ESG Data Convergence Initiative: How LPs & Pension Funds Are Navigating EDCI Challenges & Opportunities

Share:

Just a few years ago, discussions about private market Environment, Social, and Governance (ESG) data centered on how to collect it. Today, the ESG Data Convergence Initiative (EDCI) has shifted the focus to using that data to drive measurable sustainability outcomes. Over 6,000 companies globally have submitted their ESG data to EDCI based on a standardized set of metrics. With this information, EDCI has established the first widely accessible, large-scale ESG data set for private markets — enabling pension funds, institutional investors, PE firms, and VCs to incorporate ESG insights more effectively into their decision-making.

This article explores the key drivers pushing Limited Partners (LPs) and pension funds to align with EDCI, the challenges they face in doing so and the mitigation strategies employed by leading LPs to overcome these hurdles.

However, with the rise in investor ESG data requests and sustainability regulations, the tide has turned. General Partners (GPs) are now taking the lead in developing their own ESG scoring methodologies to increase engagement with their portfolio companies (PortCos), and Limited Partners (LPs) are scoring these fund managers on their responsible investment integration practices.

In this article, we explore the significance of ESG scorecards in the private markets and the best practices that leading fund managers deploy to create them.

What’s Driving LPs & Pension Funds to Align with EDCI?

- Enhanced Transparency & Benchmarking: According to a 2024 Boston Consulting Group (BCG) Report, 90% of LPs cite transparency as a critical factor for collecting sustainability data. EDCI not only provides unprecedented visibility into the ESG performance of portfolio companies, but also enables LPs to track commitments and progress against common sustainability benchmarks. For these reasons, a growing number of LPs are aligning with the Initiative

- Data Comparability, Risk Management, & Enhanced Investment Decision Making: For LPs, the ability to make informed decisions hinges on the quality and comparability of the data at their disposal. Institutional investors are motivated to align with EDCI because its standardized metrics allow them to assess potential investments through a clearer ESG lens, integrating sustainability into their financial analysis more seamlessly. This not only helps to identify risks and opportunities related to ESG factors, but also answers the growing demand for sustainable and responsible investing. As a result, GPs can better manage their portfolios in a way that reflects both financial and ESG performance, appealing to a broader range of investors.

- Shift from Public Market Data Proxies to Private Market Data: Historically, large financial institutions and pension systems have relied on public market proxies and estimators to report the carbon footprint of their private assets. This approach is far from ideal, as it is often unreliable, imprecise, and offers limited assurance engagement during auditor reviews. EDCI has emerged as a game-changer, providing LPs with access to validated and high-quality private market data, meticulously controlled and verified by BCG.

- Constructive GP Engagement: LPs increasingly view sustainability data as a tool for meaningful dialogue with GPs. An increasing number of LPs are aligning with EDCI so that they can use insights from EDCI submissions to drive constructive conversations with GPs about strengths and challenges within their portfolios, and to provide guidance to GPs on improving sustainability outcomes over time.

What Challenges are LPs & Pension Funds Facing with EDCI Alignment?

- Low Data Coverage & GP Engagement: LPs that request EDCI-aligned data from GPs still struggle with engaging with their GPs in a meaningful way and getting high data coverage. This is especially prevalent amongst North American GPs (BCG Report). To address these data gaps, LPs are often forced to rely on estimation methodologies and harmonize disclosures with other data sources, a process that demands significant time, resources, and expertise.

- Limited Scope for Climate-Related Metrics: LP commitments to climate initiatives like the Net Zero Asset Managers Initiative (NZAM) and the United Nations’ Principles for Responsible Investment (UNPRI) are driving them to demand more comprehensive climate-related disclosures from GPs that go beyond EDCI, such as physical and transitional risk considerations. By not accounting for these essential climate-specific metrics, EDCI often falls short of LPs’ evolving climate-related reporting requirements, leading them to seek additional, more relevant data from their GPs.

- Lack of a Materiality Lens: While EDCI’s standardized metrics have enhanced cross-firm ESG comparisons, they have also sparked criticism for potentially diluting the focus on materiality. Several PE firms’ ESG heads expressed frustration at the 2024 Responsible Investment Forum that data standardization initiatives like EDCI come at the expense of identifying which ESG topics are materially relevant to each company individually. One panelist articulated this tension: “I understand the idea of going to a smaller set [of metrics] so that you can have comparability, but it shouldn’t come at the expense of focusing on issues that are most material to our portfolio companies.”

What Strategies are Leading LPs Employing to Tackle these Challenges?

Leading LPs are using ESG data management platforms to address the complexities of managing large private market portfolios. These platforms aggregate data from a multitude of GPs, transforming it into actionable visualizations, analytics, and insights that are useful for deal, risk, and sustainability teams. By leveraging technology in this way, LPs are realizing a range of benefits, from improved data coverage to enhanced decision making across the value chain. More specifically, LPs are able to:

- Streamline ESG Data Collection by:

- Automating manual processes, such as data entry, KPI tracking, and version control, saving them time and money,

- Centralizing fragmented data sources into one system by ingesting data from any database and document templates; and

- Auto-Filling Data Gaps by leveraging available information, such as company revenue and industry data, alongside EDCI benchmarks, to estimate missing KPIs. Since LPs frequently receive EDCI submissions that lack critical data on emissions footprint metrics, this approach enables them and their GPs to take proactive action on ESG issues even before complete data is available.

- Focus on Data Quality & Validity: LPs are placing greater emphasis on the integrity and quality of GPs’ EDCI data submissions. By adopting ESG data management platforms, LPs gain access to comprehensive audit trails that track data entry, timestamps, and modifications, ensuring full traceability. These platforms also generate data quality scores to evaluate the accuracy of GPs’ self-reported metrics and provide transparency into carbon footprint calculation methodologies. By leveraging technology in this way, LPs can identify errors at the data collection stage, enhancing their ability to assess the reliability of submissions for external reporting.

- Drive Engagement through Automated Scorecards, AI-Driven Forecasting, and ESG Target Setting: LPs are leveraging ESG data management platforms to generate automated scorecards that deliver actionable insights into GPs’ performance against key ESG/EDCI KPIs, fostering deeper engagement with Fund Managers. These platforms also utilize historical data and AI-driven forecasting to provide predictive analytics, enabling LPs to anticipate future trends and set ESG targets across fund managers and portfolios. By setting ESG targets in this way, leading LPs are driving meaningful conversations with Fund Managers on areas for improvement and making more informed investment decisions at every stage.

- Streamline ESG Data Collection by:

In the ever-evolving ESG landscape, ESG scorecards have emerged as a powerful tool for driving sustainability performance in the private markets. By aligning with global standards, implementing consistent methodologies, and leveraging technology, fund managers have an opportunity to deliver measurable value to investors and PortCos alike. As ESG priorities continue to shape the future, firms embracing these practices will be better positioned to lead with impact.

If you are looking for support, we can connect you to one of our ESG experts for a complimentary consultation, and get you started on your ESG journey today.

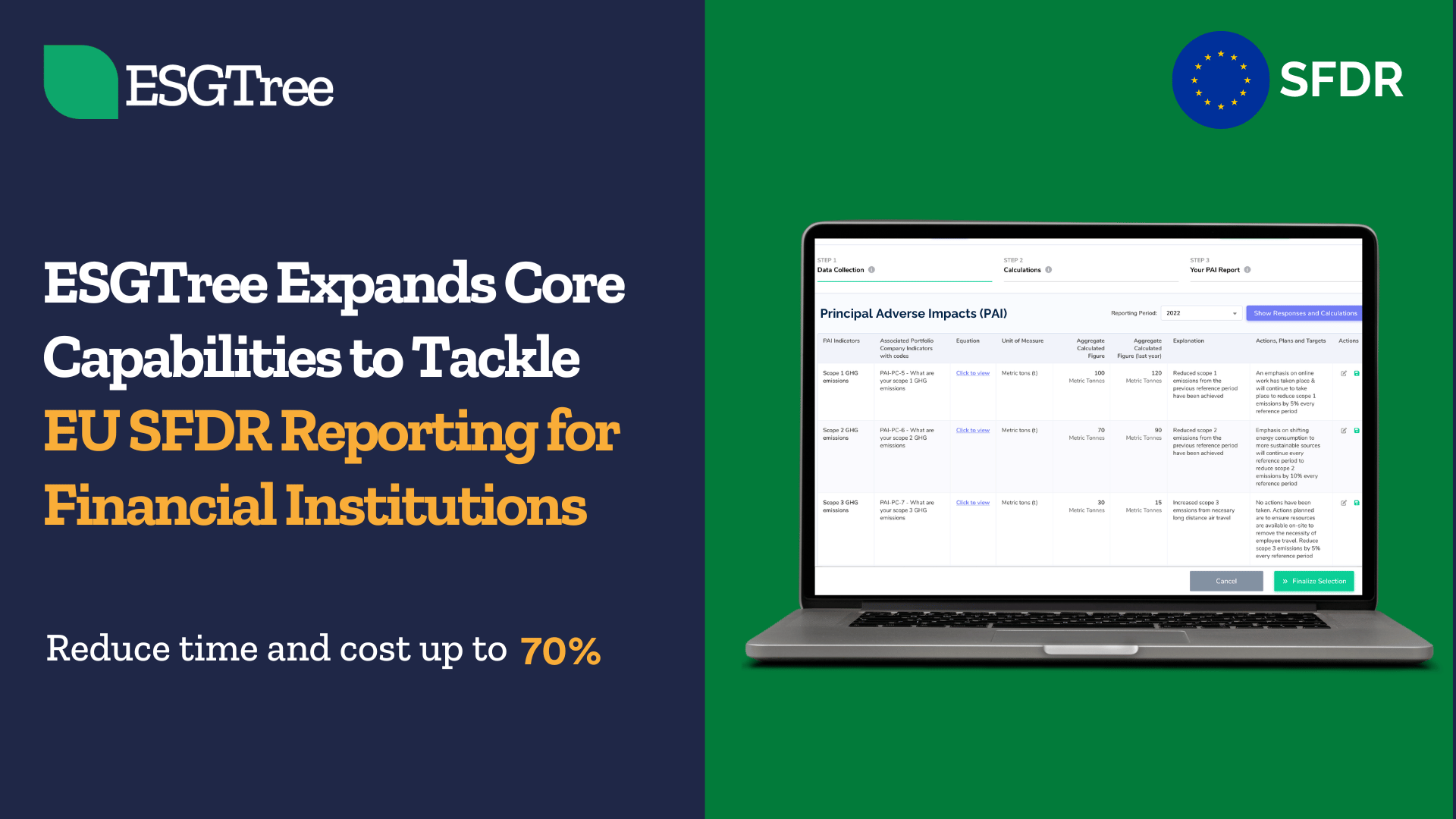

SFDR Reporting Solution for Financial Institutions

Podcast: Winning ESG Integration Strategies for GPs

Guiding Financial Institutions on the Path to Net Zero

ESGTree Expands Core Capabilities to Tackle EU SFDR Reporting for Financial Institutions

Contact Us

Office Addresses

Canada: ESGTree, CPA 4th Floor, 140 West mount Rd N, Waterloo,

ON N2L 3G6, Canada

United Kingdom: ESGTree, 33 Queen Street, London EC4R 1AP, United Kingdom