ESGTree Expands Core Capabilities to Tackle EU SFDR Reporting for Financial Institutions

Share:

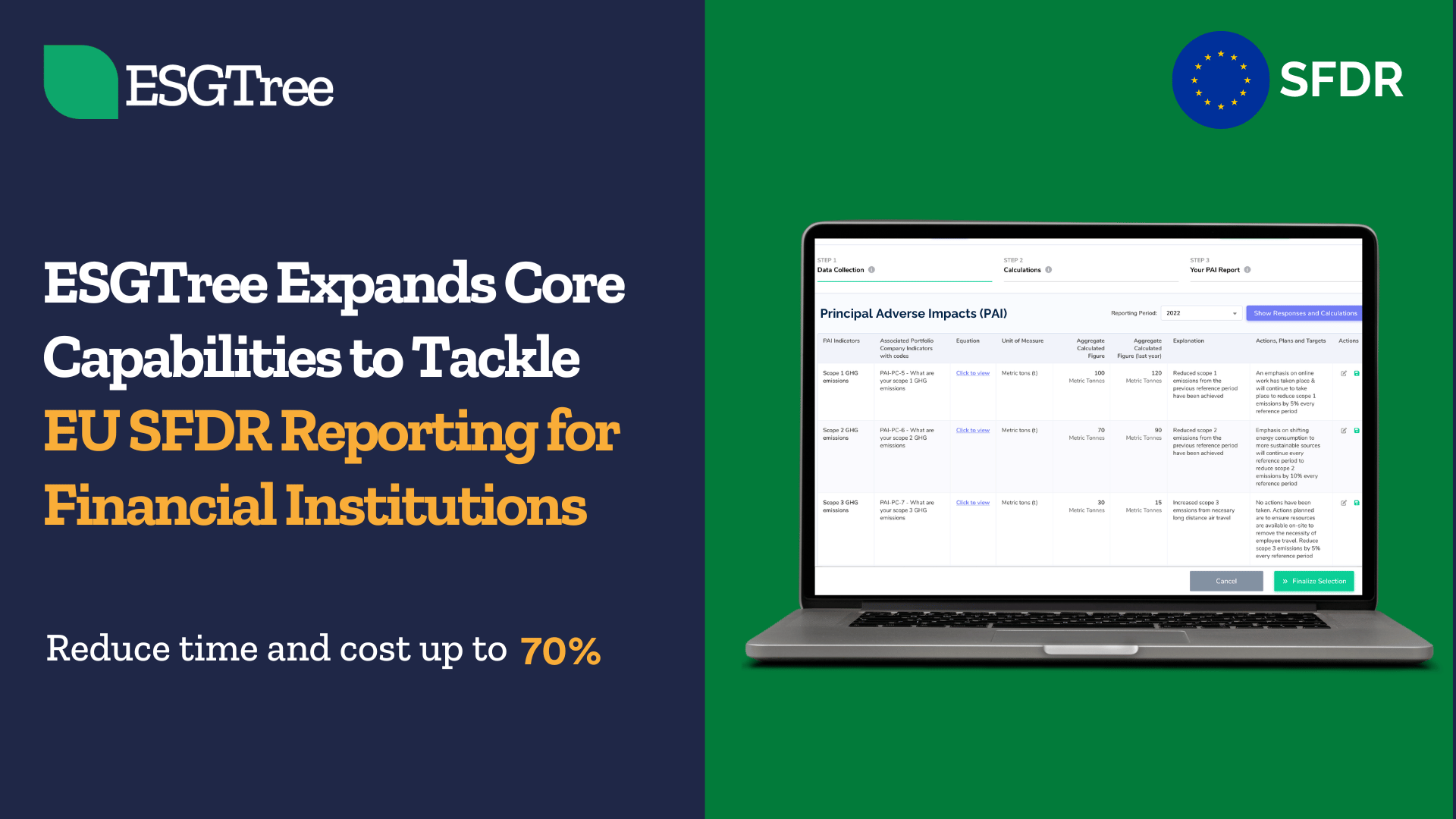

ESGTree, a cloud-based technology platform that provides Financial Institutions with a comprehensive Environmental, Social, and Governance (ESG) data solution, recently announced its expansion of SFDR capabilities available to clients. Under the SFDR automation stream, Its Principal Adverse Impact (PAI) automation tool simplifies and streamlines data management and reporting against European regulatory requirements.

The ESGTree Solution: From Burden to Opportunity

The SFDR is an EU regulatory initiative designed to improve transparency in sustainability claims of various investment products. ESGTree’s comprehensive SFDR solution includes:

- Data collection aligned with SFDR requirements:

- PAI Automation Tool: ESGTree’s digitized PAI reporting tool delivers a 360° solution to calculate, aggregate, and report on PAI indicators at both the fund level and entity level.

- ESGTree simplifies the process of collecting SFDR-aligned data with its secure, cloud-based, multi-user platform that includes built-in guidance and expert support.

- The platform translates legislation and technical indicators into an intuitive interface that empowers portfolio companies to track and enhance their performance.

- Expert Guidance via Client Success Support

- ESGTree’s dedicated team of ESG experts deliver unparalleled guidance to enhance SFDR alignment.

- Educational Resources

- ESGTree’s original and thorough Thought Leadership pieces serve as Guides through the SFDR reporting process, providing knowledge-sharing & insights on required metrics, regulatory updates, and reporting best practices.

A Holistic Approach to ESG Reporting Beyond SFDR

ESGTree offers financial institutions – including private equity firms and banks, a comprehensive Suite of Solutions to efficiently manage their ESG data. Beyond SFDR, our platform boasts an intuitive carbon calculator, customizable ESG frameworks, trends analysis, automated data management, and detailed dashboards, making it a singular, unified platform for ESG reporting.

“Our General Partners clients are consistently rated in the top 10% by their Limited Partners for ESG performance.” Says Shahzeb Irshad – SVP of Operations at ESGTree

“As regulatory landscapes evolve, so too must our approach to compliance and sustainability,” says Shahzeb Irshad – SVP of Operations at ESGTree. “Our SFDR reporting tool doesn’t just streamline the compliance process; it empowers financial institutions to uncover and harness the value of responsible investment, setting a new benchmark for ESG excellence.”

With ESGTree, financial institutions can leverage the power of cloud computing and advanced data solutions to not just comply with but excel under SFDR regulations, spearheading the movement towards a more sustainable financial ecosystem.

For more information on how ESGTree is redefining SFDR compliance and ESG disclosures, reach out at [email protected] or book a demo today.

To learn more about ESGTree’s SFDR Reporting Software click here.

About ESGTree

ESGTree is your all-encompassing solution for collecting, analyzing, and reporting ESG data. Designed with investors in mind, our cloud-based platform is fully customizable to meet your specific metrics and user experience needs. Our motto: “Making ESG work for you.”

Our Clients

We work with a range of financial institutions such as Impact Investors, Private Equity (PE) and Venture Capital (VC), Pension Funds, Development Finance Institutions (DFIs), Banks, Companies & more.

“ESGTree is great at helping to bring management teams on the same page. We view the ESGTree system and team as more of an extension of our company rather than a Software provider.“

Director, Investor Relationships at ICV Partners

ESGTree provides powerful data solutions to help private equity (PE) and venture capital (VC) firms gather, collect, analyze, benchmark and report their ESG data and that of their portfolio companies. Our carbon calculator, customizable and automated ESG frameworks, multi-level report viewing, trends analysis dashboard, and other features aimed to make ESG a value creation tool rather than a reporting burden.

Click here to learn more about our ESGTree’s ESG software solution for Private Equity & Venture Capital.