How GPs Can Operationalize ESG Integration by Investing in ESG Resources

Share:

Table of Contents

The Private Equity (PE) Market has seen greater adoption for Environment, Social, & Governance (ESG) in these past four years than ever before. Factors such as changing investor priorities and rising pressure from regulators have fueled this paradigm shift and, while the tide has not unilaterally turned, sustainability is no longer a fringe concern.

Our Critical Success Factor (CSF) Series has shown that, to remain competitive, General Partners (GPs) need to be intentional about incorporating ESG factors into business practices and stay agile in meeting changing expectations. For Mid-Market PE firms, this entails:

- Building a robust ESG integration strategy and policy (see. CSF #2)

- Choosing decision-useful ESG metrics (see. CSF #3)

- Operationalizing ESG goals by investing in ESG resources

This triangular approach to firm-wide ESG integration will enable GPs to stay ahead of Limited Partner (LP) due diligence questionnaires (DDQs) and regulations.

Investing in ESG Resources to Operationalize ESG Integration

A. Why is it Important?

Emerging ESG standards and regulations are requiring entities to report on sustainability information in tandem with financial information; while Finance Teams are equipped to deliver on the latter, they may struggle to collect sustainability data. This is because ESG data collection requires inputs from all ends of the organization, which cannot be done without developing internal capacity and competencies for ESG.

B.What Can You Do?

In order to develop internal capacity and competencies for ESG in your firm, you should consider:

Establishing Designated Roles for Sustainability and Supplementing them with Technology

- Normally, smaller PE firms don’t have a designated Head of ESG, so ESG is often clubbed under Finance, Compliance, or Investor Relations. Even in cases where PE firms have a Head of ESG, they will typically be supported by at least one resource tasked with manually creating templates for ESG KPIs, sending those KPIs to Portfolio Companies, liaising with them, trying to get data back, version control, and then making sense of this data. As LP and regulatory requests get more sophisticated and complex, these manual processes become cumbersome.

- To effectively execute the ESG imperative, PE firms need to build internal capacity. Larger firms tend to do this by hiring in-house sustainability teams that can coordinate and deliver on the many moving parts of the ESG data collection and reporting process. However, for Mid-Market PE firms this option is neither scalable nor economical. In fact, even for larger PE firms, this one dimensional human-centered approach will only take them so far in meeting their ESG integration goals.

- A better way to operationalize ESG integration goals is to adopt a hybrid approach that will enable you to retain a lean and efficient organizational model while ensuring scalability. So, instead of hiring an entire sustainability team, you can invest in a designated ESG resource and supplement that with an ESG automation and reporting platform that offers implementation support at the PortCo level. Building internal capacity in this way will likely lead to quality improvements in your firm’s ESG reporting practices, increasing your chances of capturing an ESG premium during fundraising and/or exits (PwC).

- Many firms are looking to start their ESG journey today, so it is imperative they start building capacity now.

Select an ESG Reporting and Advisory Platform using the Evaluation Criteria Below:

- Oftentimes, determining the fit of an ESG technology solution can be a difficult process. To make it easier for you, we’ve developed a list of capabilities and features to consider when evaluating ESG reporting platform providers

- If you are looking for support, we can connect you to one of our ESG experts for a complimentary consultation, and get you started on your ESG journey today.

SFDR Reporting Solution for Financial Institutions

Podcast: Winning ESG Integration Strategies for GPs

Guiding Financial Institutions on the Path to Net Zero

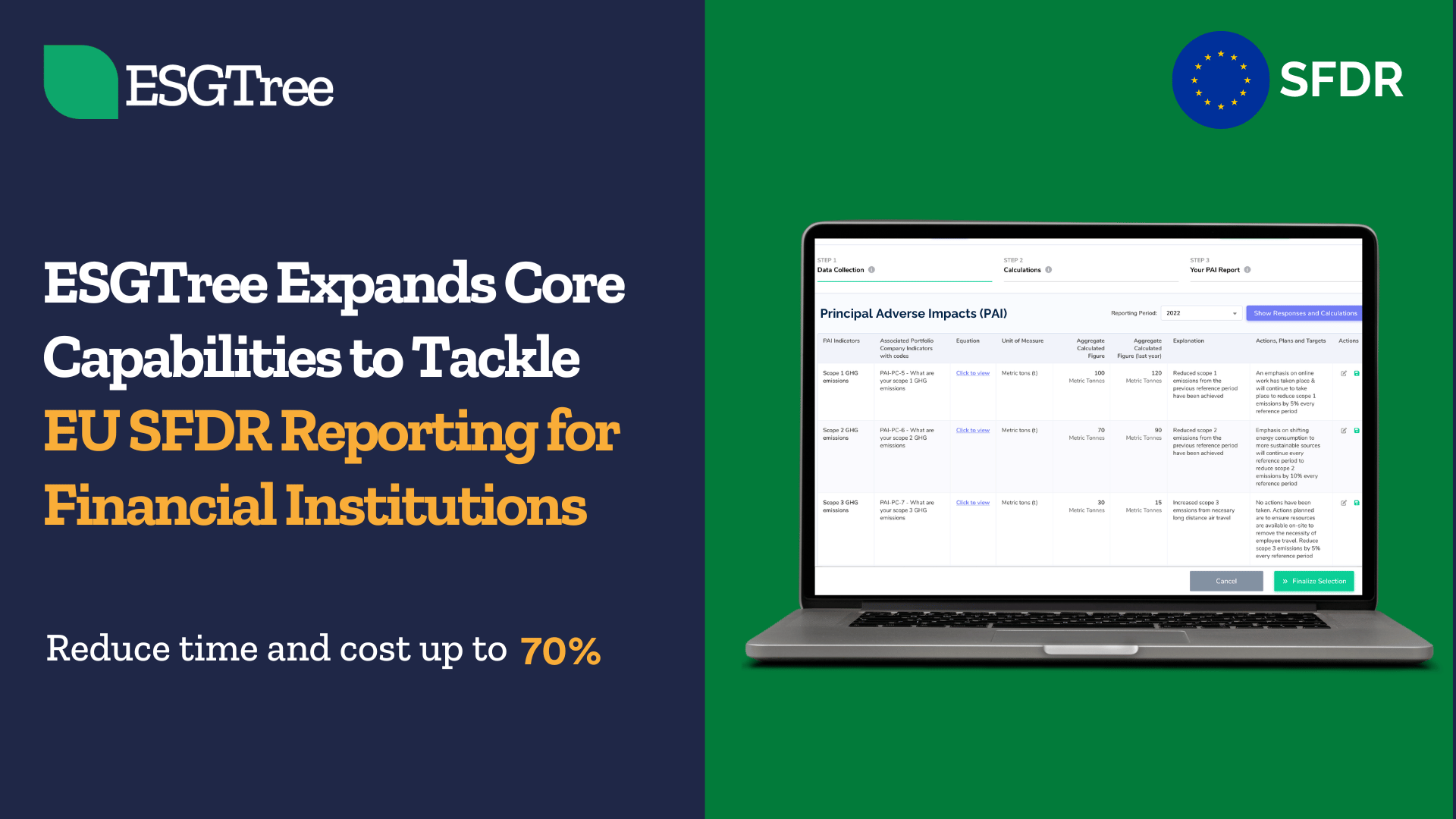

ESGTree Expands Core Capabilities to Tackle EU SFDR Reporting for Financial Institutions

Contact Us

Office Addresses

Canada: ESGTree, CPA 4th Floor, 140 West mount Rd N, Waterloo,

ON N2L 3G6, Canada

United Kingdom: ESGTree, 33 Queen Street, London EC4R 1AP, United Kingdom