A Brief Overview of the US SEC's Proposal

to Mandate Climate Disclosures

Share:

In March 2022, the United States Securities and Exchange Commission (SEC) proposed that all publicly listed US companies be mandated to report their climate data in alignment with Taskforce on Climate-related Financial Disclosures (TCFD) recommendations.

When the proposal was then opened for public comment and feedback, the SEC received over 3,400 letters – significantly more than it customarily does when seeking public input. Responses came from small businesses, large corporations, trade organizations, investors, auditors, academics and individual citizens. The proposal has received both endorsement and criticism from business leaders, government representatives and the media.

What timeline can we expect on the implementation of this proposal?

Legal experts predict that the SEC will take until the end of 2022 to finalize and publish a rule, in some form, on mandatory climate disclosures. However, they say, this rule will almost certainly face legal challenges. In particular, experts believe the SEC will face claims that the rule is an overreach of its regulatory authority. Other contentions include the belief that mandatory reporting places an undue burden on companies and might hurt financial returns.

How do US companies currently disclose climate data?

So far, companies rely on guidance based on a 1976 Supreme Court decision. This guidance focuses on materiality i.e., those considerations likely to affect financial performance and are key to a business’s goals, decision-making and impact. It also grants much discretion to companies on how to undertake this reporting.

Reporting data in-line with TCFD would be quite a departure from solely materiality-focused reporting. In addition to reporting scope 1, 2 and 3 emissions, companies would also have to report the potential impact of climate risk on their business, strategy and future health.

The four pillars of TCFD

TCFD recommendations are largely qualitative in nature and can be summarized as follows:

Governance: Companies should disclose their management and board’s strategy for monitoring and assessing climate risk (and opportunity).

Strategy: Companies should identify climate risks and opportunities foreseen over the short, medium and long term; explain the impact of these risks and opportunities on their planning and operations; and assess how resilient their strategy is in various climate-related scenarios (i.e., climate stress tests).

Risk Management: Companies should explain their process for identifying and managing climate risk and how this process fits into the overall picture of risk management.

Metrics and Targets: Companies should disclose the specific metrics used to inform their climate strategies, including the disclosure of scope 1, 2, and 3 greenhouse gas emissions among other conventional metrics. They should also disclose climate goals or targets and their progress towards reaching them.

Support and backlash to the proposal

Prominent business leaders supporting the SEC’s proposal include BlackRock CEO Larry Fink and Brookfield Asset Management’s Mark Carney. Moreover, the proposal has come in the middle of a global push for ESG regulation (shortly preceding the historic passing of the Inflation Reduction Act).

On the other hand, ESG in general has gotten caught up in America’s culture wars. This proposal has been viewed in some quarters as part of a greater push for liberal agendas. Certain Republican state governors (e.g., those of Florida, Texas and West Virginia) believe the SEC is overstepping its legal role of regulating the trade, marketing and issuance of securities (which includes for private markets) for the protection of investors.

Florida, in particular, has banned taking ESG considerations into account when making investments on behalf of its state pension plan.

Relief to investors

The World Economic Forum has predicted that half of the top 10 risks over the next decade are related to climate. This proposal, if enacted, would be hugely beneficial to investors who can then compare the risk profiles of potential investments in a transparent and standardized manner.

What would the SEC proposal mean for businesses?

Businesses would require greater internal or even external resources to implement TCFD, considering the potential exposure to legal risk and investor confusion should reporting not be undertaken carefully and thoroughly.

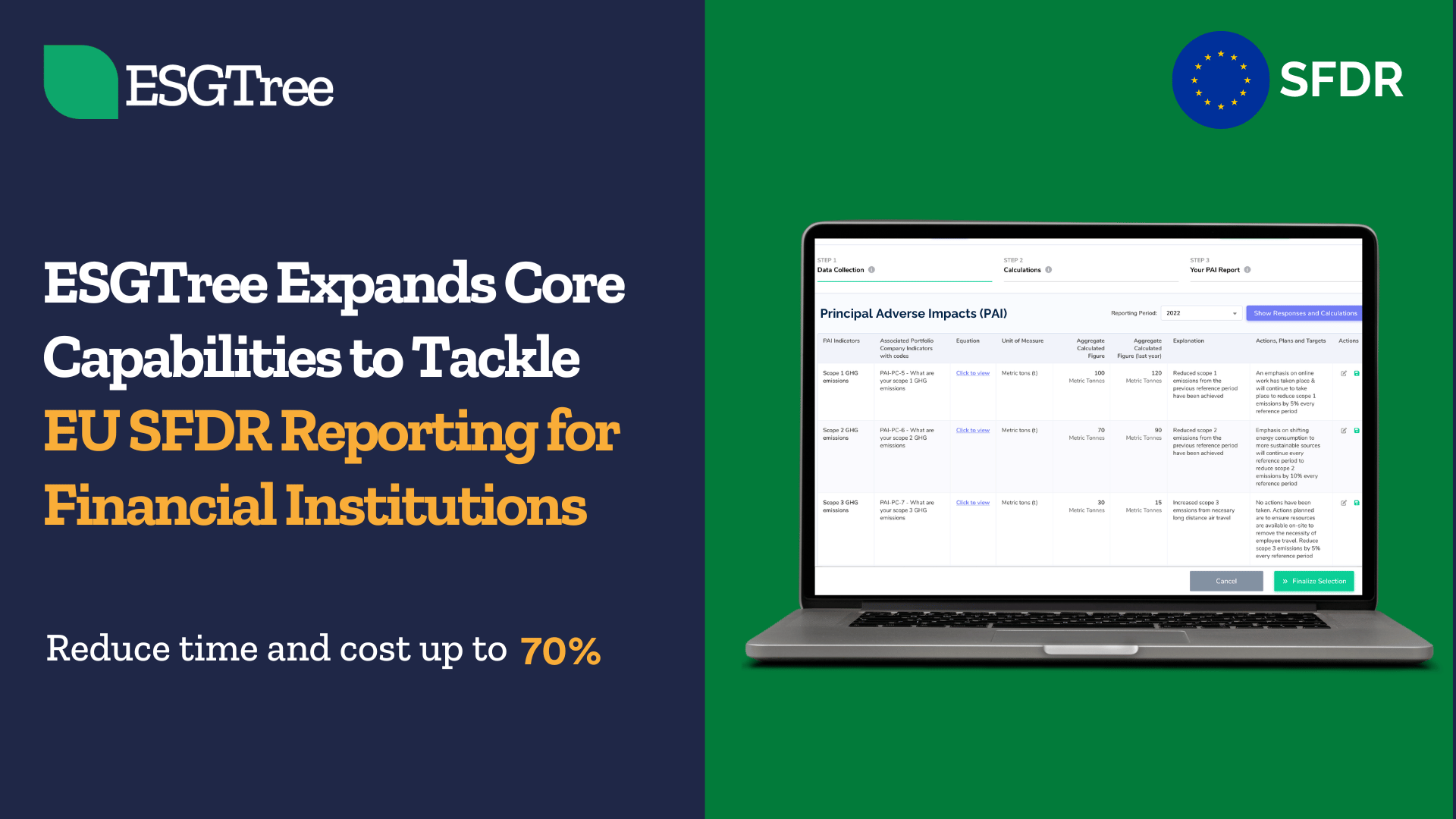

That said, climate and ESG reporting can – and should – be approached as a value creation exercise rather than a reporting burden. To simplify the TCFD reporting process, ESGTree’s cloud-based platform boils down the reporting process to 40 simple multiple choice questions that, upon completion, automatically generate the TCFD report, thereby automating much of the difficult legwork. Based on the responses to the questions, ESGTree is able to provide recommendations and action items on how to improve a company’s climate performance vis-a-vis the four pillars of the framework. ESGTree’s complementary Carbon Calculator allows for the seamless calculation of carbon emissions by taking in data that companies easily have on hand and providing figures for their Scope 1, 2 and 3 emissions instantaneously.

The global regulatory context and the way forward

The SEC proposal doesn’t exist in a vacuum. Other TCFD-aligned laws or proposals include:

- Mandatory TCFD-aligned reporting in the United Kingdom for 2022 onwards

- Mandatory TCFD-aligned reporting for Crown corporations in Canada from 2024 onwards

- Japan, New Zealand, Brazil, Singapore and Switzerland aim to have some kind of TCFD-aligned reporting by various timelines

Given international support for TCFD, it is advisable to add this reporting to climate action plans now rather than later to anticipate future regulatory changes and reduce transition risk as the world moves towards a greener economy.

ESGTree helps private capital investors automate ESG data collection and analysis for their portfolio companies. Our platform features include our carbon calculator, customizable and automated ESG frameworks, multi-level report viewing, trends analysis dashboard, and other features aimed to make ESG work for everyone.