How an ESG Integration Strategy Helps in Staying Ahead of LP DDQs & Regulations

Share:

It is evident that, to remain competitive, General Partners (GPs) need to be intentional about incorporating Environment, Social, & Governance (ESG) factors into business practices and be agile in meeting changing expectations. Once you’ve understood the importance of quality ESG reporting and the critical factors driving ESG integration in private equity (PE), you can take the first step to successfully execute the ESG imperative: i.e. building a robust ESG integration strategy & policy. This will establish your firm’s reputation as a responsible investor and signal priorities to both sustainability- minded investors and acquisition targets.

Building a Robust ESG Integration Strategy & ESG Policy

Why does it matter?

- An ESG integration strategy (a.k.a ESG strategy) is a broad term used to describe how an organization integrates ESG considerations into its investment portfolio and decision-making processes. Fundamentally, ESG considerations lead to better risk management and value creation by helping investors account for material risks—such as climate change or looming regulatory requirements—and identify opportunities to increase the profitability of portfolio companies (PortCos).

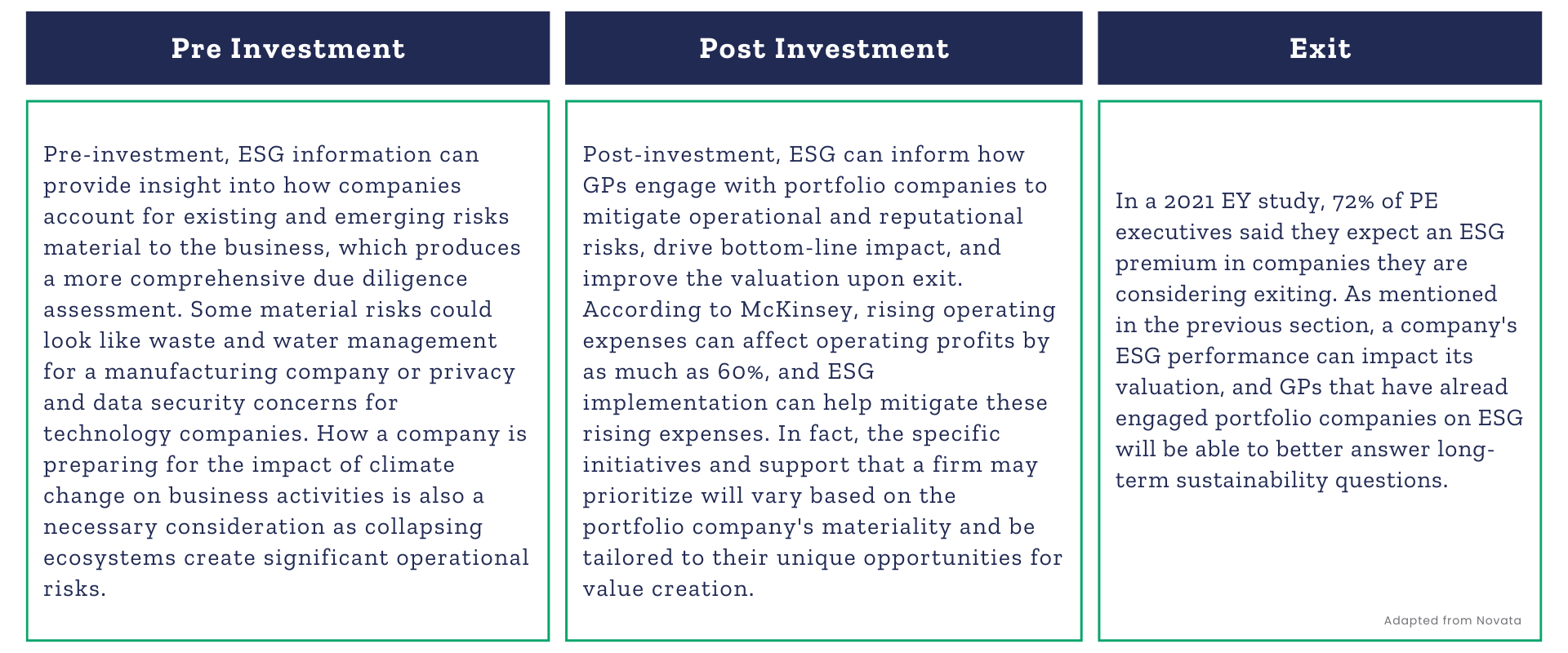

- While every GP has its own investment philosophy and investment process, having an ESG strategy that embeds sustainability across the investment lifecycle can enable your firm to make the following gains at each stage:

- As highlighted in CSF Part 1, material ESG risks have shown to lower company valuations in 80% of cases and can even turn into a deal-breaker. Vice versa, companies with strong ESG fundamentals tend to outperform their counterparts on EBITDA margin by up to 21% and have less systemic risk exposure, lowering the firm’s cost of capital and translating into a valuation premium (Accenture). For this reason alone, an ESG strategy and resultant ESG policy that incorporates ESG considerations into decision-making processes is a crucial lever to pull for your stakeholders.

What Can You Do?

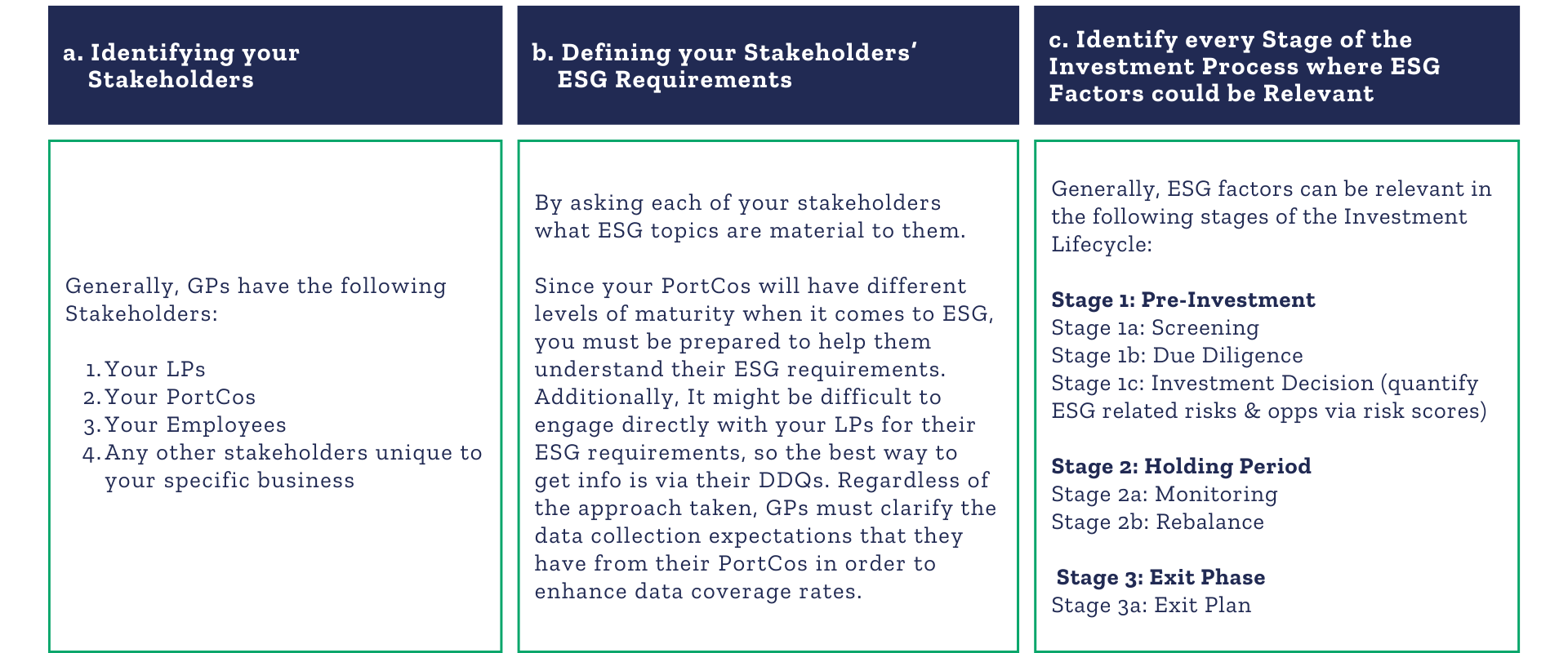

Step 1. Have a Stakeholder-Led ESG Policy Development Process

You can do this by:

This first step will guide your vision for ESG integration and will ensure that your ESG policy is relevant to the concerned stakeholders. The second (and arguably most impactful) step will anchor your ESG policy in LP demands and regulatory requirements by helping you:

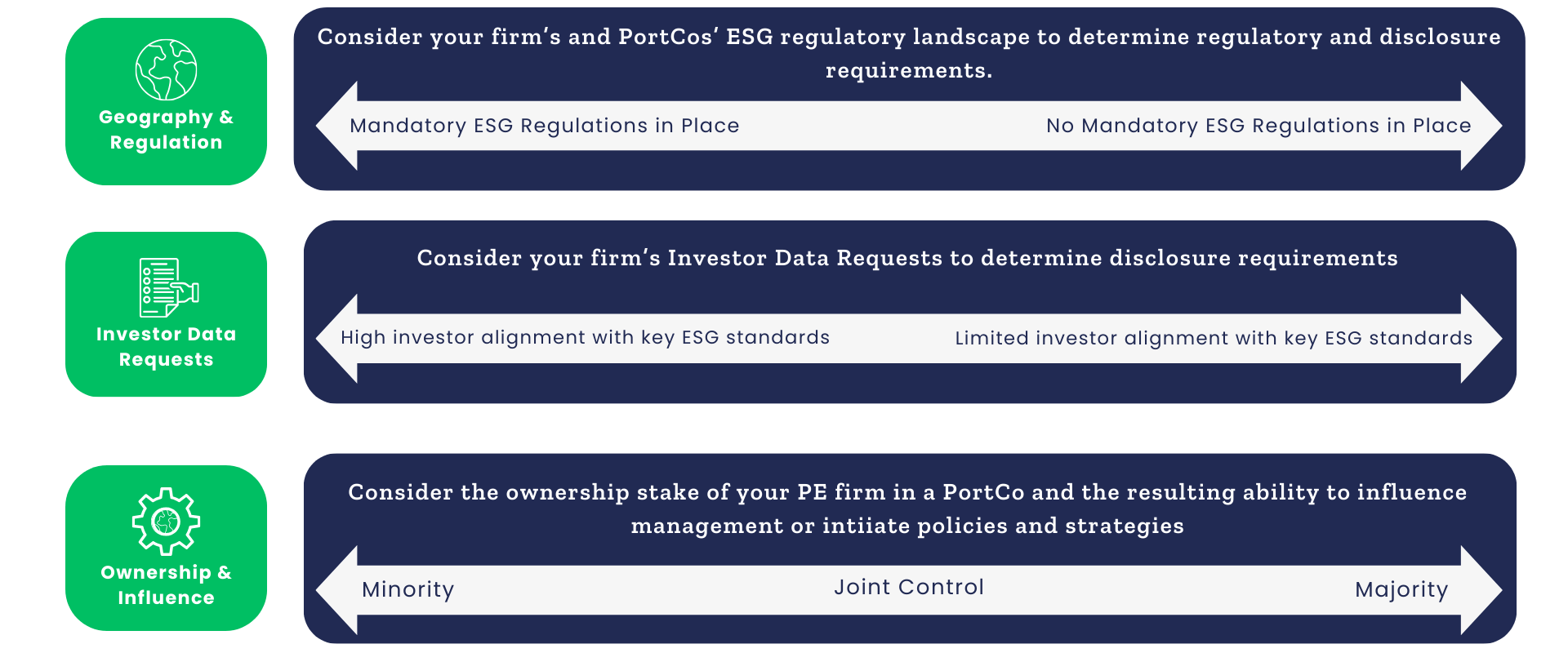

Step 2. Asses where you and your PortCos Stand on Key Materiality Factors

As discussed in Part 1 of our CSF Series, one of the biggest challenges to ESG integration in PE is prioritizing which ESG metrics to report on, at all levels. To address this challenge, a best practice is to first assess where you and your PortCos stand on the 3 materiality factors known to influence a PE firm’s decision on which ESG metrics to report on (elaborated in Image 1 below):

Step 3. Apply an Industry-Specific Lens to Choose the Right Metrics & Sustainability Frameworks

Once the context is established in Step 2, PE firms can then apply an industry-level lens to selecting decision-useful ESG metrics. This can be done by first identifying the relevant industries across your firm’s value chain, and then leveraging the SASB Materiality Finder (now part of the IFRS ISSB Standards) to help you quickly find the ESG metrics & disclosure topics that are material to your and your PortCo’s industry. To gain a deeper understanding on choosing the right metrics & frameworks for your specific use-case, read Part 3 of our CSF series, or book a free consultation with our team.

While Steps 1-3 are useful to GPs who are starting their ESG journey, they are just one part of the equation. You can develop a great ESG strategy and policy and still not be able to operationalize it fully. This is what most PE firms struggle with (Accenture). According to an Accenture Survey, most executives feel ill prepared to meet upcoming reporting and compliance requirements, with only 1 out of 3 European investment managers and 1 out of 5 North American investment managers reporting being confident about ESG integration in their fund’s practices and policies. Oftentimes, GPs find themselves committing valuable time and resources to obtain and measure ESG data from their PortCos and end up spreading themselves thin.

To learn more about how you can address this conundrum, read Part 3 of our CSF Series.

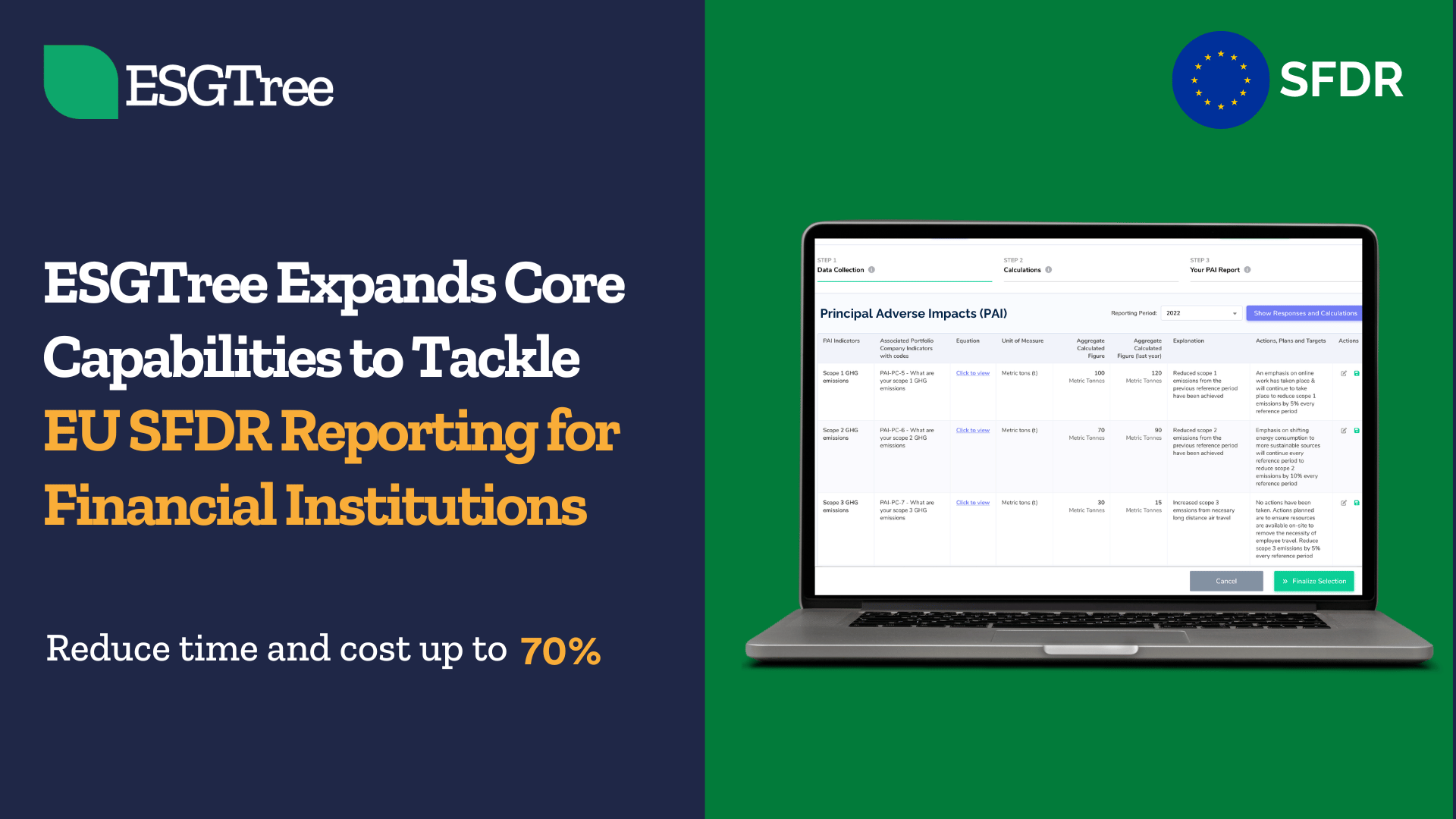

SFDR Reporting Solution for Financial Institutions

Guiding Financial Institutions on the Path to Net Zero

ESGTree Expands Core Capabilities to Tackle EU SFDR Reporting for Financial Institutions

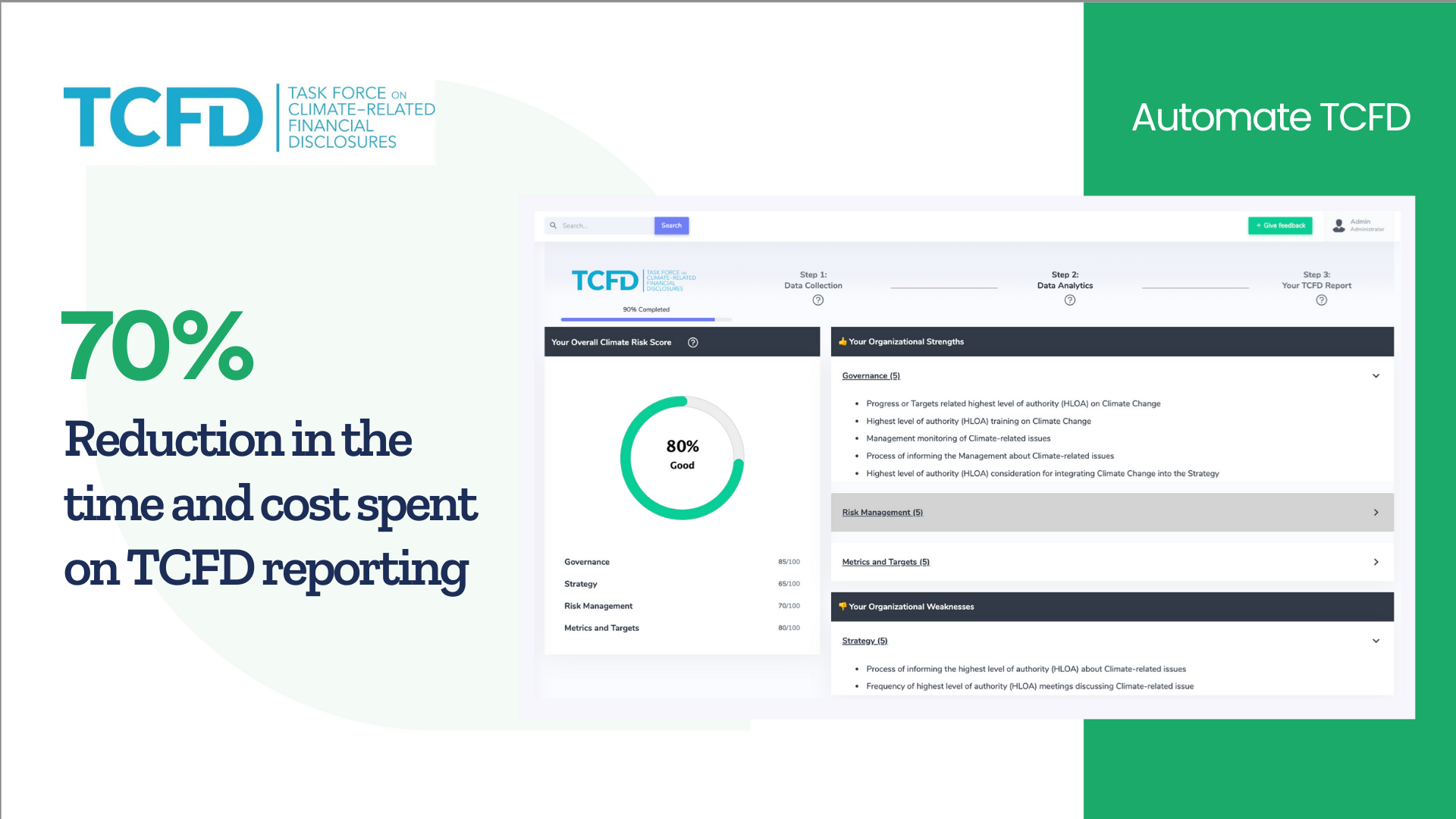

ESGTree Elevates Financial Institutions’ Climate Resilience with TCFD Reporting SaaS Solution

Contact Us

Office Addresses

Canada: ESGTree, CPA 4th Floor, 140 West mount Rd N, Waterloo,

ON N2L 3G6, Canada

United Kingdom: ESGTree, 33 Queen Street, London EC4R 1AP, United Kingdom