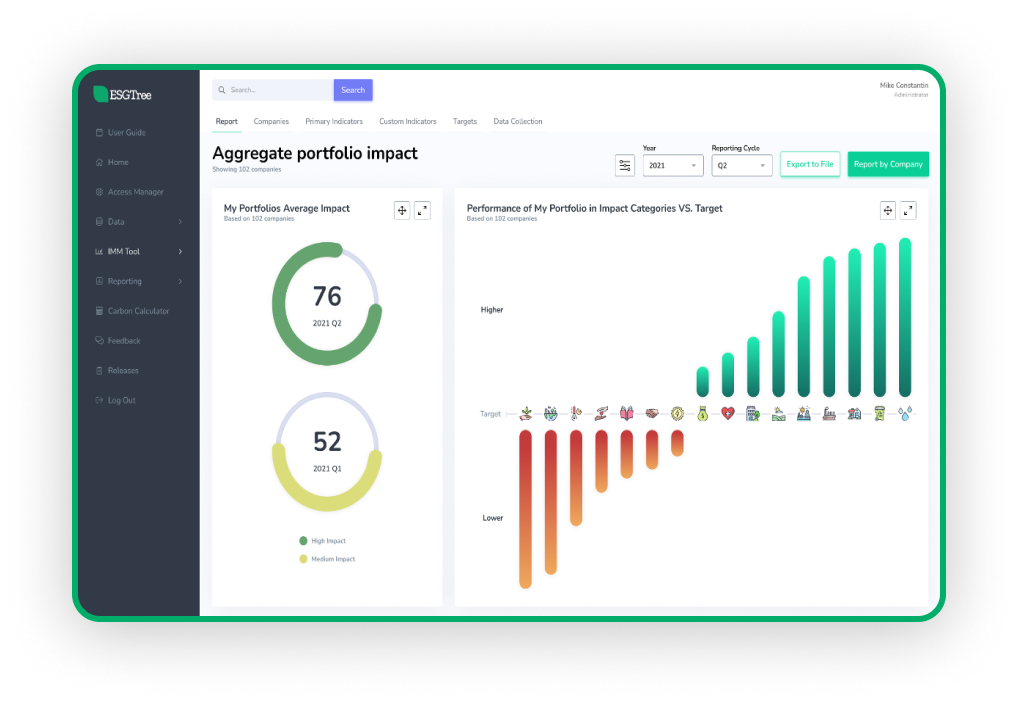

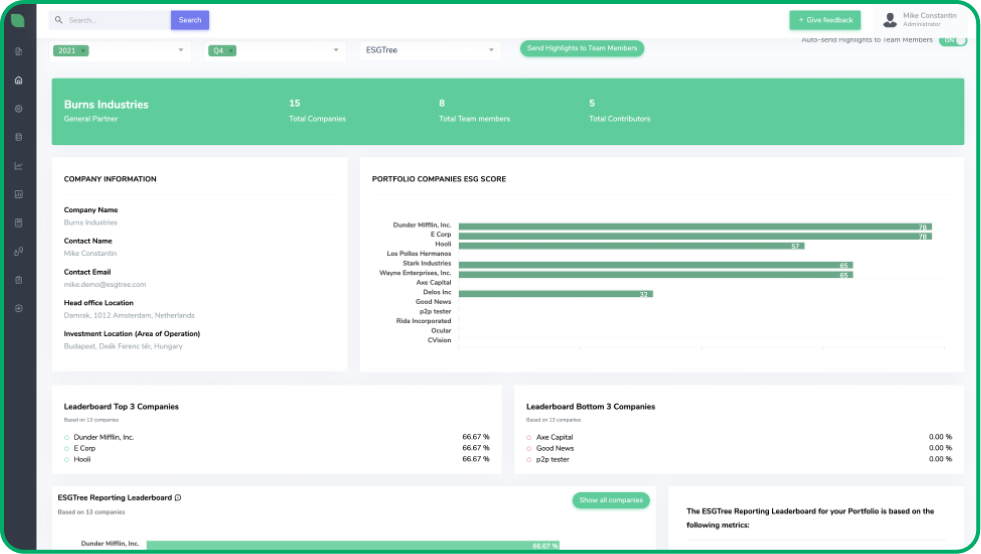

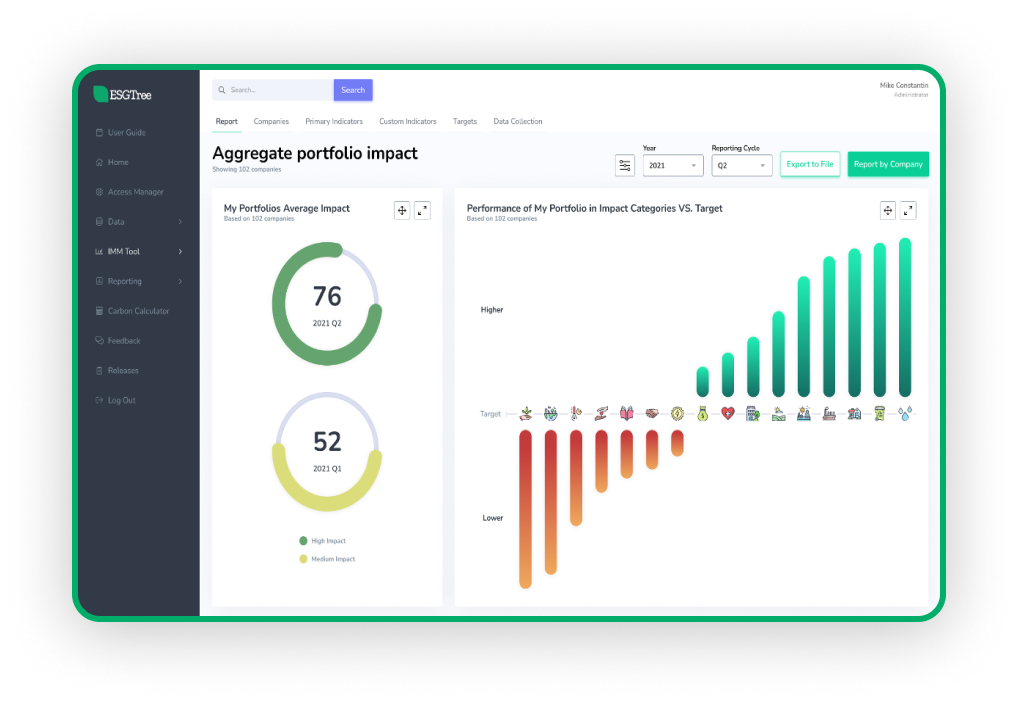

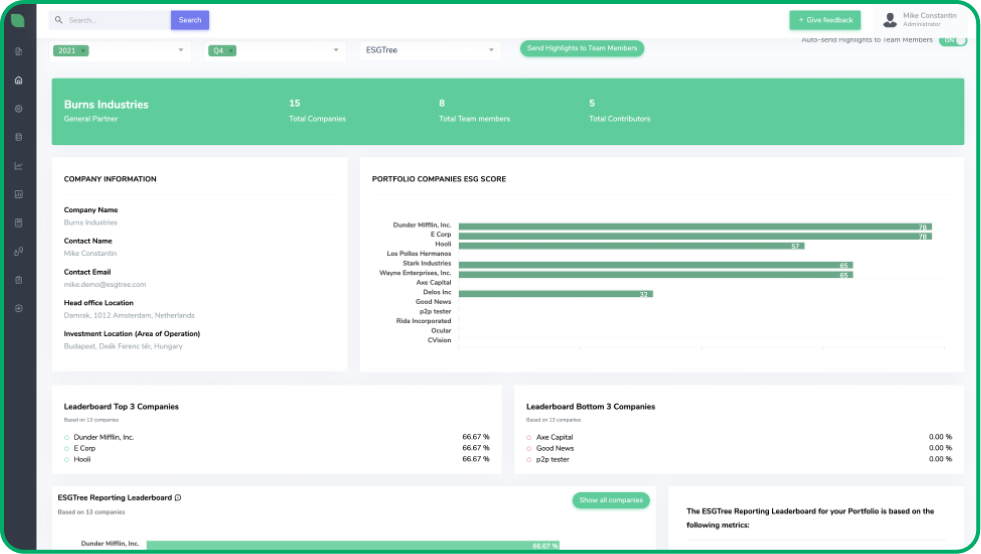

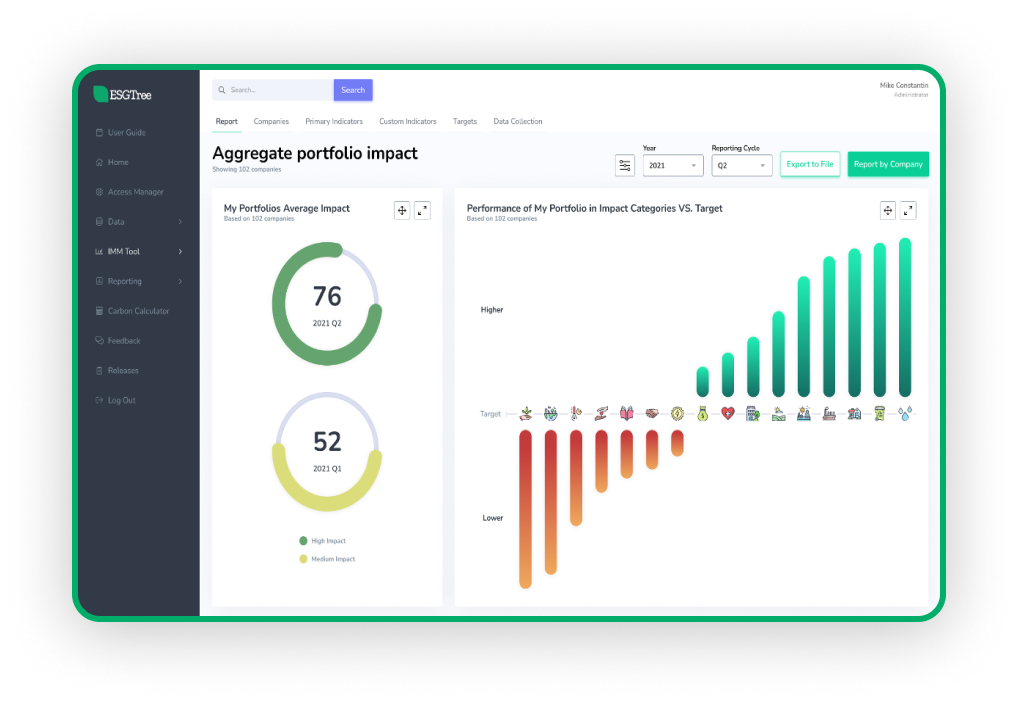

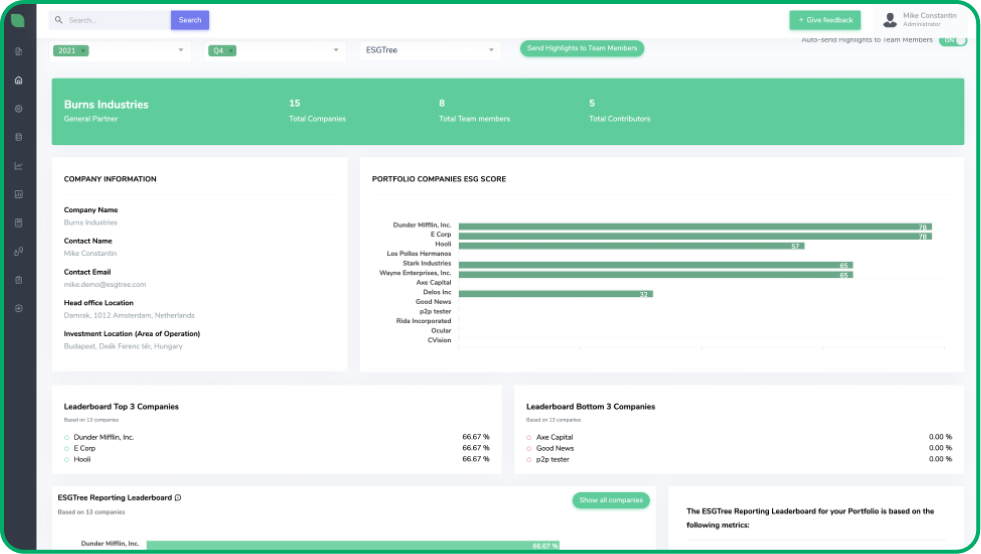

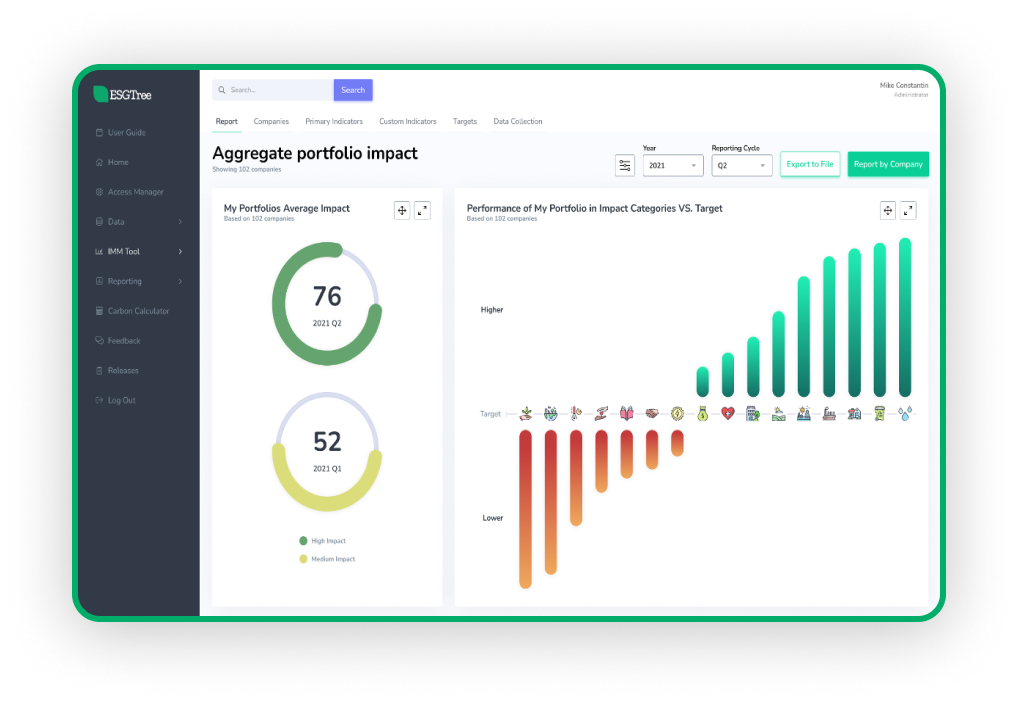

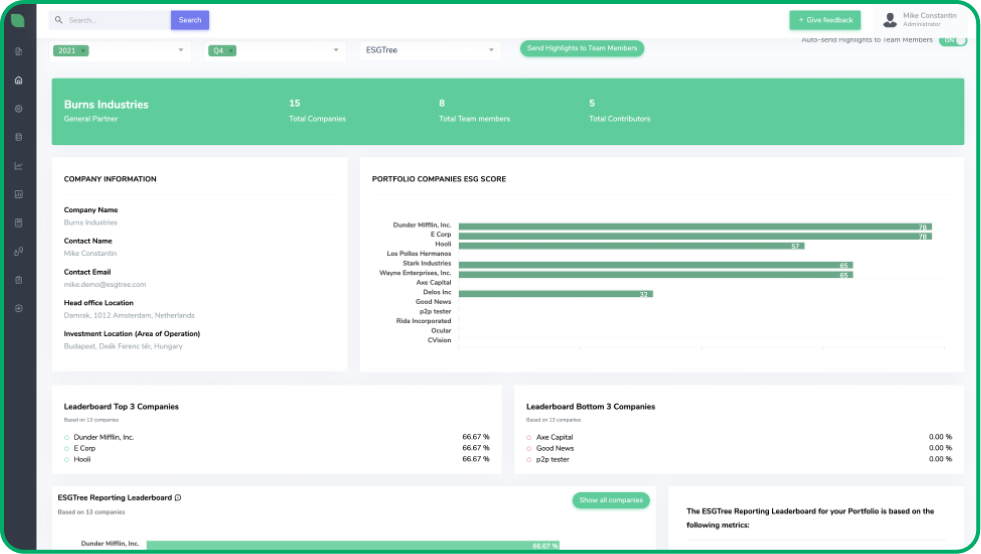

Our Product

Designed to cater to the growing ESG needs of private investors. Tailored by industry experts to manage large spreads of data, enable in-depth analytics, and meaningful insights for reporting.

Frameworks & Standards

Automated & holistic due diligence across frameworks that include, but are not limited to :

“Over 75% of private market investors plan to stop investing in Non-ESG products”- PWC

Our GP customers have been rated top 10% of ESG performers by LPs

“Over 75% of private market investors plan to stop investing in Non-ESG products”- PWC

Our GP customers have been rated top 10% of ESG performers by LPs

A One Stop Solution

Advisory

We help develop and manage your ESG policies and strategy

Automation

Set up and streamline your data across hundreds of portfolio companies

Reporting

View trends, insights and analysis for reporting back to investors & clients

ESGTree streamlines our ESG reporting to our investors. Most notably, the Carbon Calculator feature. kudos to the ESG TREE team for providing such a seamless user experience.

Jessie Chen,

Jessie Chen,

Senior Market Analyst

Senior Market Analyst

ESGTree streamlines our ESG reporting to our investors. Most notably, the Carbon

Calculator feature. Kudos to the ESGTree team for

providing such a seamless

user experience.

ESGTree streamlines our ESG reporting to our investors. Most notably, the Carbon

Calculator feature. Kudos to the ESGTree team for

providing such a seamless

user experience.

Reduce time and cost of ESG reporting by 70% while positioning yourself for fundraising and compliance

Reduce time and cost of ESG reporting by 70% while positioning yourself for fundraising and compliance

Platform Packages

A variety of options to suit your needs

Pure SaaS Plan

Cloud-based technology tools & 24/7 technical support

SaaS + Client Success

Pure Saas plan & Quarterly Reporting Support

SaaS + Advisory + Client Success

Pure SaaS plan, Client Success & Strategic Advisory Services

- Pure SaaS plan & 24/7 technical support

- Client Success support for Quarterly Reporting

- Advisory Services to support your ESG strategy and reporting

Platform Packages

A variety of options to suit your needs

Pure SaaS

Plan

Cloud-based technology tools

& 24/7 technical support

SaaS + Client

Success

Pure Saas plan & Quarterly

Reporting Support

SaaS + Advisory +

Client Success

Pure SaaS plan, Client Success & Strategic Advisory Services

- Pure SaaS plan & 24/7 technical support

- Client Success support for Quarterly Reporting

- Advisory Services to support your ESG strategy and reporting

Platform Packages

A variety of options to suit your needs

Pure SaaS

Plan

Cloud-based technology tools & 24/7 technical support

SaaS + Client

Success

Pure Saas plan & Quarterly

Reporting Support

SaaS + Advisory +

Client Success

SaaS, Strategic Advisory &

Client Success Services

Who’s Behind ESGTree?

ESGTree is led by a team that has been involved in the ESG, impact and sustainability space for over 10 years, across five continents.

With former heads & founding board members of impact investing at multiple organizations and forums, We have led global ESG efforts for countless private & public entities. Our team holds deep domain knowledge to cater to all your ESG requirements.

Our Advisory Board

Tanya Carmichael

Former Head of Global Private Equity Funds for OTPP and Chair, Institutional Limited Partners Association (ILPA)

A Conversation with our Advisory Board Member

An insightful conversation with Tanya Carmichael, ESGTree’s Advisory Board Member, ex-Head of Global Funds Private Capital at Ontario Teacher’s Pension Plan (OTPP) and ex-Chair of the Institutional Limited Partners Association (ILPA). Tanya shares her thoughts about ESG integration, reporting and how LPs can prevent GPs from drowning in due diligence questionnaires (DDQs).

Proven Satisfaction and Results

In the last four years we’ve grown to over 200 portfolio companies in our system. Our private equity clients have over $200B in assets under management.

Our Executive team has been featured in a number of news and media reports and participated in numerous select conferences and expert panels.

Partnerships & Associations

Adam Pries

Sarona Asset Management

Our experience working with ESGTree has been great. They have all the things needed for great client care and a satisfaction. ESGTree is knocking it out of the ballpark!

Frequently Asked Questions

What problem is ESGTree is solving?

______

Collecting, aggregating, and reporting ESG data is painstakingly inefficient for private capital investors. Multiple Excel sheets need to be passed around and this causes a lot of confusion and frustration for investment firms. ESGTree solves the problem of standardization, automation, and streamlining by using the power of the cloud.

Are you just a tech platform?

______

The difference with ESGTree is that the management team is made up of sustainability experts working alongside technology professionals. We have been working on ESG and sustainability services collectively for almost 20 years and can provide end-to-end advisory services to match our advanced technology.

Can you facilitate reporting to multiple investors and multiple standards?

______

ESGTree aligns with all the major standards including SASB, TCFD, SFDR, IRIS+, SDGs etc. We set up your system to cater to all your investors and all the standards you need. Just send us your investor due diligence checklists and questionnaires, and our experts will figure out the best way to organize them in the system.

How does all this work?

______

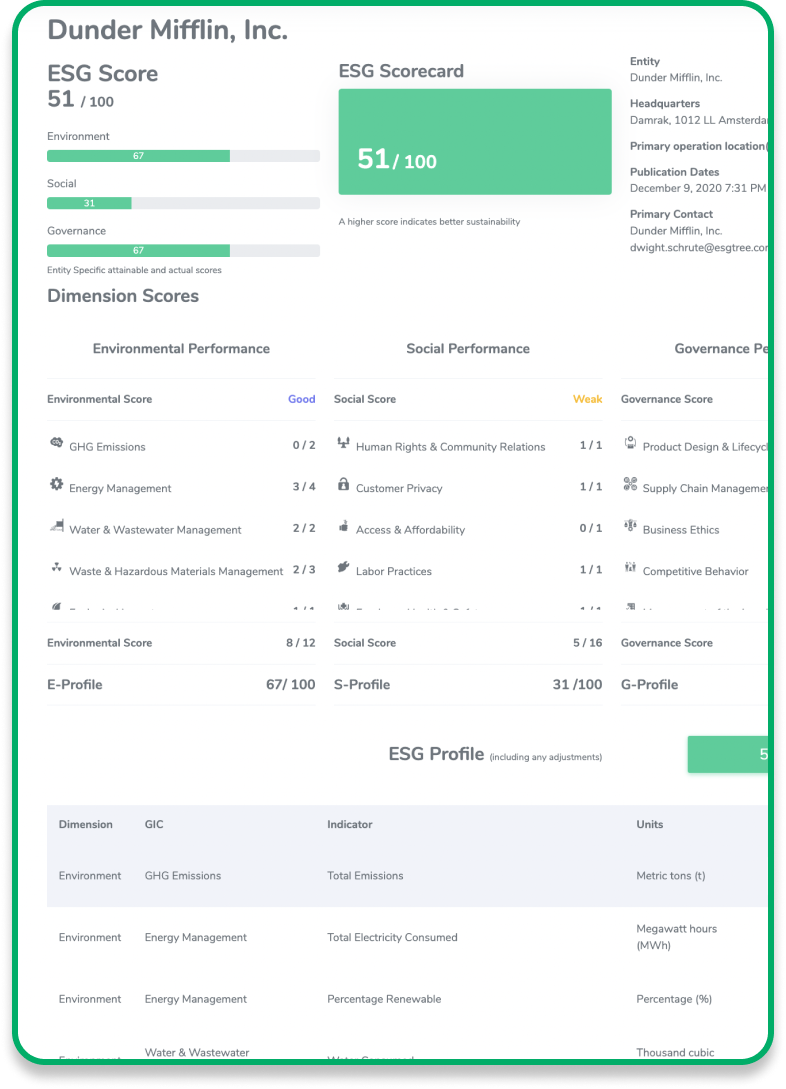

ESGTree begins with consultations and demos of our platform so you can become comfortable with how easy the technology is to use. When you agree to move forward the system is set up in a way that your portfolio companies are easily invited to join the system and submit data. As companies submit data, scorecards are automatically generated, visualizations and benchmark analysis happens in the system and your Client Success Lead helps in generating reports.

Frequently Asked Questions

What problem is ESGTree is solving?

______

Collecting, aggregating, and reporting ESG data is painstakingly inefficient for private capital investors. Multiple Excel sheets need to be passed around and this causes a lot of confusion and frustration for investment firms. ESGTree solves the problem of standardization, automation, and streamlining by using the power of the cloud.

What problem is ESGTree is solving?

______

Collecting, aggregating, and reporting ESG data is painstakingly inefficient for private capital investors. Multiple Excel sheets need to be passed around and this causes a lot of confusion and frustration for investment firms. ESGTree solves the problem of standardization, automation, and streamlining by using the power of the cloud.

What problem is ESGTree is solving?

______

Collecting, aggregating, and reporting ESG data is painstakingly inefficient for private capital investors. Multiple Excel sheets need to be passed around and this causes a lot of confusion and frustration for investment firms. ESGTree solves the problem of standardization, automation, and streamlining by using the power of the cloud.

Are you just a tech platform?

______

The difference with ESGTree is that the management team is made up of sustainability experts working alongside technology professionals. We have been working on ESG and sustainability services collectively for almost 20 years and can provide end-to-end advisory services to match our advanced technology

What problem is ESGTree is solving?

______

Collecting, aggregating, and reporting ESG data is painstakingly inefficient for private capital investors. Multiple Excel sheets need to be passed around and this causes a lot of confusion and frustration for investment firms. ESGTree solves the problem of standardization, automation, and streamlining by using the power of the cloud.

Can you facilitate reporting to multiple investors and multiple standards?

______

Collecting, aggregating, and reporting ESG data is painstakingly inefficient for private capital investors. Multiple Excel sheets need to be passed around and this causes a lot of confusion and frustration for investment firms. ESGTree solves the problem of standardization, automation, and streamlining by using the power of the cloud.

What problem is ESGTree is solving?

______

Collecting, aggregating, and reporting ESG data is painstakingly inefficient for private capital investors. Multiple Excel sheets need to be passed around and this causes a lot of confusion and frustration for investment firms. ESGTree solves the problem of standardization, automation, and streamlining by using the power of the cloud.

How does all this work?

______

ESGTree begins with consultations and demos of our platform so you can become comfortable with how easy the technology is to use. When you agree to move forward the system is set up in a way that your portfolio companies are easily invited to join the system and submit data. As companies submit data, scorecards are automatically generated, visualizations and benchmark analysis happens in the system and your Client Success Lead helps in generating reports.

What problem is ESGTree is solving?

______

Collecting, aggregating, and reporting ESG data is painstakingly inefficient for private capital investors. Multiple Excel sheets need to be passed around and this causes a lot of confusion and frustration for investment firms. ESGTree solves the problem of standardization, automation, and streamlining by using the power of the cloud.

What problem is ESGTree is solving?

______

Collecting, aggregating, and reporting ESG data is painstakingly inefficient for private capital investors. Multiple Excel sheets need to be passed around and this causes a lot of confusion and frustration for investment firms. ESGTree solves the problem of standardization, automation, and streamlining by using the power of the cloud.

What problem is ESGTree is solving?

______

Collecting, aggregating, and reporting ESG data is painstakingly inefficient for private capital investors. Multiple Excel sheets need to be passed around and this causes a lot of confusion and frustration for investment firms. ESGTree solves the problem of standardization, automation, and streamlining by using the power of the cloud.

Are you just a tech platform?

______

The difference with ESGTree is that the management team is made up of sustainability experts working alongside technology professionals. We have been working on ESG and sustainability services collectively for almost 20 years and can provide end-to-end advisory services to match our advanced technology

What problem is ESGTree is solving?

______

Collecting, aggregating, and reporting ESG data is painstakingly inefficient for private capital investors. Multiple Excel sheets need to be passed around and this causes a lot of confusion and frustration for investment firms. ESGTree solves the problem of standardization, automation, and streamlining by using the power of the cloud.

Can you facilitate reporting to multiple investors and multiple standards?

______

ESGTree aligns with all the major standards including SASB, GRI, TCFD, SFDR, IRIS+, SDGs etc. We set up your system to cater to all your investors and all the standards you need. Just send us your investor due diligence checklists and questionnaires, and our experts will figure out the best way to organize them in the system.

What problem is ESGTree is solving?

______

Collecting, aggregating, and reporting ESG data is painstakingly inefficient for private capital investors. Multiple Excel sheets need to be passed around and this causes a lot of confusion and frustration for investment firms. ESGTree solves the problem of standardization, automation, and streamlining by using the power of the cloud.

How does all this work?

______

ESGTree begins with consultations and demos of our platform so you can become comfortable with how easy the technology is to use. When you agree to move forward the system is set up in a way that your portfolio companies are easily invited to join the system and submit data. As companies submit data, scorecards are automatically generated, visualizations and benchmark analysis happens in the system and your Client Success Lead helps in generating reports.

– Purpose Built for Financial Institutions

Whether you are a seasoned ESG manager or entering the world of ESG for the first time, our goal is to make ESG reporting a value creation exercise. Our motto: Make ESG work for you.

Free 30-minute consultation and demo

Find out which standards and frameworks work for you

No pressure to subscribe

Purpose Built for Financial Institutions

Software-as-a-Service Packages

An ESG platform that gives you an end-to-end

solution

for ESG reporting.

Free 30-minute consultation and demo

Find out which standards and frameworks work for you

No pressure to subscribe

Contact Us

Office Addresses

Canada: ESGTree, CPA 4th Floor, 140 West mount Rd N, Waterloo, ON N2L 3G6, Canada

United Kingdom: ESGTree, 33 Queen Street, London EC4R 1AP, United Kingdom

Contact Us

Office Addresses

Canada: ESGTree, CPA 4th Floor, 140 West mount Rd N, Waterloo,

ON N2L 3G6, Canada

United Kingdom: ESGTree, 33 Queen Street, London EC4R 1AP, United Kingdom