Demystifying ESG Scorecards: Do They Really Help in Value Creation?

Share:

Table of Contents

The rise of environmental, social, and governance (ESG) concerns has fundamentally shifted how business performance is measured. Investors are increasingly demanding objective ways to assess a company’s ESG performance; while the public markets have responded with a proliferation of ESG rating agencies, the private markets have been slow to respond. ESG scoring for private market companies has been a relatively new concept with its own set of challenges, including reliance on fund managers for data collection and the absence of relevant scoring benchmarks and clearly defined performance targets.

However, with the rise in investor ESG data requests and sustainability regulations, the tide has turned. General Partners (GPs) are now taking the lead in developing their own ESG scoring methodologies to increase engagement with their portfolio companies (PortCos), and Limited Partners (LPs) are scoring these fund managers on their responsible investment integration practices.

In this article, we explore the significance of ESG scorecards in the private markets and the best practices that leading fund managers deploy to create them.

The Private Markets Push Towards ESG Scorecards

What the Market Has Shown us:

- A Critical Risk Management Tool: ESG scorecards are invaluable for identifying and managing risks that could impact a company’s long-term success. For instance, a scorecard might highlight vulnerabilities in a company’s supply chain due to environmental changes or reveal gaps in diversity and inclusion policies that could lead to workforce dissatisfaction or legal challenges.

- Impact on PortCo Engagement & Action Planning: Increasingly, LPs, GPs, and PortCos are using ESG scorecards to develop actionable ESG improvement plans that can be tracked over time, making them an essential tool for driving engagement and performance improvement.

- Impact on LP Fundraising Allocations: LPs are now using sophisticated scoring mechanisms to evaluate fund managers’ ESG performance, influencing fundraising allocations. GPs that adopt the best practices below can increase PortCo data coverage, drive quality improvements in their ESG scores and reporting practices, and potentially capture a valuation premium (KPMG).

Creating ESG Scorecards - Best Practices by Leading Private Equity Firms

Leading PE firms are developing internal ESG scoring methodologies to provide LPs and PortCos with a clear framework for tracking ESG performance, enhancing decision-making, and effectively communicating progress.

We’re seeing GPs adopt the following best practices to develop ESG scorecards internally:

- Align with Global Standards: Leading PE firms are aligning with global frameworks like the ESG Data Convergence Initiative (EDCI) and Sustainability Accounting Standards Board (SASB – now part of the IFRS ISSB Standards), in order to standardize ESG metrics and establish a solid foundation for their ESG Scorecards.

- Conduct Materiality Assessments: As an added layer, PE firms are also conducting detailed materiality assessments to identify the ESG topics that are most important to their underlying portfolio entities and stakeholders. This enables them to collect data on decision-useful metrics and generate value-driven scorecards.

- Develop a Consistent Scoring Methodology: Consistency and transparency are key. Leading GPs are implementing clear scoring methodologies based on pre-defined thresholds for each ESG metric. These methodologies then create a strong foundation for incorporating custom indicators.

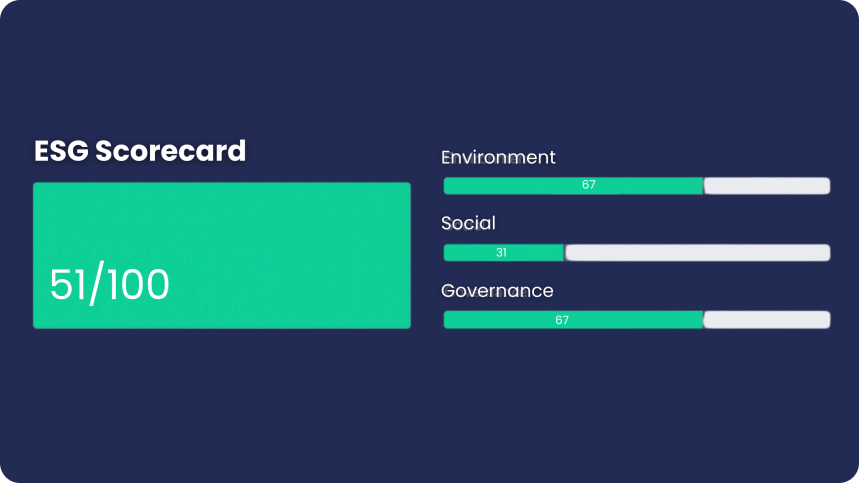

- Leverage Technology: To simplify the entire process, GPs are increasingly adopting third-party ESG Scorecards from ESG management and reporting solutions that are designed to address the unique needs of the private markets. These technology solutions automate ESG data collection, centralize fragmented ESG data sources, and provide Scorecards that deliver performance insights at the firm and portfolio levels, including peer and industry benchmark-comparisons.

Create Active Engagement Mechanisms on ESG within the Investment Portfolio: PE firms are utilizing ESG scorecards to actively engage with their PortCos and identify ESG-related risks and opportunities. By providing value back in this way, GPs are not only increasing PortCo engagement but also data coverage. At ESGTree, we receive a lot of queries from our clients’ PortCos on why their ESG scores have increased/decreased, with the motivation to understand, track and improve their ESG performance.

In the ever-evolving ESG landscape, ESG scorecards have emerged as a powerful tool for driving sustainability performance in the private markets. By aligning with global standards, implementing consistent methodologies, and leveraging technology, fund managers have an opportunity to deliver measurable value to investors and PortCos alike. As ESG priorities continue to shape the future, firms embracing these practices will be better positioned to lead with impact.

If you are looking for support, we can connect you to one of our ESG experts for a complimentary consultation, and get you started on your ESG journey today.

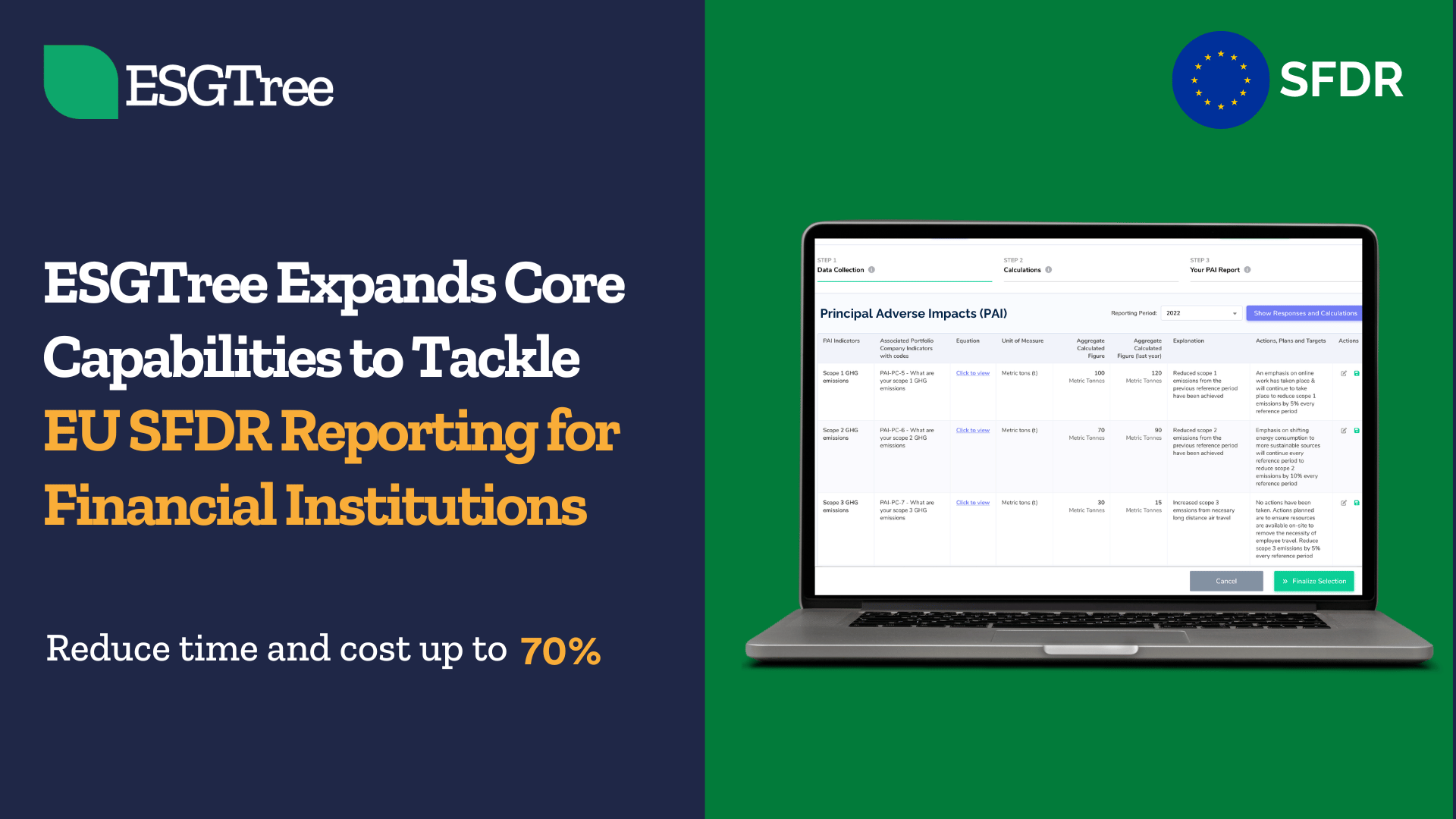

SFDR Reporting Solution for Financial Institutions

Podcast: Winning ESG Integration Strategies for GPs

Guiding Financial Institutions on the Path to Net Zero

ESGTree Expands Core Capabilities to Tackle EU SFDR Reporting for Financial Institutions

Contact Us

Office Addresses

Canada: ESGTree, CPA 4th Floor, 140 West mount Rd N, Waterloo,

ON N2L 3G6, Canada

United Kingdom: ESGTree, 33 Queen Street, London EC4R 1AP, United Kingdom