The Inflation Reduction Act of 2022: A Summary of its Climate and Energy-Related Provisions

Share:

Signing the 730-page Inflation Reduction Act into law last month was by no means inevitable.

The bill passed muster in the United States Senate only by the slimmest of margins, itself a pared down version of what was originally envisioned as a $2 trillion dollar climate spending law. Nevertheless, the US climate bill, as it is colloquially known (about 85% of it focuses on climate), has been heralded as a genuine gamechanger, described as both “sweeping” and “historic” in most media commentary.

In a nutshell, the Inflation Reduction Act is a $737 billion law focusing on healthcare, taxes and the environment. It aims to lower drug prices for American consumers, increase corporate tax, and provide $369 billion in spending on clean energy, environmental justice initiatives, and cutting greenhouse gas emissions – potentially by 40% below 2005 levels by decade’s end, according to some estimates.

The bill has also faced some criticism from environmental groups over certain concessions to the fossil fuel industry. It links renewable energy and fossil fuels together by prohibiting the leasing of land for wind and solar projects without first leasing land for oil and gas ones. It also guarantees drilling opportunities in Alaska and the Gulf of Mexico (the Biden administration had previously curtailed offshore drilling).

To understand the scope of this massive bill, a summary of key climate and clean energy-related clauses pertaining to industry and economy is provided below. *

Reducing Carbon Emissions

The bill focuses on reducing carbon output across all sectors of the American economy by providing:

- $30 billion in grants and loans for states and utilities companies to accelerate their transition to clean energy

- $27 billion towards accelerating the deployment of clean technologies

- $9 billion for federal procurement of domestically produced clean technologies

- $6 billion towards reducing emissions in the industrial manufacturing sector

- Tax credits for the usage of clean energy sources and their storage, for clean fuels and clean commercial vehicles, and for reduction of emissions from industrial manufacturing

- A Methane Reduction Programme to reduce leaks from natural gas production and distribution

The protocol provides guidelines for reporting on the emissions of the seven greenhouse gases listed under the Kyoto Protocol: carbon dioxide, methane, nitrous oxide, hydrofluorocarbons, perfluorocarbons, sulphur hexafluoride and nitrogen trifluoride. Of these, carbon dioxide is by far the most emitted greenhouse gas as a result of human activity.

Clean Energy Transition

The bill devotes $60 billion to support domestic renewable energy manufacture across the supply chain. Provisions include:

- $30 billion in tax credits to support the manufacture of solar panels, wind turbines, batteries, and the processing of minerals critical for such purposes

- $20 billion in loans to build country-wide clean vehicle manufacturing facilities

- $10 billion in investment tax credit to build clean energy manufacturing facilities (e.g., factories making electric vehicles or solar panels)

- $2 billion in grants to retool auto manufacturing facilities to equip them to build clean vehicles

- $2 billion towards national energy research

- $500 million towards the Defense Production Act for heat pumps and processing of critical minerals

Environmental Justice and Supporting Rural Communities

The bill will spend $60 billion on initiatives supporting those disproportionately affected by climate change. Key initiatives include:

- $3 billion in grants to community-led projects addressing climate-change related public health issues (e.g., communities disproportionately affected by pollution)

- $3 billion towards reducing air pollution at ports by procuring zero-emissions technology

- $3billion to support neighbourhood safety, equity and accessibility programs

- $1 billion to buy clean heavy-duty vehicles such as school buses and garbage trucks

In addition to the $60 billion, further funding is allocated towards developing clean energy in rural communities and protecting the natural environment. This includes:

- $20 billion (roughly) to bolster sustainable agricultural practices

- $5 billion for forest conservation efforts

- $4 billion to combat drought in the nation’s west

- $2.6 billion for coastal habitat restoration efforts

- Grants and tax credits to support the production of biofuels

To do this, the Partnership for Carbon Accounting Financials (PCAF) was launched in 2019. Conceived by financial institutions, this industry-led framework condenses and standardizes the collection, assessment and reporting of financed emissions.

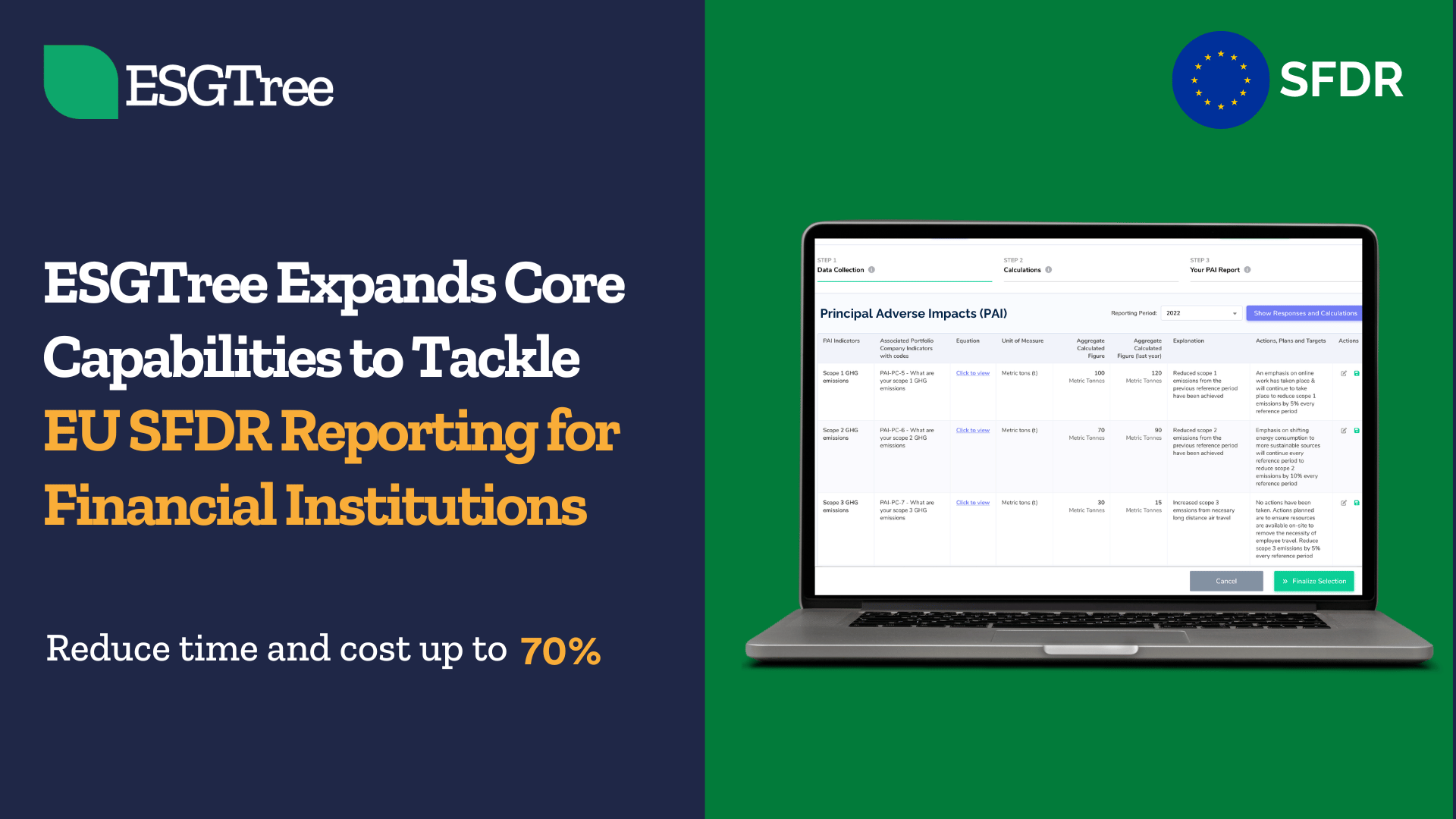

ESGTree’s automation of the PCAF framework simplifies this process by allowing companies to input basic activity related information to calculate their carbon emissions across all scopes while providing investors with figures and analytics for financed emissions of their portfolio. ESGTree is currently working with Canadian banks to automate their PCAF data collection, analysis, and reporting.

Fossil Fuels

The Inflation Reduction Act also contains provisions on the fossil fuel industry that both support and constrain it. These include:

- Federal lands and offshore waters cannot be leased for renewable energy projects without also providing space for fossil fuel projects

- Funding is provided to the industry to monitor air pollution

- Incentives are provided to install carbon capture and efficiency-related solutions

- Fees are imposed for natural gas extraction and methane leaks

Who might benefit the most from the Inflation Reduction Act?

Industries that look to benefit from the climate bill include renewable energy, electric vehicles, and mineral/lithium extraction (e.g., for batteries).

Canada’s energy and mining sectors also look to benefit. Canada may also be incentivized to play “climate catch up” with the US, which formerly seemed to lag behind on global efforts to combat climate change and bolster greener economies.

The Climate Bill and ESG Reporting

Given the millions of dollars of investment into the green energy transition, one wonders what mechanisms for accountability could be put in place for companies involved in this transition. One answer might be the US Securities and Exchange Commission (SEC) proposal to mandate climate reporting for public companies, aligned with Taskforce on Climate-related Financial Disclosures (TCFD) recommendations.

An aspect of both the climate bill, as well as TCFD reporting, is attention to greenhouse gas emissions. This means both investors and organizations must be able to collect and analyze hard data around emissions and other metrics and targets – and strategize around it. Tools that streamline and simplify this process, such as ESGTree Carbon Calculator, will become increasingly necessary as ESG regulation continues to solidify around the world.

While the Inflation Reduction Act is indeed a huge victory in the effort to ‘green’ the American economy, it does not exist in a vacuum. While not an ESG bill per se, it certainly compliments global efforts to enhance and standardize ESG compliance.

ESGTree provides powerful data solutions to help private equity (PE) and venture capital (VC) firms gather, collect, analyze, benchmark and report their ESG data and that of their portfolio companies. Our carbon calculator, customizable and automated ESG frameworks, multi-level report viewing, trends analysis dashboard, and other features aim to make ESG a value creation tool rather than a reporting burden.