The Private Equity (PE) Market has seen greater adoption for Environment, Social, & Governance (ESG) in these past 4 years than ever before. Today, PE firms are highly motivated to integrate ESG considerations at the firm & portfolio company (PortCo) levels, primarily because of:

Factor 1: Investor (LP) Priorities – ESG Reporting & ESG Integration:

What the Market has Shown Us:

GPs globally are reporting a rise in Limited Partner (LP) requests for ESG data in Due Diligence Questionnaires (DDQs) as it provides crucial insight into how a company is responding to emerging societal and climate risks.

According to a report from the Principles for Responsible Investment (PRI), over 80% of Private Equity Investors (i.e. LPs) now consider ESG factors central to their investment decisions; in 2021 alone, half of the total fundraising flowed into firms with formal ESG policies, underscoring its growing importance in private markets. In fact, our experience with PE clients has confirmed that LPs are now applying sophisticated scoring mechanisms to score current & potential fund manager’s performance on ESG, further influencing future fundraising allocations.

GPs are now seeing entire acquisitions fall through because the PortCo that they were exiting from did not have an ESG Policy at par with market standards. The fact that more than 70% of mergers and acquisitions (M&A) leaders (Deloitte) and 93% of LPs (Bain) report withdrawing from potential acquisition deals over ESG and sustainability concerns, further substantiates this.

In some cases, LPs are even placing ESG data collection conditions on their investment commitments, leaving GPs with no choice but to comply. Our PE clients are sharing that a frequent LP requirement during fundraising is the commitment for portfolio level ESG data collection by the GP.

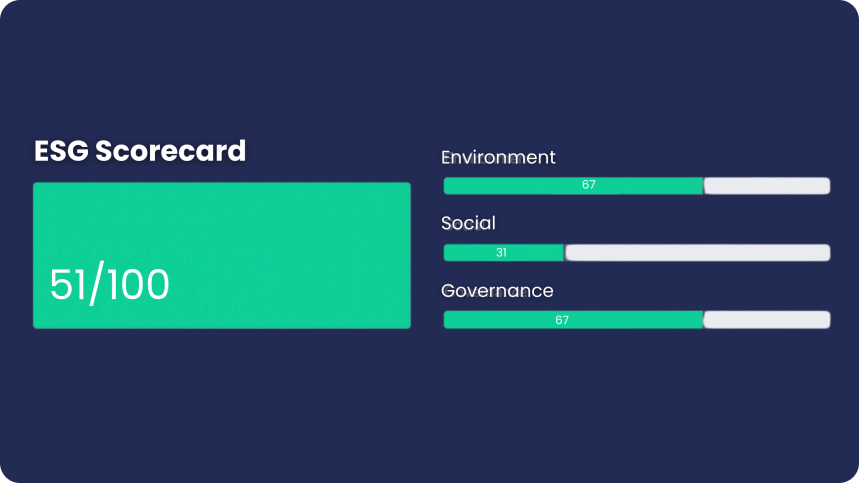

According to a PwC Survey, LPs are willing to absorb between 5% and 9% in management fees if there are quality improvements in their GPs’ ESG data reporting practices. ‘Quality improvements’ encompass: 1) improvements in a PE firms’ and its PortCos’ data coverage & data accuracy, 2) access to trends & visualizations for analysis at both the firm and PortCo levels, and 3) benchmarked ESG data to evaluate performance against a set sustainability metrics relative to peers.