TCFD Reporting: Software Solutions for Financial Institutions

Share:

A Global Shift Towards TCFD

In 2017, the Task Force on Climate-related Financial Disclosures (TCFD) introduced a framework to help organizations report their climate-related financial information and assess climate risks and opportunities.

Today, the TCFD is one of the most commonly used disclosure frameworks across the globe, with countries such as the UK and New Zealand among the first to require TCFD-aligned climate reporting. In fact, the TCFD is now set to move into the administration of the International Sustainability Standards Board (ISSB), a merger that is expected to bring further cohesion among the plethora of sustainability standards and frameworks available for asset managers. Thankfully in the past six years, financial institutions have recognized that climate risks are intertwined with financial risks, motivating them to drive emissions down.

The Four Pillars of the TCFD

The framework itself consists of 11 disclosure recommendations spanning four interrelated thematic areas: governance, strategy, risk management, and metrics and targets. Apart from the last area, these recommendations are largely qualitative in nature and can be summarized as follows:

- Governance: companies should disclose their management and board’s strategy for monitoring and assessing climate risk (and opportunity).

- Strategy: companies should identify climate risks and opportunities foreseen over the short, medium and long term; explain the impact of these risks and opportunities on their planning and operations; and assess how resilient their strategy is in various climate-related scenarios (i.e., climate stress tests).

- Risk Management: companies should explain their process for identifying and managing climate risk and how this process fits into the overall picture of risk management.

- Metrics and Targets: companies should disclose the specific metrics used to inform their climate strategies, including the disclosure of scope 1, 2, and 3 greenhouse gas (GHG) emissions among other conventional metrics. They should also disclose climate goals or targets and their progress towards them.

TCFD Reporting Made Easier with Software Solutions

Reporting GHG Emissions: A Novel Requirement

Measuring and disclosing financed emissions (i.e., GHG emissions associated with loans and investments) as part of climate disclosures is a new deliverable for many organizations/ financial institutions and, as such, will require new routines, organizational structures, and processes for gathering data.

All this takes time and resources – the learning curve is steep and for some companies these changes need to be implemented in time for the 2024 reporting year. A lot of the times, organizations estimate their climate figures by buying data from providers such as MSCI, S&P, & Sustainalytics to fulfil their climate disclosure requirements – unfortunately, financial institutions cannot do this for their private markets portfolios. This is primarily because their investing and lending data needs to be collected first-hand from the portfolio, which can only be done with the help of customized tools, automations, and individuals with industry expertise. For these reasons, financial institutions, on the private markets side, end up seeking the expertise of external consultants and Software solutions that can ease the reporting burden by seamlessly collecting climate data that tracks the full extent of their carbon footprint.

Partnering with a SaaS platform on ESG automation can help:

– Streamline collection of large sets of climate data

– Calculate emissions with easily available activity data

– Generate automated TCFD Assessments

A Deep Dive into ESGTree’s TCFD Reporting Software for Private Equity

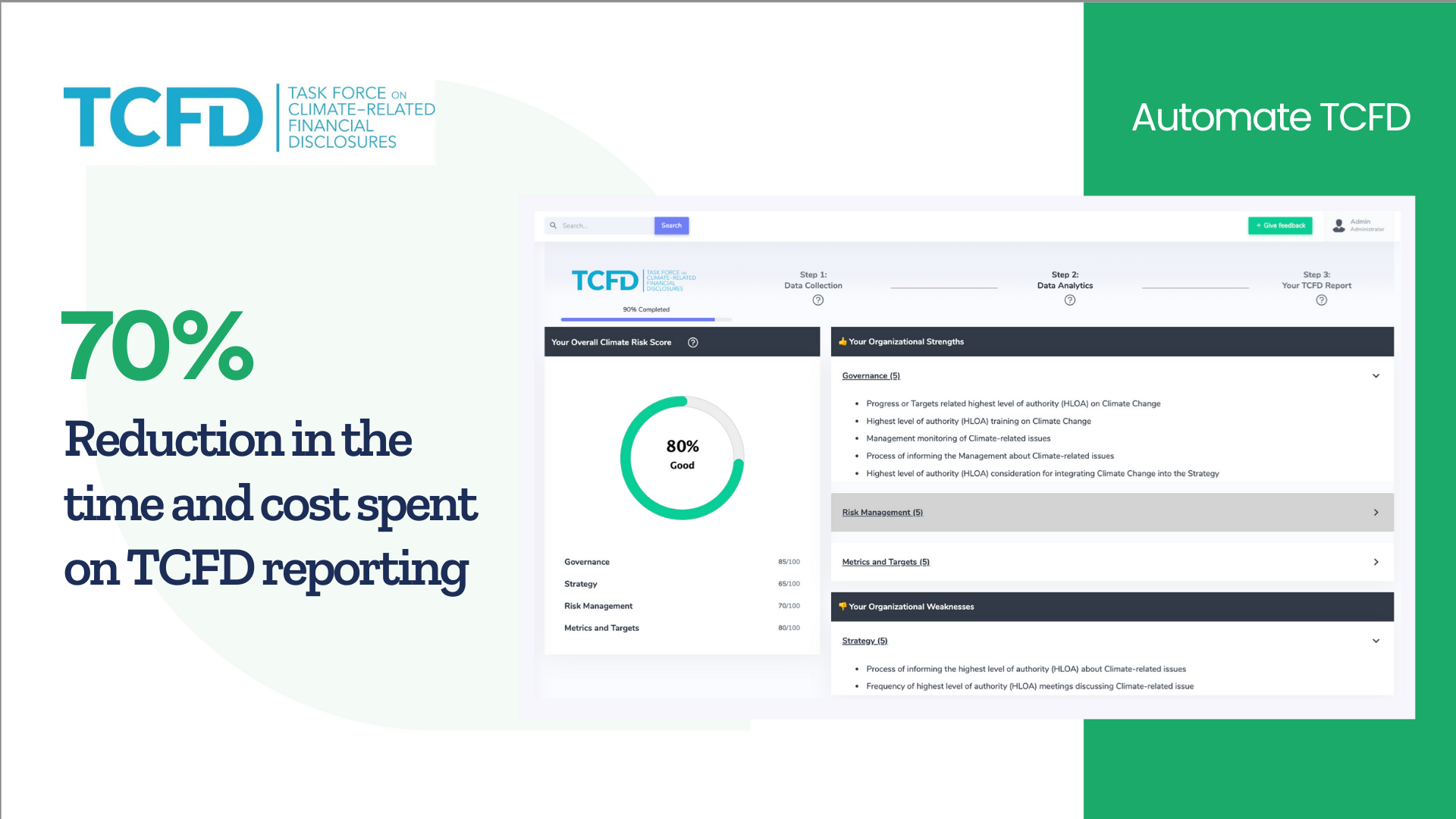

ESGTree is purpose-built for financial institutions and private equity firms. We offer a full suite of features for your TCFD reporting needs:

ESGTree’s TCFD Tool Features | Description |

Automatic TCFD report generation | Upon completing 40 multiple-choice questions, our platform automatically generates your TCFD report – automate the difficult legwork and eliminate the need for external consultants. |

Climate Strategy Expertise | We leverage advanced analytics and automate major ESG and climate disclosure frameworks to deliver timely, independent, and decision-useful insights. |

Quality & Clear Climate Maturity Assessment | We assess an organization’s climate maturity, considering both the clarity (breadth of coverage) and quality (depth of actions) of its climate performance against TCFD recommendations. Our platform provides recommendations and action items to improve climate performance vis-a-vis the four pillars of the TCFD framework. |

Data-Driven Market Intelligence | Benchmark your climate progress against a data set of 10,000+ companies. |

Proprietary Carbon Calculator & Portfolio Company Scorecards | Our Carbon Calculator allows for seamless calculation of carbon emissions by taking in data that companies readily have on hand to provide figures for Scope 1, 2, and 3 emissions on the spot. |

Trends, Analysis and Visualizations | We offer trends analysis and visualizations by ESG framework, indicator and reporting period. |

Add-on Advisory Services for ESG policy creation, strategy road-mapping, training, and reporting | Our Client Success Team is comprised of experts in Climate, ESG and impact investing who advise our clients on strategy and provide support on every step of the ESG journey. |

Free client success support from ESGTree experts |

A Deep Dive into ESGTree’s TCFD Reporting Solution for Private Equity

Given the international buy-in and legislative action around TCFD, we strongly advise adding the TCFD framework to your climate action plan. By acting now, you can stay ahead of the regulatory curve and minimize transition risk as the world moves towards a lower carbon economy.

With ESGTree, save the time and cost of ESG reporting by harnessing the power of the cloud and streamlining ESG data collection, analysis and disclosure.

For more information on the TCFD Reporting Solution, please contact us at :

ESGTree helps private capital investors automate ESG data collection and analysis for their portfolio companies. Our platform features include our carbon calculator, customizable and automated ESG frameworks, multi-level report viewing, trends analysis dashboard, and other features aimed to make ESG work for everyone.

#ESGTree #TCFDReporting #SustainableFinance #ClimateResilience #FinancialInstitutions #PrivateEquity #VentureCapital

Why ESGTree? – Differences that Make a Difference

Who Should the Economy Really Serve?

What We’ve Learned Automating the ESG Data Convergence Initiative (EDCI) for Clients

What Does the Rise of ESG Mean for Impact Investing?

Summary

Share:

A Global Shift Towards TCFD

The Four Pillars of the TCFD

TCFD Reporting Made Easier with SaaS Solutions

Automate TCFD with ESGTree's TCFD Software

A Deep Dive into ESGTree’s TCFD Reporting Solution for Private Equity

Contact Us

Contact Us

Office Addresses

Canada: ESGTree, Kindred Centre for Peace Advancement, 140 Westmount Rd N, Waterloo,ON N2L 3G6, Canada

United Kingdom: ESGTree, 33 Queen Street, London EC4R 1AP, United Kingdom