The ISSB Standards: A Milestone in the Global Economy

Share:

On 26th June, 2023, the ISSB finally launched its inaugural sustainability standards, ushering in a new era in international corporate reporting

The International Sustainability Standards Board (ISSB) has issued its first two IFRS Sustainability Disclosure Standards: the IFRS S1, which provides a set of general disclosure requirements designed to enable companies to communicate to investors about the sustainability-related risks and opportunities they face over the short, medium and long term, and the IFRS S2 , which sets out specific climate-related disclosures and is designed to be used with IFRS S1. Both standards fully incorporate the 4 pillars of the Task Force on Climate-related Financial Disclosures (TCFD), namely Governance, Strategy, Risk Management, and Metrics and Targets.

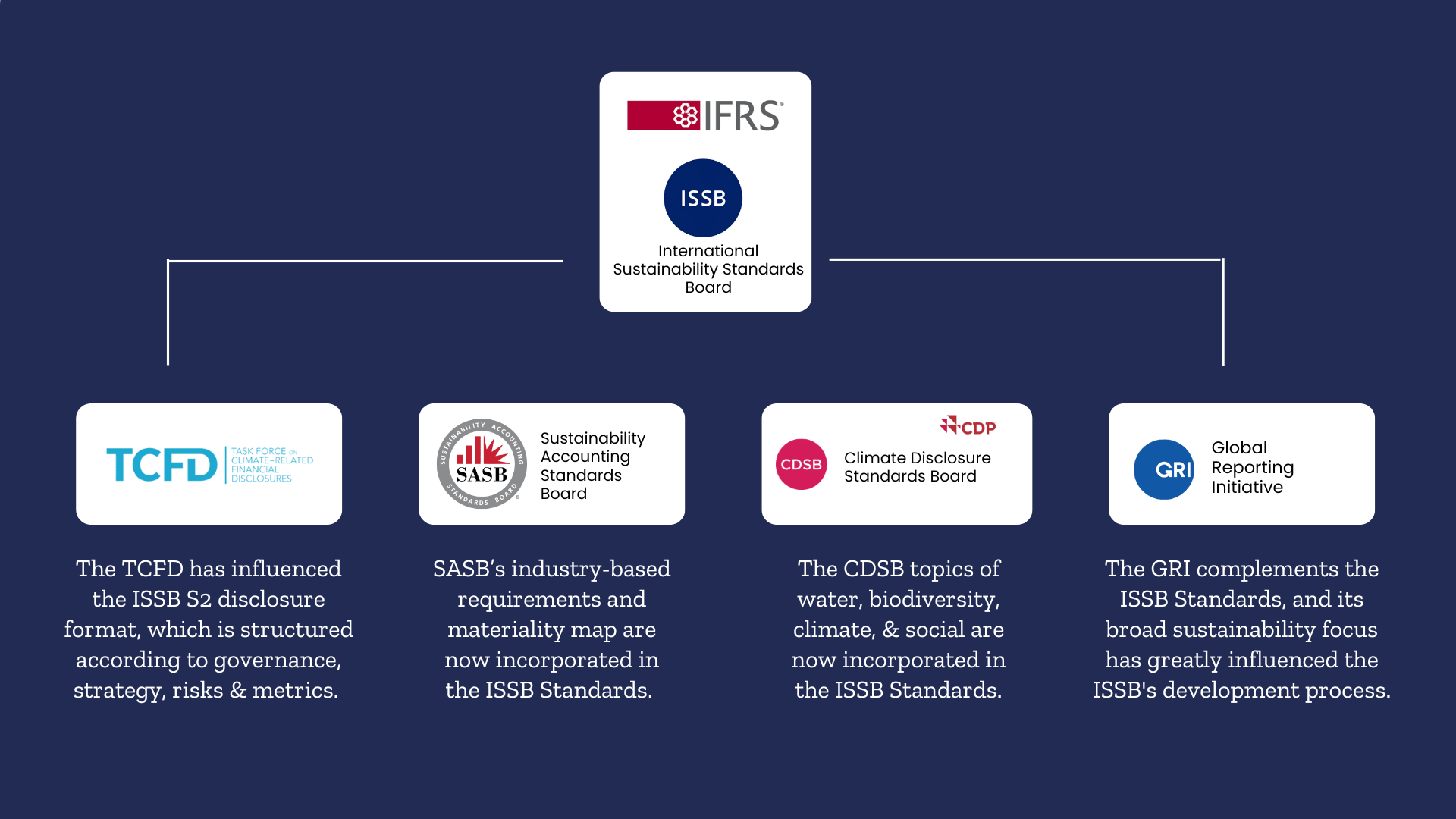

Interestingly, the TCFD – which has been adopted into UK law and is used voluntarily by many of the world’s biggest asset managers – has now moved into the administration of the ISSB. This merger, as well as the ISSB’s subsumption of the Sustainability Accounting Standards Board (SASB), marks a significant advancement in the ISSB’s promise of bringing cohesion among the plethora of sustainability standards and frameworks available for asset managers.

The International Sustainability Standards Board (ISSB)

The ISSB is a standards-setting body that focuses on creating standards for disclosing sustainability-related financial information. It was launched by the International Financial Reporting Standards (IFRS) Foundation on November 3, 2021 at COP26 in Glasgow.

The IFRS Foundation is a not-for-profit, public interest organization established “to develop high-quality, understandable, enforceable and globally accepted accounting and sustainability disclosure standards.” Alongside the ISSB, the IFRS foundation also established the longer-standing International Accounting Standards Board (IASB), primarily responsible for setting global financial accounting standards, namely the IFRS Accounting Standards, that are used by over 140 jurisdictions around the world.

The IFRS S1 and IFRS S2: In a Nutshell

While the final Standards contain several notable changes from the 2022 drafts , they continue to lean heavily on SASB’s industry-specific disclosure topics and strongly align with the European Sustainability Reporting Standards (ESRS), Global Reporting Initiative (GRI), the Greenhouse Gas Protocol, and many more (see Figure 1 below).

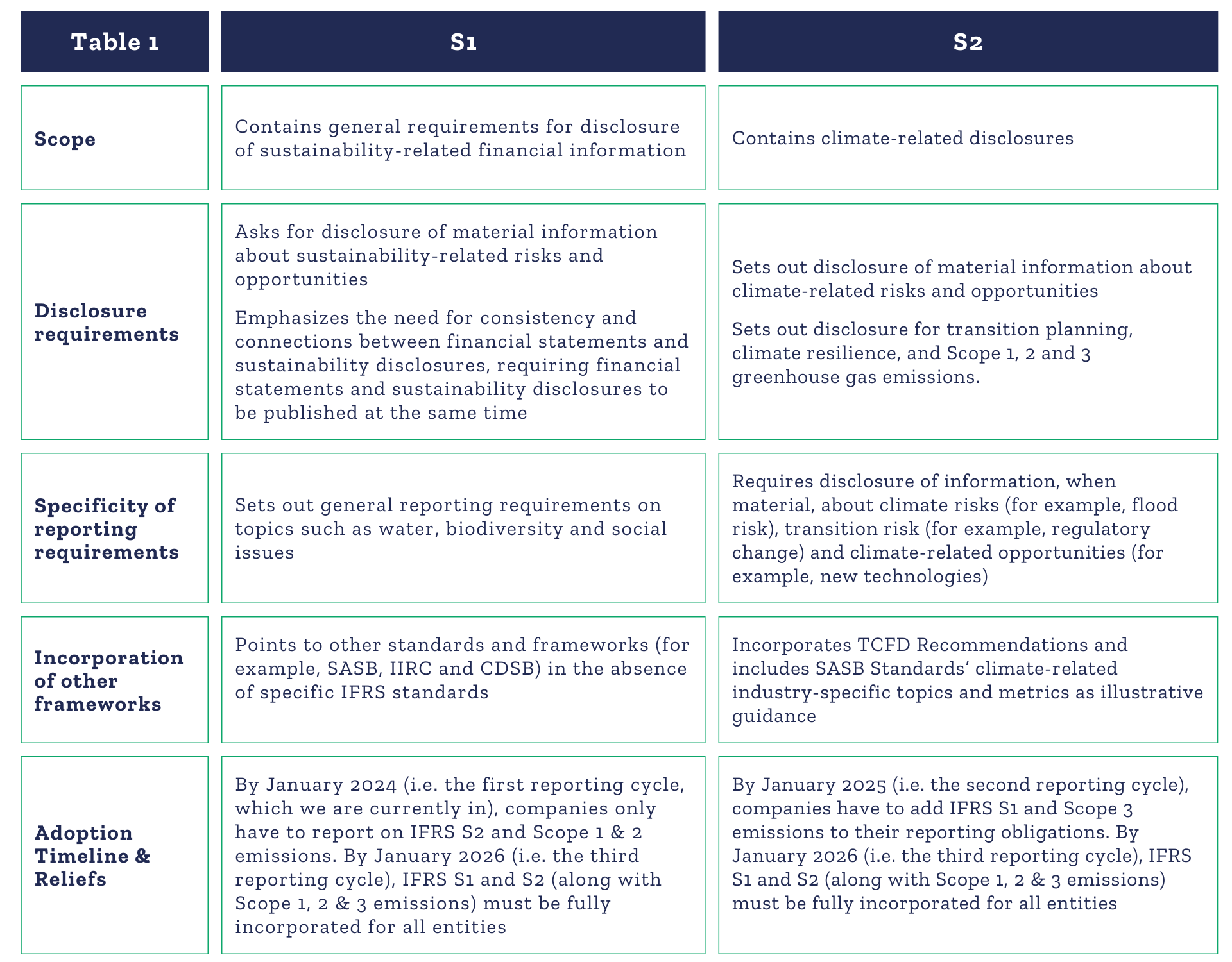

IFRS S1: The IFRS S1, for instance, asks companies to disclose material information about sustainability-related risks and opportunities across their value chain alongside financial statements, and leverages the works of predecessor organizations such as the Sustainability Accounting Standards Board (SASB)*, the Climate Disclosure Standards Board (CDSB) and the International Integrated Reporting Council (IIRC). This ensures a global baseline and allows the ISSB standards to be applicable to any accounting framework.

*To further provide nuance and context, IFRS S1 asks companies to consider using industry-based disclosure topics outlined in the SASB Standards for topics beyond climate, which are covered by IFRS S2. IFRS S1 also follows the architecture of TCFD for the core content of the disclosure

IFRS S2: Like IFRS S1, IFRS S2 requires companies to disclose material information*, specifically on climate-related risks and opportunities, that may affect their performance and prospects. It builds on the requirements of IFRS S1, fully incorporating the TCFD recommendations in its core content alongside additional details that go beyond TCFD (such as information about the planned use for carbon credits to achieve net emission targets, financed emissions, and measurement approaches for scope 3 emissions)

Key requirements for disclosures also include details on a company’s transition plans, its use of scenario analysis, quantitative data on scope 1-3 emissions, and how it intends to achieve climate-related targets, if any.

*IFRS S2 is also aligned with CDP’s Climate Questionnaire and the SASB standards, requiring industry-specific, cross-industry, and company-specific disclosures under metrics and targets.

In a nutshell, the S1 & S2 are characterized by the key elements highlighted in the Table below:

Adopting the ISSB Standards

The IOSCO Approval: Impact on Voluntary and Mandatory Reporting

The International Organization of Securities Commissions (IOSCO) completed its independent assessment of the ISSB standards and officially endorsed them in July 2023. This endorsement marked a major milestone toward making the Standards mandatory within many jurisdictions worldwide. With IOSCO’s backing, the IFRS S1 and S2 are expected to be adopted or adapted by its 130 member jurisdictions, representing over 95% of global financial markets. This will help transform the standards from voluntary to effectively mandatory in these regions.

Transition Groups & Reliefs

Now that IFRS S1 and IFRS S2 are issued, the ISSB will work with jurisdictions and companies to support adoption. It acknowledges that this level of reporting is “new for many, and represents a significant change in reporting practices globally,” so it has created a Transition Implementation Group that will act as a public forum for addressing practical questions and will support companies with capacity-building initiatives. For specific details on reliefs & adoption timeline, refer to Table 1 “Adoption Timeline & Reliefs” above.

Challenges to Adoption

While such concessions will ease the reporting burden on many companies, smoothen the transition period, and encourage compliance, companies will still struggle with data gathering, verification, and technical compliance requirements. For companies looking to start their ISSB reporting today, it is essential for them to deploy mitigation strategies that will gear them up for the January 2024 reporting period.

While the adoption of IFRS S1 and S2 may have seemed like a long-shot when they were first introduced, it is clear that they are here and ready to be reported on. In fact, we are currently in the first reporting cycle for the IFRS S1, but there’s a lot of legwork involved in setting up internal reporting capacity. So, early adoption and early assessments are really crucial for setting up that internal capacity in the face of upcoming regulations.

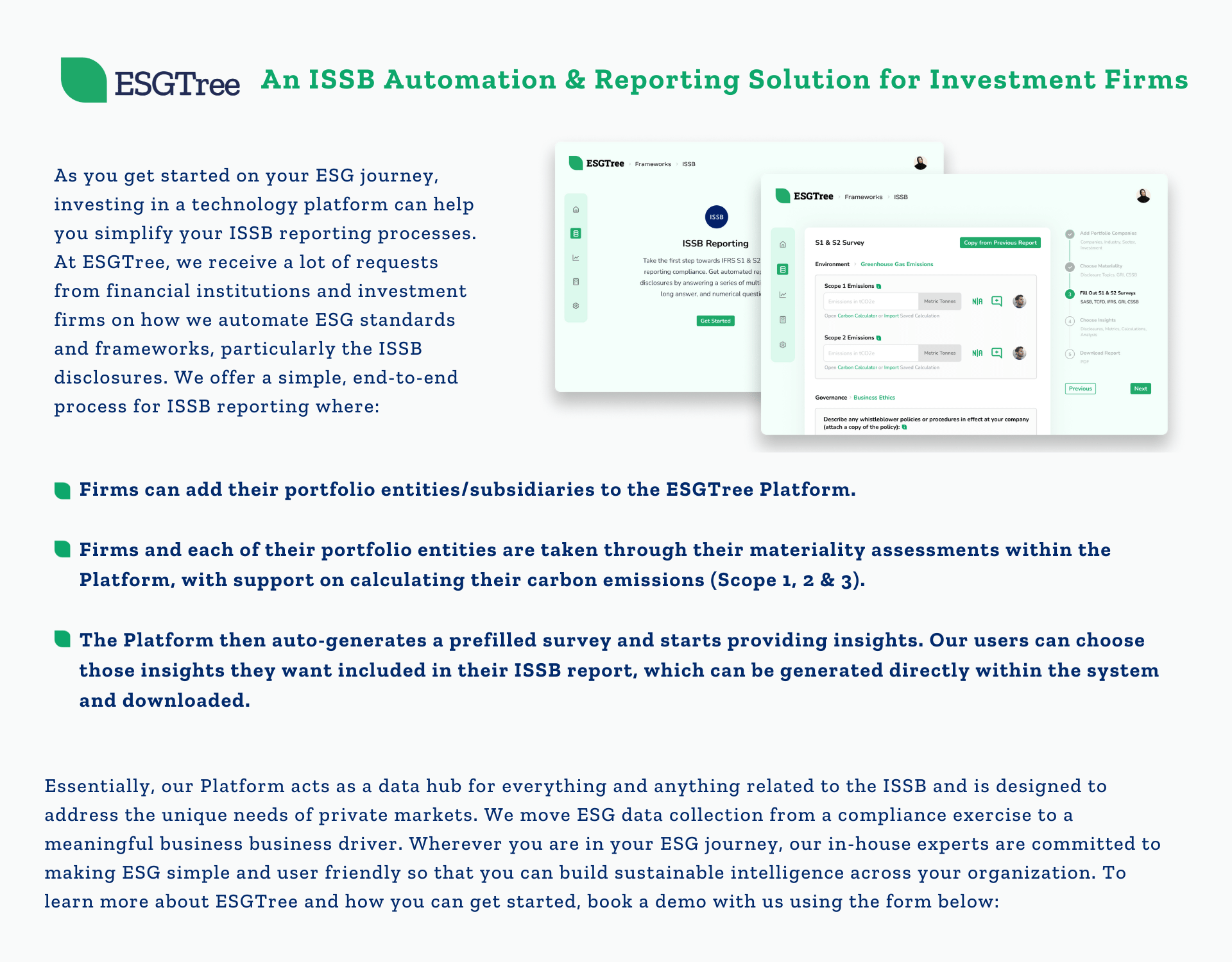

About ESGTree

ESGTree helps companies gather, analyze, and report on sustainability information, greatly reducing the time and effort required to comply with investor demand and regulation. Our platform automates all major industry-leading frameworks, along with Greenhouse Gas Protocol-aligned carbon calculations, to provide a holistic ESG solution for financial institutions.

Purpose-built for private capital investors, ESGTree’s data automation solutions allow private equity and venture capital firms to gain insights into their portfolio companies’ ESG performance over time, attribute ESG data correctly, and benchmark their data to assess a portfolio company’s progress in relation to other comparable companies in the region. These insights enable investors to identify potential risks and opportunities and make informed investment decisions based on a portfolio company’s ESG performance. Our cloud-based platform and advisory services meet the needs of both seasoned ESG managers as well as those entering the world of ESG for the first time.

Why ESGTree? – Differences that Make a Difference

Who Should the Economy Really Serve?

What We’ve Learned Automating the ESG Data Convergence Initiative (EDCI) for Clients

What Does the Rise of ESG Mean for Impact Investing?

Summary

Share:

IFRS Sustainability Standards Launch: A New Era for Corporate Reporting

IFRS S1 and S2: Key Elements of ISSB Sustainability Standards

From Voluntary to Mandatory: IFRS S1 and S2 Impact on Reporting Practices

Challenges and Solutions in Adopting IFRS S1 & S2 Standards

ESGTree: Simplifying ESG Reporting and Compliance

Contact Us

Contact Us

Office Addresses

Canada: ESGTree, CPA 4th Floor, 140 West mount Rd N, Waterloo,

ON N2L 3G6, Canada

United Kingdom: ESGTree, 33 Queen Street, London EC4R 1AP, United Kingdom