ESGTree Elevates Financial Institutions’ Climate Resilience with TCFD Reporting SaaS Solution

Share:

[Waterloo] – 11/09/23 – ESGTree, a pioneer in ESG solutions, is proud to introduce its TCFD Reporting Solution, revolutionizing the way financial institutions approach climate disclosures and regulation. By providing a simplified, actionable approach to sustainability reporting, ESGTree empowers organizations to position themselves strategically for fundraising, compliance, innovation and success.

This latest innovation comes at a time when regulators are clamping down on sustainability reporting, investors are demanding robust ESG strategies, and assessing climate risk and opportunity is critical to economic growth and resiliency. Central to these concerns is the Task Force on Climate-Related Financial Disclosures (TCFD). The TCFD reporting framework is recognized for its central role in defining climate reporting worldwide, with its architecture guiding the development of the highly anticipated standards recently released by the International Sustainability Standards Board (ISSB).

A Core Tool for Financial Resilience

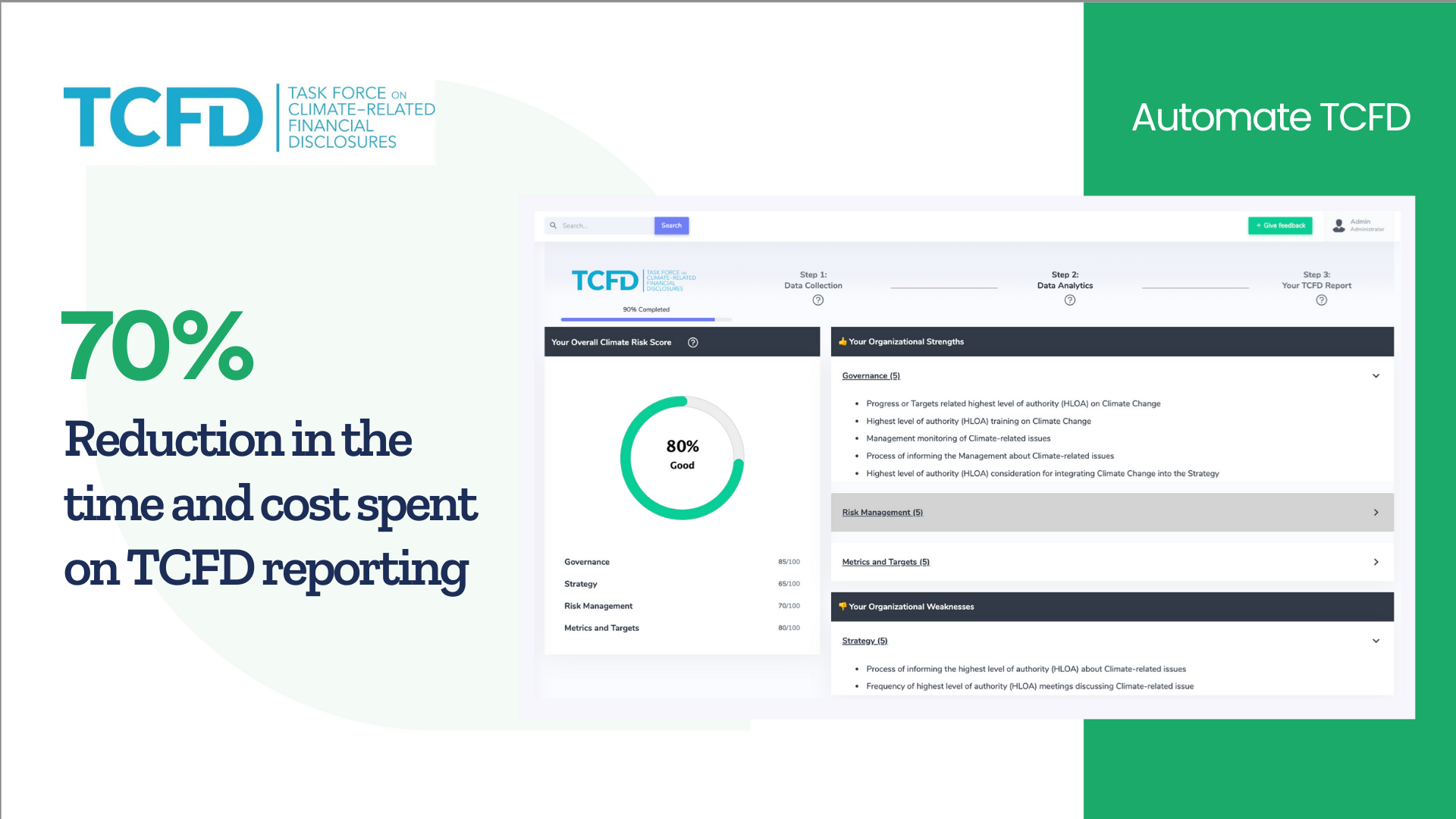

ESGTree’s TCFD Reporting Solution leverages a user-friendly multiple-choice questionnaire to generate automatic, comprehensive TCFD assessments, supported by actionable recommendations and sustainability scorecards for portfolio companies. This streamlined approach allows users to assess their current sustainability profile, and identify areas of improvement across TCFD’s four pillars: Governance, Risk Management, Strategy, and Metrics and Targets. Critically, it expedites the reporting process and eliminates the need for hiring external consultants.

“Our aim is to revolutionize the way financial institutions approach climate-related disclosures,” explains Shahzeb Irshad, Vice President of Platform & Partnerships at ESGTree. “We’ve designed our solution to simplify the disclosure process while delivering tailored recommendations, enabling organizations to address climate risks and opportunities efficiently.”

Reporting GHG Emissions: A Novel Requirement

Although the TCFD is the gold standard for climate disclosures, the intricacies of TCFD reporting pose a significant challenge to financial institutions. Measuring and disclosing financed emissions (i.e., GHG emissions associated with loans and investments) as part of climate disclosures is a new deliverable for many organizations/ financial institutions and, as such, will require new routines, organizational structures, and processes for gathering data. All this takes time and resources – the learning curve is steep and for some companies, these

changes need to be implemented in time for the 2024 reporting year.

Automate TCFD with ESGTree's TCFD Reporting SaaS

ESGTree’s TCFD Reporting Solution serves as a beacon, addressing these intricate challenges by automating scenario analysis and carbon calculations. By streamlining the reporting process, our platform significantly curtails procedural & resource time and costs, lending critical support during the assurance process. This not only reduces expenses but also equips financial institutions to furnish justifications to auditors and assurers, ultimately driving down the number of observations and associated costs.

Pioneering the Future of ESG

Climate resilience is paramount for financial institutions. With the TCFD Reporting Solution, you not only meet regulatory requirements but also elevate your sustainability strategies.

Pricing and Availability

The enhanced ESGTree platform, now inclusive of the TCFD reporting automation

tool, is open for use. Existing ESGTree clients seeking to integrate this enhancement can contact their dedicated account manager.

Click here to learn more about ESGTree’s TCFD Software Solution for Financial Institutions or fill out the form below to book a demo.

Feel free to reach out to us on [email protected] with any other queries.

ESGTree helps private capital investors automate ESG data collection and analysis for their portfolio companies. Our platform features include our carbon calculator, customizable and automated ESG frameworks, multi-level report viewing, trends analysis dashboard, and other features aimed to make ESG work for everyone.

#ESGTree #TCFDReporting #SustainableFinance #ClimateResilience #FinancialInstitutions

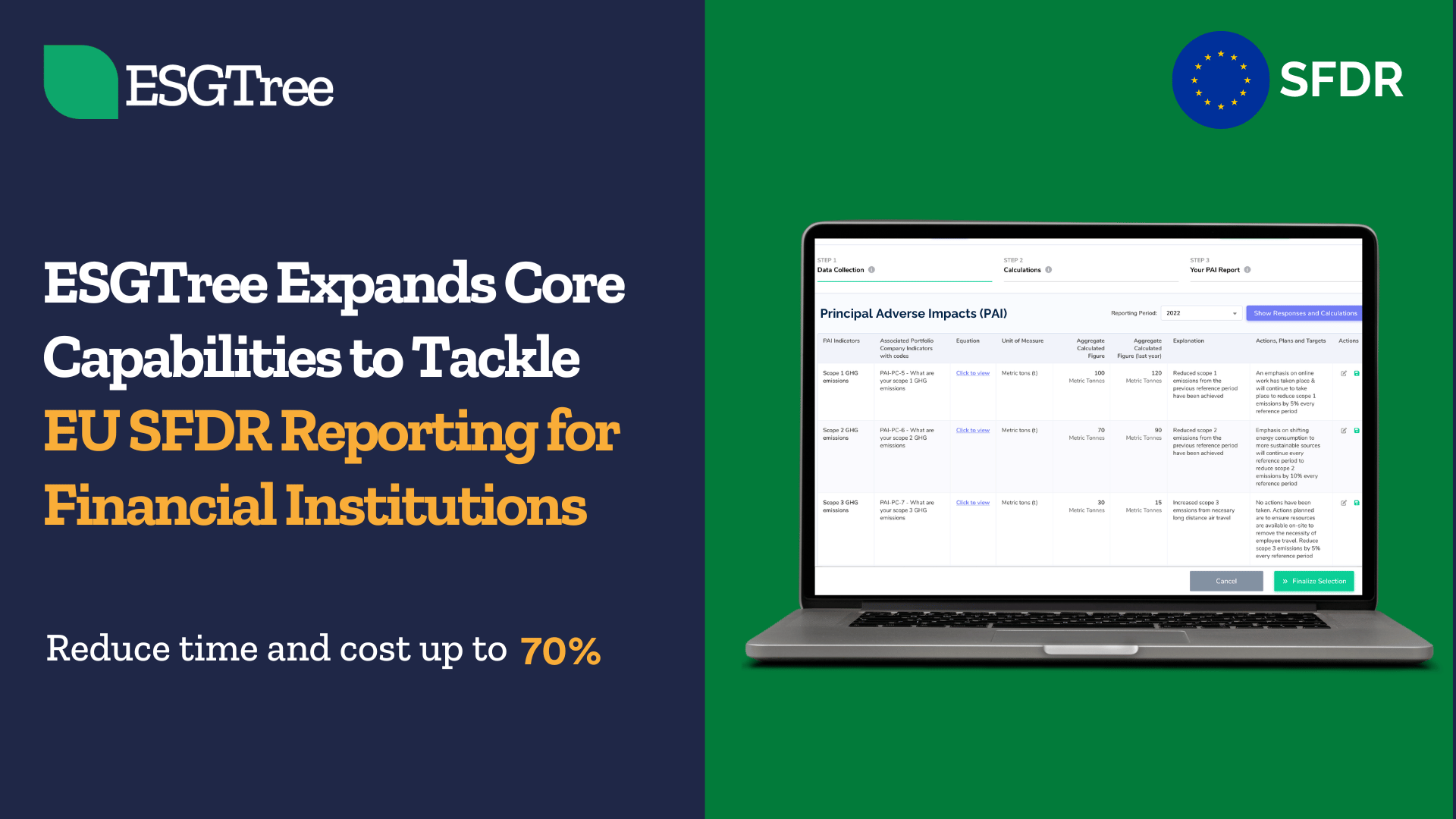

SFDR Reporting Solution for Financial Institutions

Guiding Financial Institutions on the Path to Net Zero

ESGTree Expands Core Capabilities to Tackle EU SFDR Reporting for Financial Institutions

ESGTree Elevates Financial Institutions’ Climate Resilience with TCFD Reporting SaaS Solution

Summary

Share:

A Core Tool for Financial Resilience

Integrating the TCFD framework into ISSB Standards

Reporting GHG Emissions: A Novel Requirement

Automate TCFD with ESGTree's TCFD Reporting SaaS

Pioneering the Future of ESG

Contact Us

Contact Us

Office Addresses

Canada: ESGTree, Kindred Centre for Peace Advancement, 140 Westmount Rd N, Waterloo,ON N2L 3G6, Canada

United Kingdom: ESGTree, 33 Queen Street, London EC4R 1AP, United Kingdom