The ISSB’s IFRS Standards : What’s New & What’s to Come?

Share:

On 26th June, 2023, the ISSB finally launched its inaugural sustainability standards, ushering in a new era in international corporate reporting

The International Sustainability Standards Board (ISSB) has issued its first two International Financial Reporting Standards (IFRS): the IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information and IFRS S2 Climate-related Disclosures. Both standards fully incorporate the 4 pillars of the Task Force on Climate-related Financial Disclosures (TCFD), namely Governance, Strategy, Risk Management, and Metrics and Targets, and the recent merger between the ISSB an TCFD brings the Standards one step closer to becoming the global baseline for sustainability reporting.

In this article, we highlight the key changes in the final S1 & S2 standards since the 2022 drafts, explore the implications of the Standards on voluntary & mandatory reporting, and discuss the things to expect from the ISSB in the future. For a more general overview & introduction to the ISSB Standards, click here.

The IFRS S1 and IFRS S2: What’s New?

The final Standards incorporate feedback from more than 1,400 global stakeholders and contain several notable changes from the 2022 drafts (see Table 1 below):

| Revisions | S1 – Exposure Draft | S1 – Final Published Standard | S2 – Exposure Draft | S2 – Final Published Climate Standard |

| Relief for First-Year Reporting | On April 4, the ISSB announced its intent to prioritize climate-related disclosures and provide other “transitional reliefs” to facilitate companies’ initial reporting pursuant to the Standards. More specifically, in their first year of reporting, companies need not: (i) provide sustainability reporting at the same time as traditional financial reporting, (ii) disclose Scope 3 emissions, (iii) calculate Scope 1 and 2 emissions using the Greenhouse Gas Protocol if the company has previously used a different framework for doing so, (iv) provide comparative information relative to prior reporting years and (v) provide disclosures around sustainability-related risks and opportunities beyond those required by the Climate Standard. | |||

| Revised Framework for Identifying Sustainability Risks and Opportunities: | Companies were required to disclose “significant sustainability-related risks and opportunities that [were] useful to the primary users of general-purpose financial reporting when they assess enterprise value and decide whether to provide resources to the entity.” | The final S1 Standard omits the terms “significant” and “enterprise value” and instead calls for disclosure of information about all “sustainability-related risks and opportunities that could reasonably be expected to affect the entity’s cash flows, its access to finance or cost of capital over the short, medium, or long term.” | Nil | Nil |

| Additional Requirements for Metrics and Targets (Including Scope 3 Emissions) | Nil | Nil | This was not a requirement in S2 Exposure Draft | To identify climate-related risks and opportunities, companies must use “climate-related scenario analysis and a resilience assessment.” Also, if a company has a transition plan, it must disclose information about it, including the assumptions used to develop it. |

| Exemption of Commercially Sensitive Information | This exemption did not exist in the S1 Exposure Draft | The Standards have been revised to allow companies to omit information on sustainability-related opportunities — though not sustainability-related risks — if information about the opportunities is deemed to be commercially sensitive. | Nil | Nil |

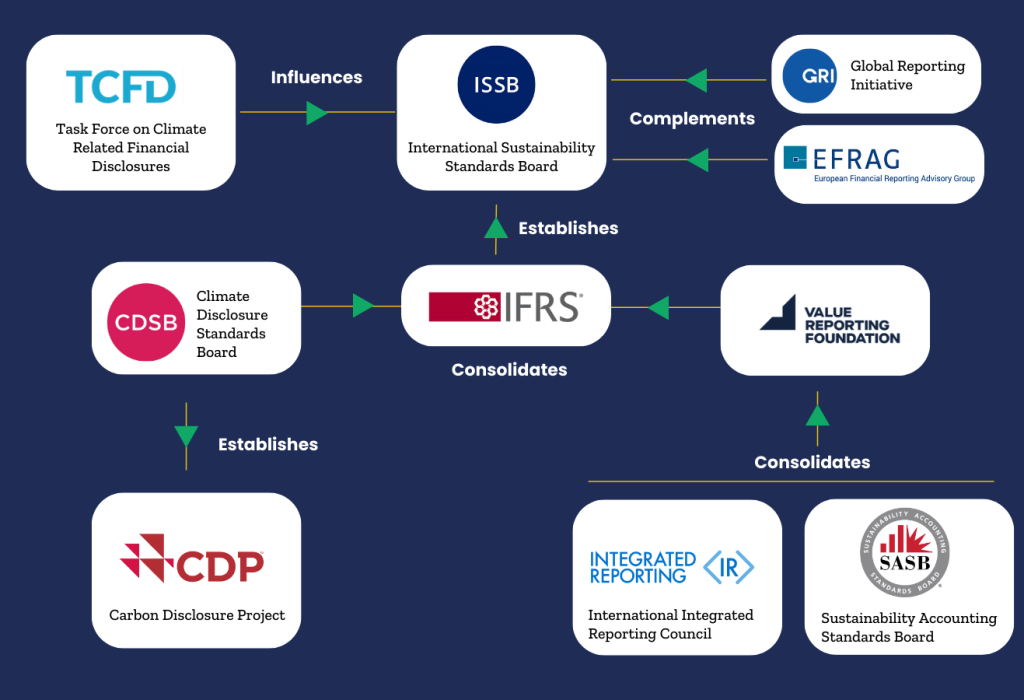

Despite these changes, the Standards continue to lean heavily on industry-specific disclosure topics issued by the Sustainability Accounting Standards Board (SASB) and strongly align with the European Sustainability Reporting Standards (ESRS), Global Reporting Initiative (GRI), the Greenhouse Gas Protocol, and many more (see Figure 1 below).

Potential Impact of S1 & S2 on Voluntary & Mandatory Reporting Regimes

The fact that 1) an investor advisory group of prominent asset managers and owners from around the world helped the ISSB develop its Standards, 2) the World Economic Forum is convening a group of sustainability reporting professionals to aid the implementation of the Standards, 3) influential Voluntary Sustainability Reporting Organizations like the Principles for Responsible Investment (PRI) are advocating for governments to align mandatory reporting requirements with the Standards, and 4) the CDP has announced its plan to integrate Climate Disclosures into its platform in 2024, indicates that the Standards are likely to shape investor expectations and, consequently, global corporate sustainability reporting.

The Standards are also expected to be incorporated into regulatory regimes in a number of jurisdictions; the UK, Canada, Australia, New Zealand, China, Honk Kong, Singapore, Malaysia, Nigeria, and Japan, for instance, have all signed their intent to adopt the Standards. A snowball effect in regulatory adoption is much anticipated, especially once the International Organizations of Securities Commissions (IOSCO) approves the final Standards, allowing national securities regulators to adopt them into their respective regulatory frameworks. This alone will mark a breakthrough for the ISSB Standards, transforming their very nature from Voluntary to Mandatory.

A Caveat to the ISSB as a Global Baseline Sustainability Reporting Standard

While the Standards show promise in establishing a global baseline for sustainability reporting, it is unclear whether full alignment between voluntary and mandatory reporting requirements can be achieved. Notably, the draft European Sustainability Reporting Standards (ESRS) proposed by the European Commission for the Corporate Sustainability Reporting Directive (CSRD) go beyond the IFRS Standards by requiring the “double materiality” principle, in which a company must report both on how its business is affected by sustainability issues (“outside in”) and how its activities impact society and the environment (“inside out”). Similarly, the Global Reporting Initiative (GRI) – which is the most widely utilized voluntary sustainability reporting standard globally – surpasses the IFRS Standards by mandating reporting on “impact materiality”, i.e., environmental and societal impacts concerning various stakeholders, not solely investors. To top it off, it is unclear as to whether the Securities and Exchange Commission’s (SEC’s) final climate disclosure rule will be influenced by the the IFRS Standards – considering that the United States is still the deepest and most important capital market in the world, the outcome here will potentially steer the IFRS Standards towards – or away from – becoming the global baseline for sustainability reporting.

What’s Next for the ISSB?

Additional Standards Forthcoming

In April 2023, right before publishing the final IFRS S1 & S2 Standards, the ISSB announced plans to consult on additional standards related to: (i) biodiversity, (ii) ecosystems and ecosystem services, (iii) human capital, (iv) human rights and (v) integration in reporting. Regulators in the EU, UK, U.S. and other jurisdictions are simultaneously considering reporting regimes focused on one or more of those topics, and companies can monitor the development of the ISSB’s standards for indications of the potential direction of future regulation.

Challenges to Adoption & Implementation

While the shift towards Scope 3 reporting and greater climate change disclosure can improve transparency and offer investors more data to make informed decisions, companies will face infrastructural challenges to meet the Standards’ requirements. For instance, companies/financial institutions will have to conduct a substantial amount of first-time data collection in order to comply with ISSB’s data requirements. To do this successfully, they will need to radically shift & revolutionize the way their sustainability data is collected and reported on.

The good news that the ISSB is introducing training programmes to support those applying its Standards and is providing “transitional reliefs” to facilitate companies’ initial reporting pursuant to the Standards. More specifically, in their first year of reporting, companies need not: (i) provide sustainability reporting at the same time as traditional financial reporting, (ii) disclose Scope 3 emissions, (iii) calculate Scope 1 and 2 emissions using the Greenhouse Gas Protocol if the company has previously used a different framework for doing so, (iv) provide comparative information relative to prior reporting years and (v) provide disclosures around sustainability-related risks and opportunities beyond those required by the Climate Standard. While such concessions will ease the reporting burden on many companies, smoothen the transition period, and encourage compliance, companies will still struggle with data gathering, verification, and technical compliance requirements and may need to outsource or partner with SaaS companies such as ESGTree to gear up for the January 2024 reporting period.

ESG SaaS to Ease the Reporting Burden on Financial Institutions

Since the ISSB requirements are built on an amalgamation of the ESG standards shown in Figure 1, companies and financial intuitions that adopt these standards now, rather than later, will be better equipped to meet and exceed regulatory compliance in the future. Those that are new to sustainability disclosures can use this year (2023) to prepare for the application of ISSB rules by:

- Evaluating internal systems and processes for collecting, aggregating, and validating sustainability-related information across the company and its value chain

- Reviewing the sustainability-related risks and opportunities that affect the company’s business

- Understanding the IFRS Standards by either visiting the ISSB website or contacting the ESGTree Customer Success Team for more customized and stepwise guidance

- Incorporating the SASB standards and CDSB framework, TCFD recommendations, and/or the Integrated Reporting framework (all which ISSB leverages) into the company’s ESG reporting process

Partnering with ESG technology solutions like ESGTree will simplify and streamline the collection of large ESG data sets and carbon emissions calculations and will automate the ESG standards and frameworks mentioned in Figure 1 as a first step towards compliance with the IFRS Standards.

Although the landscape of global sustainability reporting remains fragmented and evolving, the publication of the IFRS Standards represents an important step toward establishing a common understanding of the basic information required to assess the sustainability-related risks and opportunities businesses face.

About ESGTree

ESGTree helps companies gather, analyze, and report on sustainability information, greatly reducing the time and effort required to comply with investor demand and regulation. Our platform automates all major industry-leading frameworks, along with Greenhouse Gas Protocol-aligned carbon calculations, to provide a holistic ESG solution for financial institutions.

Purpose-built for private capital investors, ESGTree’s data automation solutions allow private equity and venture capital firms to gain insights into their portfolio companies’ ESG performance over time, attribute ESG data correctly, and benchmark their data to assess a portfolio company’s progress in relation to other comparable companies in the region. These insights enable investors to identify potential risks and opportunities and make informed investment decisions based on a portfolio company’s ESG performance. Our cloud-based platform and advisory services meet the needs of both seasoned ESG managers as well as those entering the world of ESG for the first time.

For more information on our ESG Reporting Solution, please contact us at :

Why ESGTree? – Differences that Make a Difference

Who Should the Economy Really Serve?

What We’ve Learned Automating the ESG Data Convergence Initiative (EDCI) for Clients

What Does the Rise of ESG Mean for Impact Investing?

Summary

Share:

Key Changes in ISSB's IFRS Standards

Understanding the IFRS S1 and IFRS S2 Standards

Potential Impact on Voluntary and Mandatory Reporting

Challenges and Solutions for Compliance

About ESGTree: Simplifying Sustainability Reporting

Contact Us

Contact Us

Office Addresses

Canada: ESGTree, Kindred Centre for Peace Advancement, 140 Westmount Rd N, Waterloo,ON N2L 3G6, Canada

United Kingdom: ESGTree, 33 Queen Street, London EC4R 1AP, United Kingdom