Tech, Teams, and Tactics: A Complete Approach to ESG Data Management in Private Equity

Share:

The Private Markets ESG Data Collection Conundrum

Table of Contents

Private market investors face 3 major inefficiencies when it comes to ESG data collection:

1) Manual Processes:

Private market firms often rely on manual ESG data collection processes, which usually consists of:

- Spreadsheets or static data collection documents

- Fragmented ESG Data sources (e.g. sustainability reports, employee handbooks, policy documents) that are difficult to extract, scrape, and aggregate data from.

- Several data contributors across the organization, leading to data validation issues

- Manual Data-sharing via email, leading to version control issues

With the growing number of investor data requests and ESG regulatory requirements, sustainability teams are becoming resource strapped, making these manual processes redundant.

2) Low Data Coverage Rates from portfolio entities, mainly because of:

- Fragmented Data Ownership: Since different PortCos have different internal structures, it can be unclear who is responsible for managing ESG data. For example, some data may be under the responsibility of the finance team, while others could be with HR or compliance departments. This fragmentation not only complicates the data collection process but also creates delays in obtaining accurate ESG metrics across the portfolio.

- Limited Understanding of ESG Importance: PortCos will often deprioritize ESG data collection if they don’t see ESG as a value-driver, leading to incomplete or delayed reporting.

3) Lack of Standardization in ESG Metrics & Benchmarking:

While initiatives like the ESG Data Convergence Initiative (EDCI) and ILPA’s Diversity In Action (DIA) are standardizing ESG metrics in the Private Markets to a large extent, custom investor KPIs and the evolving nature of ESG standards make it difficult to consolidate and compare ESG data across portfolios.

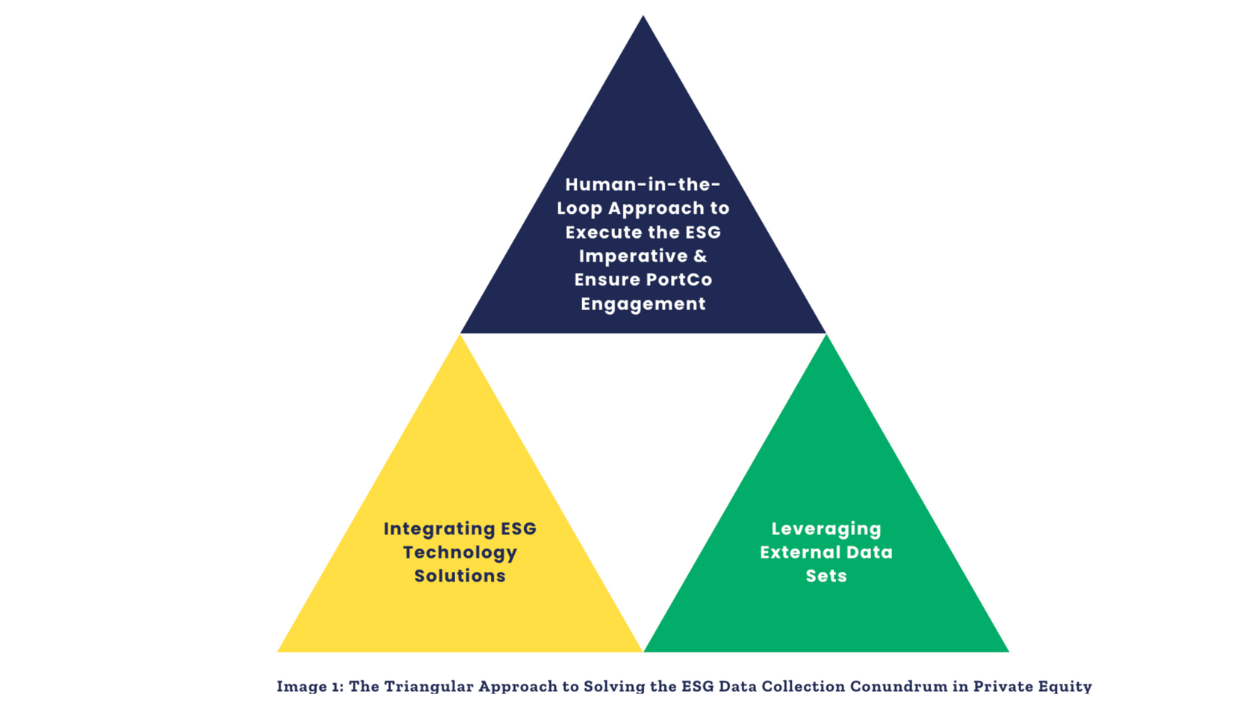

A Triangular Approach to ESG Data Management for Private Equity

1) Human-in-the-Loop Approach & Portfolio Engagement

The demand for talent with the expertise to collect, analyze, and report on ESG data is on the rise, and PE firms are investing in sustainability teams to build internal capacity. However, this alone is not enough to improve data quality and coverage rates. You can have a skilled sustainability team to operationalize the ESG imperative, but if your PortCos don’t recognize the strategic value of ESG, data submissions and engagement will be low.

What the Market has shown us:

- Effective ESG data collection hinges on PortCo buy-in, particularly from senior leadership.

- GPs are implementing targeted strategies to build PortCo awareness and engagement:

- Allocating Sustainability Champions: Some GPs are assigning dedicated ESG champions who actively work with PortCos to showcase the financial and long-term value of ESG integration. By fostering a collaborative relationship, these champions can support PortCos in understanding how ESG performance aligns with strategic business goals.

- Annual Refresher Sessions: GPs are organizing annual workshops and refresher sessions to educate PortCo leadership and staff on the evolving importance of ESG. These sessions can cover the latest regulatory requirements, industry benchmarks, and potential cost savings or revenue growth opportunities tied to ESG initiatives.

- Incentivizing ESG Goals: Some firms are even exploring financial incentives/recognition programs for PortCos that meet or exceed ESG benchmarks, creating a direct link between data collection efforts and positive outcomes.

While these efforts can improve response rates from portfolio entities, they cannot effectively address the inefficiencies associated with ESG data collection. In fact, PE firms are realizing that sustainability teams and PortCo engagement are just one part of the solution to the private markets ESG data collection conundrum.

While these efforts can improve response rates from portfolio entities, they cannot effectively address the inefficiencies associated with ESG data collection. In fact, PE firms are realizing that sustainability teams and PortCo engagement are just one part of the solution to the private markets ESG data collection conundrum.

2) Combining Technology with Human Teams

More recently, we’ve seen GPs adopt a hybrid approach, where sustainability teams/roles are supplemented by ESG management and reporting solutions that optimize the entire data collection and reporting process.

What the Market has shown us:

- This hybrid approach mitigates the inefficiencies around ESG data collection and lowers the barriers to PortCo data submission by:

- Automating Manual Processes such as data entry, KPI tracking, and version control,

- Centralizing Fragmented Data Sources into one system, where PortCos can directly upload documents, spreadsheets, and reports, and auto-extract key ESG metrics and calculations via in-built scraping tools,

- Facilitating cross-departmental communication through in-built collaboration tools that allow sustainability teams to effectively coordinate with PortCos, including all the technical, regulatory, and knowledge-sharing support required for the reporting journey.

- Quality Improvements in ESG Reporting Practices and Coverage Rates can Translate into an ESG Premium: Building internal capacity in this way will likely lead to quality improvements in GPs’ ESG reporting practices, increasing their chances of capturing an ESG premium during fundraising and/or exits (PwC).

3) Leveraging External Data Sets

While the hybrid approach above provides a strong foundation for collecting quality ESG data, leveraging external data sets brings the entire process full circle. GPs increasingly view external data sources as an essential component of ESG reporting, as they not only complement internal data but also provide sector-specific and geographic benchmarks, offering a comprehensive view of portfolio-level ESG performance. For instance, if a GP wants to assess its PortCos’ carbon emissions, it can use industry- and region-specific data on carbon outputs to establish meaningful performance benchmarks. By integrating external data in this way, GPs and PortCos gain a comparative framework, allowing them to evaluate where they stand relative to industry standards and peer metrics.

Clearly, solving the private markets’ ESG data collection conundrum demands a multi-faceted, triangular approach that integrates technology, skilled sustainability teams, and external data sets. By taking decisive steps now, private market players can transform ESG from a compliance exercise into a powerful catalyst for long-term value creation and sustainable growth.

- If you are looking for support, we can connect you to one of our ESG experts for a complimentary consultation, and get you started on your ESG journey today.

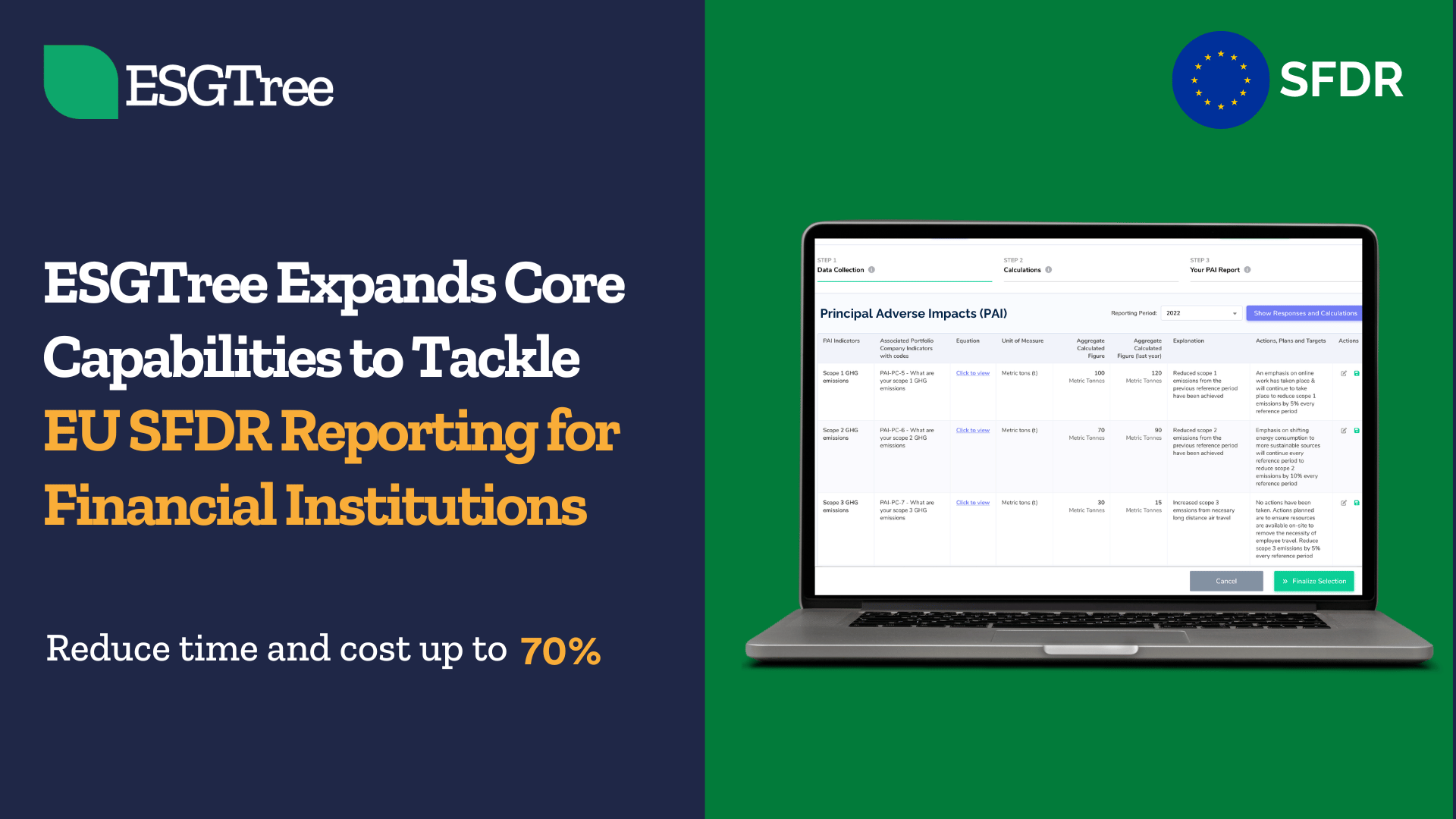

SFDR Reporting Solution for Financial Institutions

Podcast: Winning ESG Integration Strategies for GPs

Guiding Financial Institutions on the Path to Net Zero

ESGTree Expands Core Capabilities to Tackle EU SFDR Reporting for Financial Institutions

Contact Us

Office Addresses

Canada: ESGTree, CPA 4th Floor, 140 West mount Rd N, Waterloo,

ON N2L 3G6, Canada

United Kingdom: ESGTree, 33 Queen Street, London EC4R 1AP, United Kingdom