Diversity Equity & Inclusion: Preparing Private Equity for DEI Reporting

Share:

When the Institutional Limited Partners Association (ILPA) updated its diversity and inclusion guidelines for GPs last year, it signalled to the private equity industry that the ‘S’ of ESG would now be of increasing scrutiny and importance to investors.

ILPA expanded its Due Diligence Questionnaire (DDQ) and Diversity Metrics Template to provide for more robust reporting on Diversity, Equity and Inclusion (DEI) and a strengthening of reporting mechanisms. In the words of ILPA CEO Steve Nelson, “While DEI is a comparatively newer area of focus for Limited Partners (LPs), the industry is experiencing a sea change in LPs’ appetite for more nuanced information about team diversity and General Partner (GP) actions to advance DEI.”

ILPA expanded its Due Diligence Questionnaire (DDQ) and Diversity Metrics template to provide for more robust reporting on Diversity, Equity and Inclusion (DEI) and a strengthening of reporting mechanisms. In the words of ILPA CEO Steve Nelson, “While DEI is a comparatively newer area of focus for LPs, the industry is experiencing a sea change in LPs’ appetite for more nuanced information about team diversity and GP actions to advance DEI.”

DEI Reporting: What the Market Has Shown Us:

- Tracking diversity, equity, and inclusion (DEI) has gained traction among private equity (PE) firms and LPs. This development is part of a larger societal trend. In recent years, global social movements centered on DEI have sparked reexamination in every part of society, including business. In fact, research shows that DEI is good for business, regardless of geography.

- In the private markets industry, LPs are placing increasing importance on PE firms’ diversity metrics in making allocation decisions. In response, the PE industry is making steady progress on improving the diversity of its workforce. In fact, research by the Institutional Allocators for Diversity, Equity and Inclusion (a consortium of asset owners looking to drive DEI in the asset management industry) found that DEI in private equity (PE) can potentially improve performance and reduce risk across portfolios.

- Other studies also bode well for DEI and PE. The International Finance Corporation (IFC), for example, found that “venture capital-backed companies in emerging markets with gender-balanced leadership teams had a 1.6 times increase in their step-up valuation, or change in valuation between rounds of financing.”

- Our own experience corroborates this trend. When automating ESG frameworks, such as the ESG Data Convergence Initiative, we have had to provide additional reporting add-ons on DEI to satisfy our clients’ investor demand for this information.

DEI Reporting: Where to Start?

Before embedding strong ‘S’ policies into an organization, two things are paramount: asking the right questions and collecting the right data. As a baseline, one may ask: How can my business maximize the quality of life for its people (i.e., its employees, management, suppliers and community), particularly for marginalized groups (such as women or minorities)? How will my DEI efforts minimize risk and safeguard my reputation as an equitable organization?

Benchmarking and DEI Reporting - Giving Data Meaning

- At the 2022 Invest Canada conference in Ottawa this May, ESGTree was posed a pertinent question on benchmarking and DEI: should DEI policies account for region? In other words, how should DEI efforts in a homogenous region differ from those in a diverse metropolitan area? Indeed, questions of benchmarking – in other words, of contextualizing information – give meaning to raw data in ways that account for ground realities and therefore impact strategy and performance.

- Asking the right questions will help organizations move beyond token DEI initiatives that serve only to tick off the boxes investors ask for. Embedding genuine DEI policies into a business – beyond boosting company morale, culture and output – minimizes reputational risk. A workplace that embraces and celebrates a diverse community of stakeholders, while emphasizing mutual respect, is less likely to have to battle harassment, racial or other scandals later down the line, or spend precious time putting out fires while trying to do business. In the super-information age, the court of public opinion is the only one that matters. And it moves fast.

DEI Reporting and the Power of Automation

- With so much at stake, from investor appetite to reputation management to hiring and retaining the right talent, a majority of organizations are still struggling to effectively manage and analyze their ‘S’ data.

- 55% of companies surveyed by Ernst and Young reported that they still used excel spreadsheets to manage their ESG data. The 72 respondents surveyed included some of the largest corporations in the United States. At the same time, respondents acknowledged how serious ESG reporting is becoming and anticipated devoting much more time to it.

- This gap between action and intention is easier to understand when accounting for the current difficulties that companies face when collecting and analyzing ESG data. The ESG industry, though exponentially expanding, is still in the midst of regulating and standardizing metrics and reporting mechanisms. ESG managers (a job that in itself is only now rapidly growing) are faced with various reporting frameworks and different requirements for different investors, with little guidance on how to implement them. Hiring external consultants to handle this data is both expensive and time-consuming. In such an environment, GPs can stay ahead of the curve, and save themselves much hassle and headache, by automating their data and using cloud-based systems to collect, analyze and report it.

- In fact, ILPA’s third Diversity in Action (DIA) roundtable in August 2024 revealed that, while firms can take a variety of approaches to collecting and aggregating ESG and DEI data, many firms that lack the resources to build robust internal data collection platforms are frequently leveraging service providers and consultants to aid in the process.

The road toward equity in PE is long, but sustained efforts on actions that can fast-track progress will help the industry realize its goals. LPs can further strengthen the industry’s dedication to DEI and, by turning these commitments into action, PE firms can sharpen the competitive advantage that diversity offers.

Difficulties in ESG data reporting

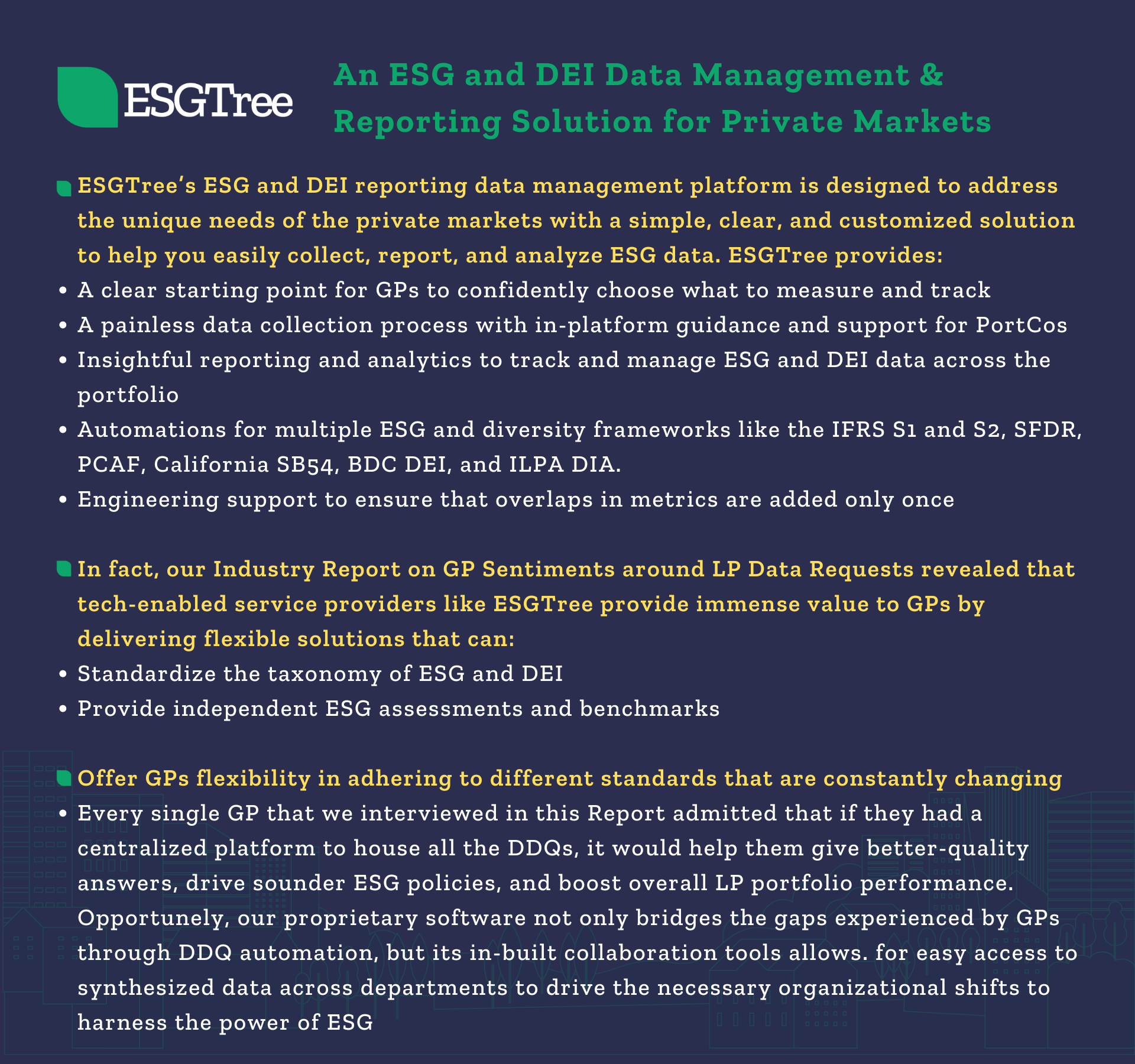

This gap between action and intention is easier to understand when accounting for the current difficulties that companies face when collecting and analyzing ESG data. The ESG industry, though exponentially expanding, is still in the midst of regulating and standardizing metrics and reporting mechanisms. ESG managers (a job that in itself is only now rapidly growing) are faced with various reporting frameworks and different requirements for different investors, with little guidance on how to implement them. Hiring external consultants to handle this data is both expensive and time-consuming.

ESGTree highly recommends that organizations harness the power of the cloud and data automation to keep on top of investor demand, prepare for future regulatory requirements, minimize reputational risk, and gain the most from inclusive policies.