ESG LP DDQS: A LOVE-HATE RELATIONSHIP FOR GPs

Share:

Key Finding

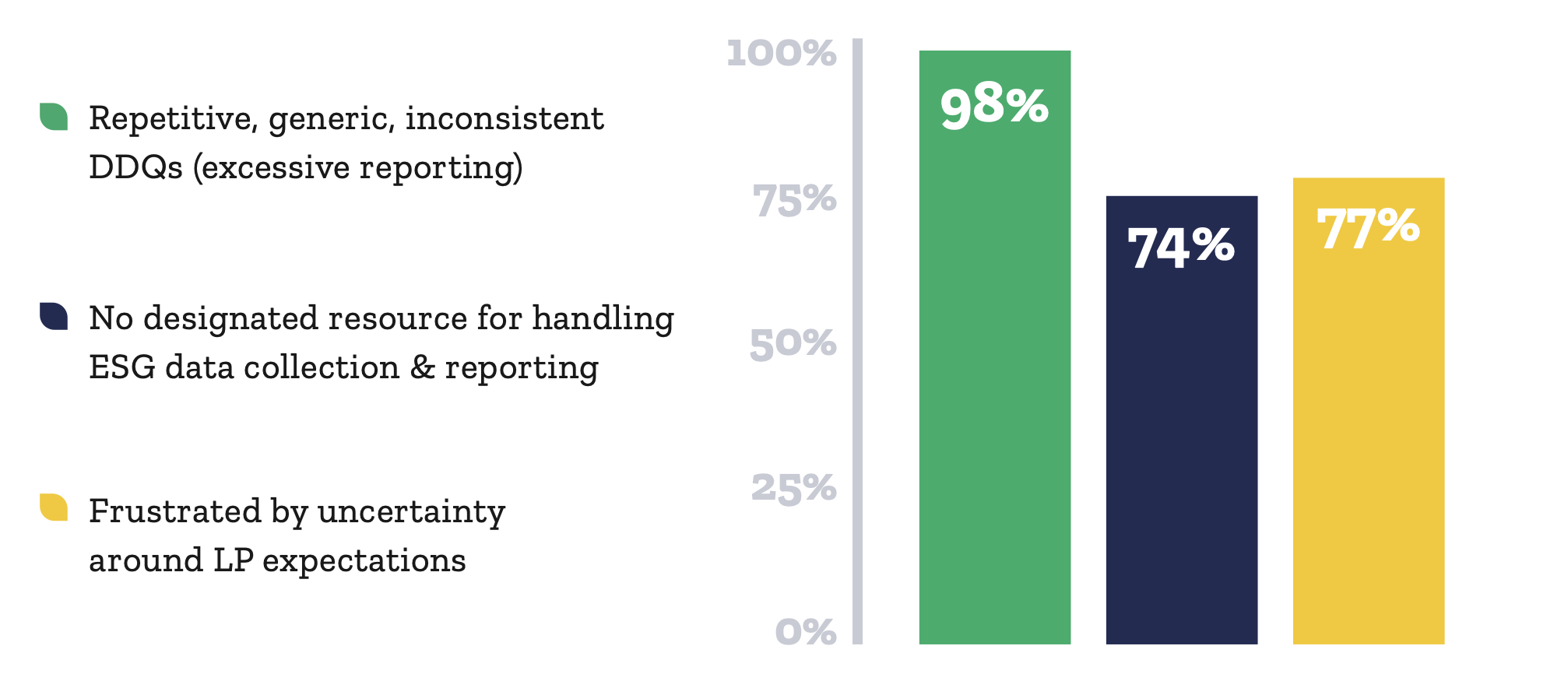

While a majority of General Partners (GPs) believe that ESG is a core value, 90% of them find investor Due Diligence Questionnaires (DDQs) to be excessive, repetitive, and inefficient. This frustration is exacerbated by the fact that 88% struggle to find effective ESG reporting solutions.

(source: Independent ESGTree survey)

Over the past two years, an overwhelming majority of General Partners (GPs) have increased efforts to manage and measure the ESG performance of their portfolio companies. Indeed, this trend has been examined in a 2022 Bains & Company and Institutional Limited Partners Association (ILPA) report, revealing that Limited Partner (LPs) no longer view ESG efforts as an exercise in good PR or risk mitigation, but rather as a compelling value creation tool. Yet, when it comes to meeting LP demand for greater ESG integration, GPs continue to report a lack of clarity and guidance around ESG data collection. Our report delves deeper into this conundrum by highlighting the pain points that GPs and LPs experience when it comes to LP due diligence and exploring the possible solution to these existing challenges.

The GP Sentiment – A Triad of Challenges

Our extensive interviews with GPs from some of the biggest private equity firms revealed a triad of challenges that GPs experience when it comes to LP due diligence. While 80% of the interviewed GPs appreciate the purpose and significance of ESG, almost all of them 1) remain unsure about the value of the “excessive” DDQs, 2) report a lack of clarity and guidance around ESG data, and 3) lack a designated internal resource for handling ESG data collection and reporting.

The root cause of most of the challenges around LP due diligence is that LPs themselves are still trying to work out what they are looking for and why it is important to them. 77% of the GPs that ESGTree interviewed reported being discouraged by this uncertainty among LPs, making it a key contributor to the GP consensus that there is a lack of clarity and guidance around ESG data reporting. Despite the numerous frameworks and initiatives to standardize ESG data collection in the private equity sphere, the tug-of-war between GPs and LPs remains far from resolved.

The GP-LP Sentiment – Data Overload

The GPs we interviewed also discussed the problem of data overload, which can be frustrating for both GPs and LPs alike. Collecting and processing ESG data all at once is overwhelming, tedious, complex and unrealistic for GPs and their portfolio companies. The situation is exacerbated by the fact that most GPs (74%) do not have designated internal resources for handling ESG data collection and reporting, and “are all stretched so thin” (as one ESG head told us). At the same time, LPs don’t want to receive raw portfolio company data that they might struggle to analyse and interpret; they prefer information in a more digestible format.

GPs feel that tech-enabled service providers like ESGTree are providing immense value by delivering flexible solutions that can:

- Standardize the taxonomy of ESG

- Provide independent ESG assessments and benchmarks

- Offer GPs flexibility in adhering to different standards that are constantly changing

Every single GP that we interviewed admitted that if they had a centralized platform to house all the DDQs, it would help them give better-quality answers. This in turn would drive sounder ESG policies beyond basic box ticking, boosting overall LP portfolio performance. On the other hand, a lack of attention to ESG can jeopardize proposed deals, the Bains & Company report adds.

In order to reap the benefits of ESG, however, management teams need to come on board. Rather than silo ESG within risk management teams, an organizational shift is required where ESG is embedded into every level of an organization, starting at the top. Fortunately, firms are starting to recognize this: a recent KPMG survey found that 73% of organizations felt that the CFO was critical to leading ESG strategy, highlighting a growing awareness that ESG risk and financial risk are intertwined.

Opportunely, our proprietary software not only bridges the gaps experienced by GPs through DDQ automation, but its in-built collaboration tools allow for easy access to synthesized data across departments to drive the necessary organizational shifts to harness the power of ESG.

Why ESGTree:

Our platform is purpose-built for private equity investors and offers automated data collection requests with auto-reminder notifications, ready-to-implement framework automations, ESG advisory services, and other customizable features.

Our Client Success Team is comprised of veteran experts in ESG, technology and impact investing, who advise our clients on their ESG strategy. Currently, there is a large skill gap in the market and most providers lack trained ESG specialists to keep up with evolving ESG requirements and regulations.

Our unique ESG scorecards, benchmarking tool, and carbon calculation software serve a diverse set of private equity firms.

We position ESG as a value-creation exercise rather than a reporting burden.

ESGTree Features:

- Automated data collection with portfolio-level access & aggregation capabilities

- Company-specific ESG scorecards to provide value creation for portfolio companies

- Simplified greenhouse gas emissions calculator

- Multi-level trends analysis and visualizations by indicator, framework, and reporting periods

- Client success support from ESG experts

- Ready-to-implement framework automation including SASB, IRIS+, TCFD, EDCI, PCAF, SFDR and DEI.

- Industry benchmarking against a dataset of 10,000+ companies

- Purpose-built to streamline ESG reporting and collaboration for Limited Partners (LPs), General Partners (GPs) and portfolio companies.

A Brighter Future for ESG Reporting & LP Due Diligence

Despite the challenges of LP due diligence, GPs are faced with an immense opportunity to create value from ESG adoption. Firms that choose not to prioritize robust and integrated ESG strategies and reporting mechanisms may hurt their fundraising capacity and fall behind in an investment environment where ESG is now a mainstream consideration. Fortunately, it appears that the private funds industry is moving towards a greater understanding of GP reporting requirements and an improved interpretation of ESG regulatory disclosure rules. Above all, all GPs agreed that consolidated ESG standards across all working groups would be invaluable, along with regular, constructive dialogue between GPs and LPs on what is achievable. Ideally, LP due diligence must go beyond regulatory requirements and become more effective at defining, measuring, evaluating and communicating ESG impacts, to the benefit of all participants.

Our Clients

We work with a range of financial institutions such as Impact Investors, Private Equity (PE) and Venture Capital (VC), Pension Funds, Development Finance Institutions (DFIs), Banks, Companies & more.

“ESGTree is great at helping to bring management teams on the same page. We view the ESGTree system and team as more of an extension of our company rather than a Software provider.”

Director, Investor Relationships at ICV Partners

ESGTree provides powerful data solutions to help private equity (PE) and venture capital (VC) firms gather, collect, analyze, benchmark and report their ESG data and that of their portfolio companies. Our carbon calculator, customizable and automated ESG frameworks, multi-level report viewing, trends analysis dashboard, and other features aimed to make ESG a value creation tool rather than a reporting burden.

With ESGTree, save the time and cost of ESG reporting by harnessing the power of the cloud and streamlining ESG data collection, analysis and disclosure.

For more information on the ESGTree’s ESG Reporting Solution, please contact us at :

or

SFDR Reporting Solution for Financial Institutions

Guiding Financial Institutions on the Path to Net Zero

ESGTree Expands Core Capabilities to Tackle EU SFDR Reporting for Financial Institutions

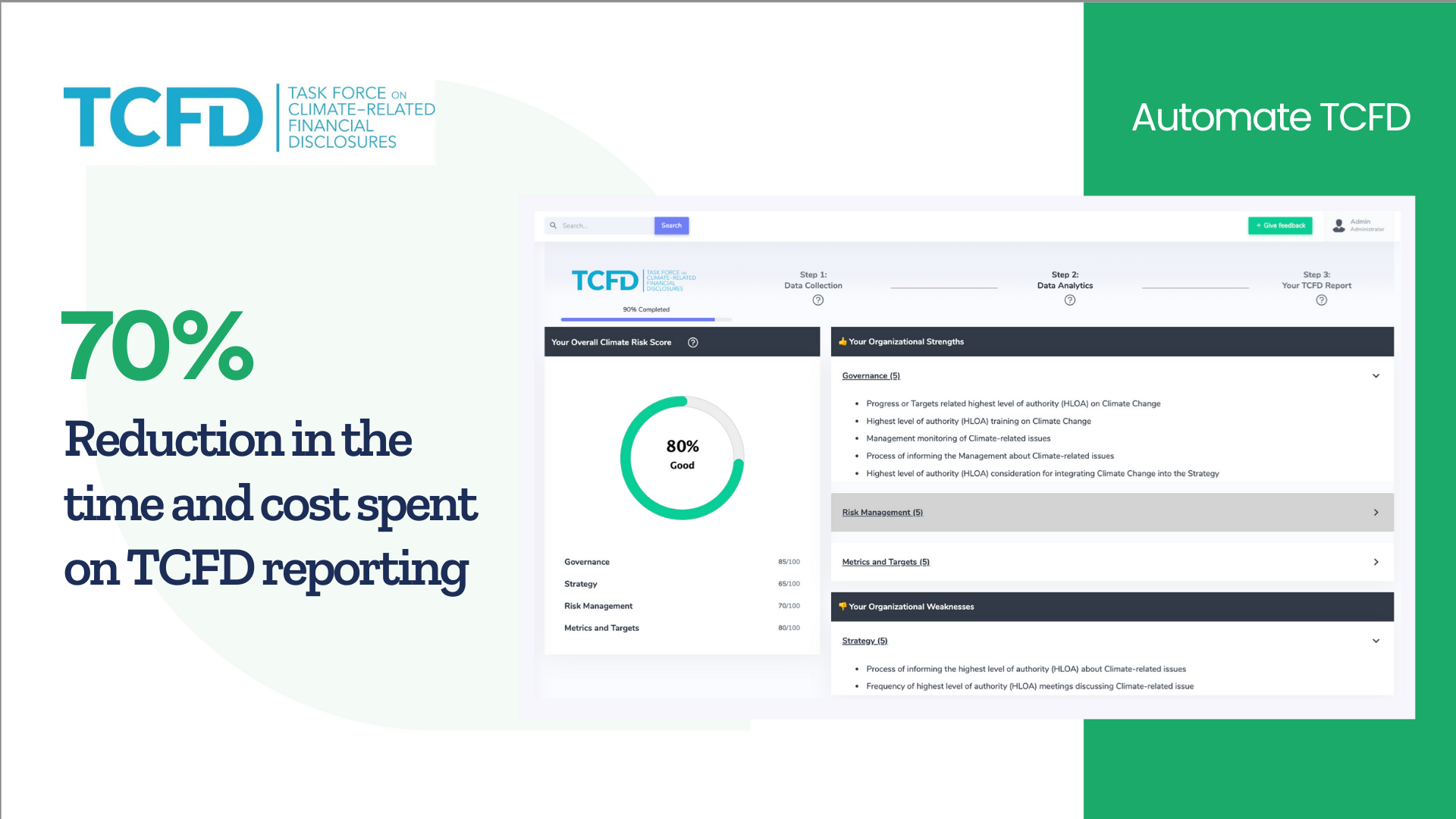

ESGTree Elevates Financial Institutions’ Climate Resilience with TCFD Reporting SaaS Solution

Contact Us

Office Addresses

Canada: ESGTree, CPA 4th Floor, 140 West mount Rd N, Waterloo,

ON N2L 3G6, Canada

United Kingdom: ESGTree, 33 Queen Street, London EC4R 1AP, United Kingdom