IFRS S1 and S2: How Investment Firms Can Prepare for ISSB Reporting

Share:

Table of Contents:

On 26th June, 2023, the ISSB finally launched its inaugural sustainability standards, ushering in a new era in international corporate reporting

On 26th June, 2023, the International Sustainability Standards Board (ISSB) launched its inaugural IFRS Sustainability Disclosure Standards (IFRS S1 and S2), ushering in a new era in international corporate reporting. With 20+ jurisdictions (including Canada, the UK, Australia, New Zealand, China, & Japan) already engaged in the adoption process, these standards have become the baseline for most regulatory adoption of sustainability disclosures worldwide. In the same way that standardized accounting practices emerged decades ago to establish a baseline for corporate reporting, the IFRS S1 and S2 represent the next step in the evolution of these practices.

While these standards are not yet mandatory, investment firms that adopt them early on can gain a competitive edge through improved ESG reporting practices, which can lower a firm’s cost of capital and translate into a valuation premium (Accenture).

What are the IFRS S1 and S2? A Brief Overview

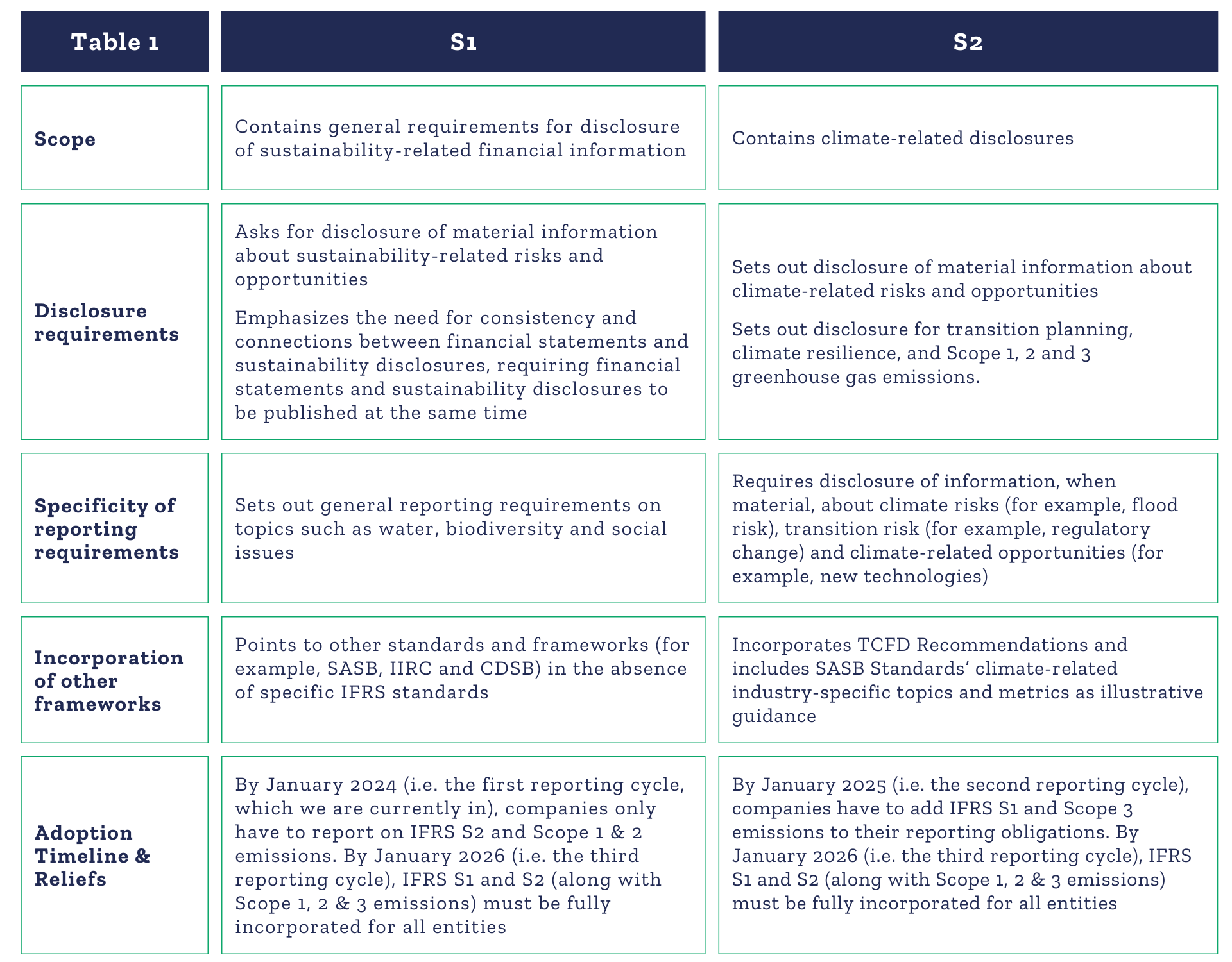

- IFRS S1 provides a framework for disclosing sustainability-related information that is material to a company’s performance. This framework uses the Sustainability Accounting Standards Board (SASB) Standards (now absorbed into the ISSB).

- IFRS S2 sets out specific climate-related disclosures, including climate-related physical & transitional risks, any net-zero targets, and Scope 1, 2, & 3 greenhouse gas (GHG) emissions.

In a nutshell, S1 & S2 are characterized by key elements highlighted in the table below:

For more on the IFRS S1 and S2 Standards, read our Thought Leadership Series for unique insights on this Global Milestone, What’s New, and What’s to Come.

Common Challenges to Implementation - Preparing Investment Firms for IFRS S1 and S2:

Investment firms looking to start their ISSB-aligned ESG Reporting journey must first assess the challenges to implementation that may arise along the way. To help these firms prepare for ISSB reporting, we have identified three common challenges to implementation that should be considered before adopting the IFRS sustainability standards. We have also supplemented each challenge with potential mitigation strategies.

Challenge 1 – Integrating New Requirements into Existing Systems

- Typically, financial and sustainability reporting is managed separately. However, the IFRS Sustainability Standards have created a shift in traditional reporting norms, requiring sustainability data to be a part of the financial reporting process. To adapt to this, investment firms must ensure that their internal systems are flexible enough to manage both financial and sustainability data while maintaining efficiency. This may require system upgrades, new processes, and additional support to handle the complexity of combined disclosures.

Mitigation Strategy: Evaluate the Reporting Requirements; Assess Materiality:

- A thorough evaluation of reporting requirements, grounded in a materiality assessment, is essential for effective ISSB disclosure. For smaller firms, this assessment typically focuses on internal operations. However, for investment firms with portfolios of multiple entities, the materiality scope is far broader. Each entity may face unique reporting obligations depending on its industry, geography, and operations. By focusing on materiality, investment firms can streamline the reporting process, ensuring that only relevant data is disclosed and unnecessary reporting burdens are avoided. For additional Gguidance on materiality assessments, read Steps 2 & 3 in Part 2 of our Critical Success Factor Series for ESG Integration in Private Equity, or book a free consultation with our team of experts.

Challenge 2 – Concerns of Internal Capacity & Accessing Cross Departmental Information:

- While finance teams are experienced in managing financial data, the inclusion of sustainability metrics demands coordination across multiple departments. Additionally, departments that previously had no involvement in reporting may now need to provide critical data for disclosures. Quantitative indicators under the ISSB Standards add another layer of complexity to cross-departmental collaboration. For example, calculating a single indicator might involve inputs from three or four different departments, including calculations that must be precisely applied.

- These shifts mean that investment firms must build capacity within departments and develop a cohesive strategy for accessing, processing, and validating cross-departmental information.

Mitigation Strategy 1: Conduct a Data Gap Analysis:

- Conducting a data gap analysis will allow firms to understand what’s missing and where new processes are needed. This gap analysis will then guide firms on how to:

Mitigation Strategy 2: Develop Internal Competencies and Assign Responsibilities:

- To effectively execute the ISSB imperative, investment firms need to build internal capacity and competencies. Larger firms tend to do this by hiring in-house sustainability teams that can coordinate and deliver on the many moving parts of the ESG data collection and reporting process. However, this option is neither scalable nor economical. Instead, firms can take a hybrid approach by assigning overall responsibility for ISSB compliance at the C-suite level, investing in a designated ESG resource, and supplementing this with an ESG reporting technology platform that offers implementation support at the portfolio company (PortCo) level. For more guidance on developing internal capacity, read Part 4 of our Critical Success Factor Series for ESG Integration in Private Equity, or book a free consultation with our team.

Challenge 3 – Portfolio Management:

- As part of ISSB reporting, investment firms must also disclose sustainability data from all of their PortCos.. This process involves collecting, aggregating, and validating data from diverse entities and creates challenges around data accuracy, completeness, and consistency.

Mitigation Strategy 1: Create Sustainability Champions across Portfolio Entities:

- For investment firms, especially those managing diverse portfolios, assigning sustainability champions within each PortCo is critical. These champions coordinate sustainability efforts, align internal teams, and ensure the timely collection and validation of required data. Their role is also to advocate for sustainability initiatives within the organization, preventing the dilution of efforts across multiple departments. Once this is established, the firm will be better equipped to:

Mitigation Strategy 2: Support Portfolio Entities on Materiality Assessments:

- Conducting materiality assessments across PortCos can be complex and resource-intensive. Investment firms can add value by providing support for these assessments, whether through in-house expertise or by engaging third-party advisors. This not only streamlines the data collection process but also enhances PortCos’ understanding of the importance of sustainability, leading to better reporting and stronger alignment with the firm’s overall ISSB/ESG strategy. For additional guidance on materiality assessments, read Steps 2 & 3 in Part 2 of our Critical Success Factor Series for ESG Integration in Private Equity, or book a free consultation with our team.

For a more in-depth guide to preparing for ISSB reporting, watch our exclusive webinar below, held in collaboration with CPA-Ontario and sponsored by CSPM-University of Waterloo. You can also download the webinar slides here.

Preparing Investment Firms for IFRS S1 and S2

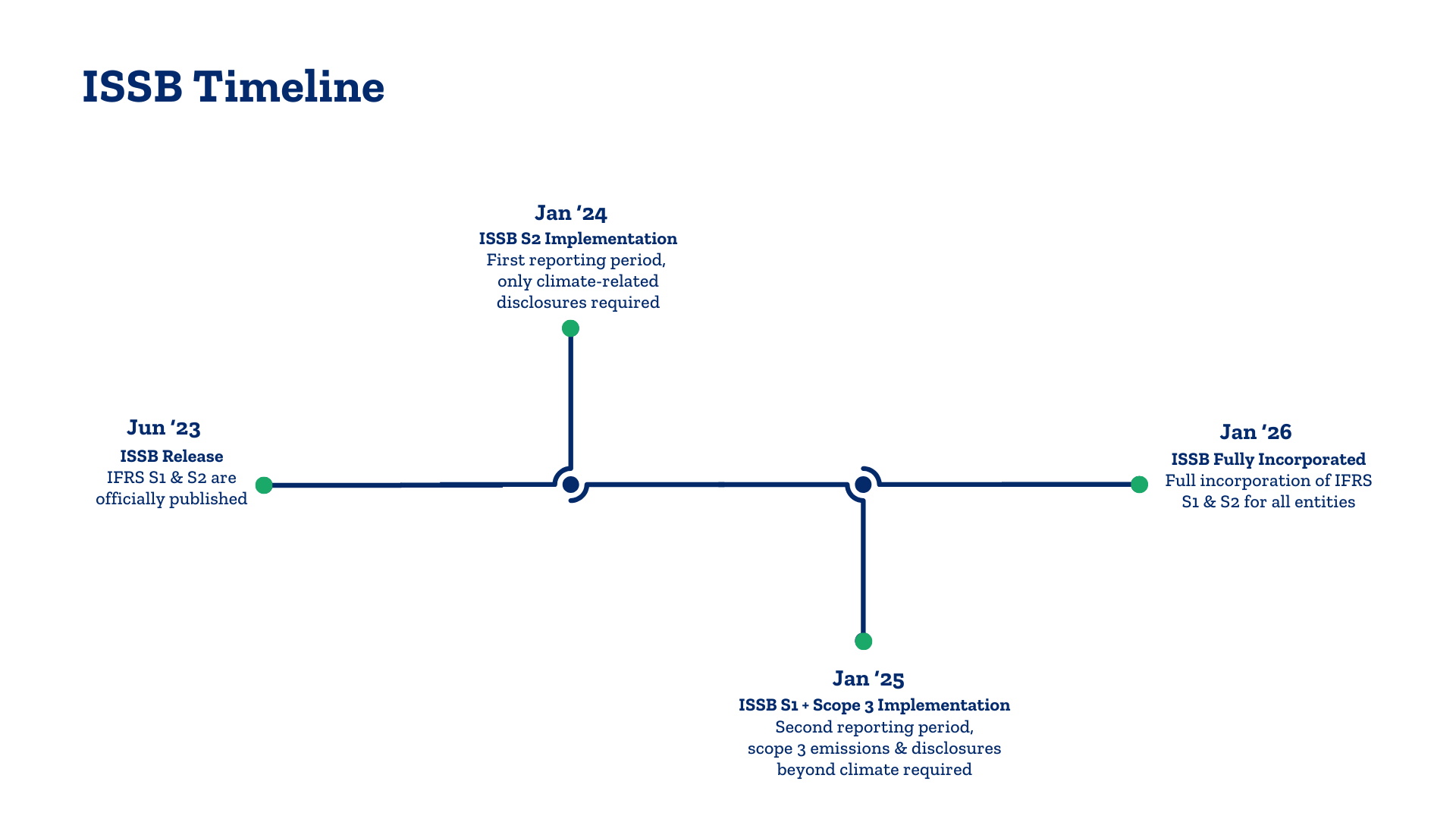

The ISSB Adoption Timeline: As shown in the timeline below, the ISSB has provided temporary reliefs/exemptions to ease compliance and make the adoption process more manageable for companies. In the very first reporting cycle (i.e. January 2024), companies only have to report on IFRS S2 and Scope 1 & 2 emissions. In the second reporting cycle (i.e. January 2025), companies have to add IFRS S1 and Scope 3 emissions to their reporting obligations. By the third reporting cycle (i.e. January 2026), IFRS S1 and S2 (along with Scope 1, 2 & 3 emissions) must be fully incorporated for all entities.

Why ESGTree? – Differences that Make a Difference

Who Should the Economy Really Serve?

What We’ve Learned Automating the ESG Data Convergence Initiative (EDCI) for Clients

What Does the Rise of ESG Mean for Impact Investing?

Contact Us

Contact Us

Office Addresses

Canada: ESGTree, CPA 4th Floor, 140 West mount Rd N, Waterloo,

ON N2L 3G6, Canada

United Kingdom: ESGTree, 33 Queen Street, London EC4R 1AP, United Kingdom