Navigating the Complexities of Financed Emissions: Key Insights for LPs and Pension Funds

Share:

Table of Contents

Key Takeaways:

- A financial institution’s financed emissions are, on average, 700x higher than its direct emissions. (Carbon Disclosure Project’s (CDP) Time to Green Finance report)

- Fragmented data sources, resource gaps, and inconsistent Scope 3 measurements make it difficult for LPs to accurately disclose their financed emissions

- Centralized platforms, audit trails, and automated detection systems can streamline emissions data management and ensure accuracy.

Key Motivations for Disclosing Financed Emissions

Limited Partners (LPs) and Pension Funds (also known as institutional investors) are facing increasing calls to manage their financed emissions because of:

Regulatory Mandates

An increasing number of jurisdictions now require institutional investors to disclose financed emissions. Key regulations include:

- Canada’s OSFI Guideline B-15: Mandates federally regulated financial institutions and pension funds to disclose the emissions of the companies they finance or insure, driving transparency in financed emissions.

- New Zealand’s Climate-Related Disclosures Regime: Requires large financial institutions, such as banks, insurers, and investment managers, to report on climate-related risks and opportunities, including their financed emissions.

- The United States’ SEC Climate-Related Disclosure Rule: If finalized, the proposed rules would require public companies, including institutional asset managers, to disclose climate-related risks, metrics, and GHG emissions.

- The European Union’s Sustainable Finance Disclosure Regulation (SFDR): Obligates financial market participants to disclose Principal Adverse Impacts (PAI) on sustainability, including metrics for financed emissions and climate impacts.

Public Commitments & Climate Initiatives:

As LPs and pension funds work towards fulfilling their public commitments on decarbonization, their demands on General Partners (GPs) to disclose emissions increase significantly. Prominent climate initiatives / public commitments on decarbonization include:

- Partnership for Carbon Accounting Financials (PCAF): Provides the leading global standard for measuring and reporting financed emissions, ensuring comparability and consistency across companies, portfolios, and industries.

- Science Based Targets initiative (SBTi): Offers a tailored framework for financial institutions to set and align financed emissions reduction targets with the Paris Agreement.

- Net Zero Asset Managers Initiative (NZAM): Guides asset managers in aligning portfolios with net-zero goals by 2050, emphasizing financed emissions reduction through robust frameworks.

Country Commitments – Annual COP Events

- In recent years, countries have set ambitious decarbonization targets at annual COP events. Public Financial Institutions, like Pension Funds, are the first to receive these targets, which they then cascade down to their entire portfolio.

- COP29 (2024) just established a framework for the mandatory disclosure of financed emissions, public pension funds will be the first movers on this.

Long-Term Investment Risks:

- As institutional investors may have long-term holdings, unchecked/rising financed emissions pose a significant risk to the exit values and profitability of underlying portfolio entities.

Barriers to Disclosing Financed Emissions Accurately

Amid the growing emphasis on these disclosures, LPs and Pension Funds face several key challenges when reporting their financed emissions:

Complexity of Carbon Calculations, which stems from:

- Carbon emissions data (i.e. Scope 1, 2, and 3 emissions) is spread across multiple reporting entities, from layers of fund managers to their underlying portfolio entities and then further down to their respective suppliers.

- Since fund managers and portfolio entities each have a different way of storing this data, either manually or on centralized servers or both, data aggregation becomes complex.

- Different asset classes are at varying stages of maturity in capturing emissions data, further complicating the data collection process.

Willingness & Resource Constraints:

- Smaller fund managers and many portfolio companies often lack the bandwidth, resources, and willingness to conduct detailed emissions reporting, leading to major gaps in their data submissions to investors.

Data Availability and Completeness:

- Although over 90% of all emissions are Scope 3 (World Resources Institute), only 12% of organizations measure them (Carbon Emissions Survey, BCG).

- Even when companies do measure Scope 3 emissions, the quality and completeness of this data is often inconsistent (World Resources Institute). To fill these data gaps, institutional investors face the burden of relying on emissions estimation methodologies and harmonizing disclosures with other data sources, a process that requires time, resources, and expertise.

Intricate Fund Structures & Attribution Complexity:

- The intricate structures of investment funds, such as complex ownership layers (IMF Working Paper) and diverse asset classes, makes it challenging for LPs to trace emissions data back to specific activities or entities.

- Without clear lines of accountability, obtaining accurate data from multiple layers of ownership becomes cumbersome and resource-intensive. This process is further complicated when investors have to determine how to attribute responsibility for those emissions correctly, based on the type of investment (equity, debt, etc.)

Looking Ahead: Mitigation Strategies for Institutional Investors

- Centralize Data via Technology: In our experience, the challenge of collecting sparse data across multiple stakeholders can be mitigated by leveraging a unified platform capable of automatically:

- Ingesting data from any database and document templates.

- Applying estimation methodologies based on available data to provide a full emissions footprint.

- Create Audit Trails for Data Integrity: Ensuring the validity of emissions data is critical. By incorporating audit logs into existing/new systems, LPs can track who entered the data, when it was added, and whether any changes were made, ensuring data traceability.

- Implementing Thresholds for Outlier Detection: Leading LPs and Pension Funds are implementing thresholds to automatically identify outliers within their emissions data. As data management systems become smarter, they will be able to automatically identify outliers, reducing the manual effort involved in tracking and verifying emissions data.

By adopting these mitigation strategies, LPs and Pension Funds can navigate the complexities of financed emissions disclosure with greater confidence, ensuring that they remain on track to meet regulatory requirements, country-level commitments, and their overall sustainability goals.

If you are looking for support, we can connect you to one of our ESG experts for a complimentary consultation, and get you started on your ESG journey today.

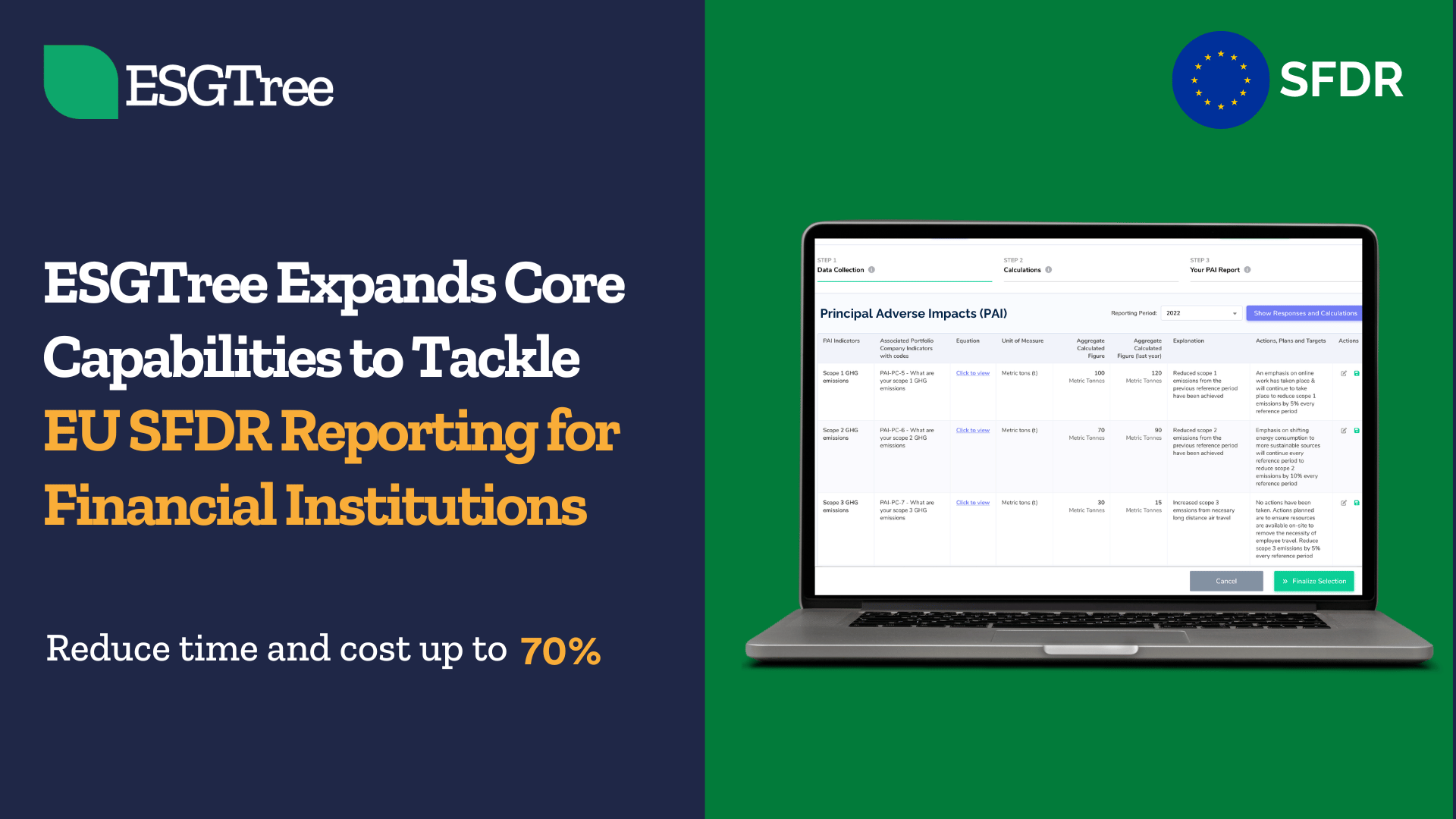

SFDR Reporting Solution for Financial Institutions

Podcast: Winning ESG Integration Strategies for GPs

Guiding Financial Institutions on the Path to Net Zero

ESGTree Expands Core Capabilities to Tackle EU SFDR Reporting for Financial Institutions

Contact Us

Office Addresses

Canada: ESGTree, CPA 4th Floor, 140 West mount Rd N, Waterloo,

ON N2L 3G6, Canada

United Kingdom: ESGTree, 33 Queen Street, London EC4R 1AP, United Kingdom