Why ESGTree? - Differences that Make a Difference

Share:

The Triad that Differentiates ESGTree from Competitors

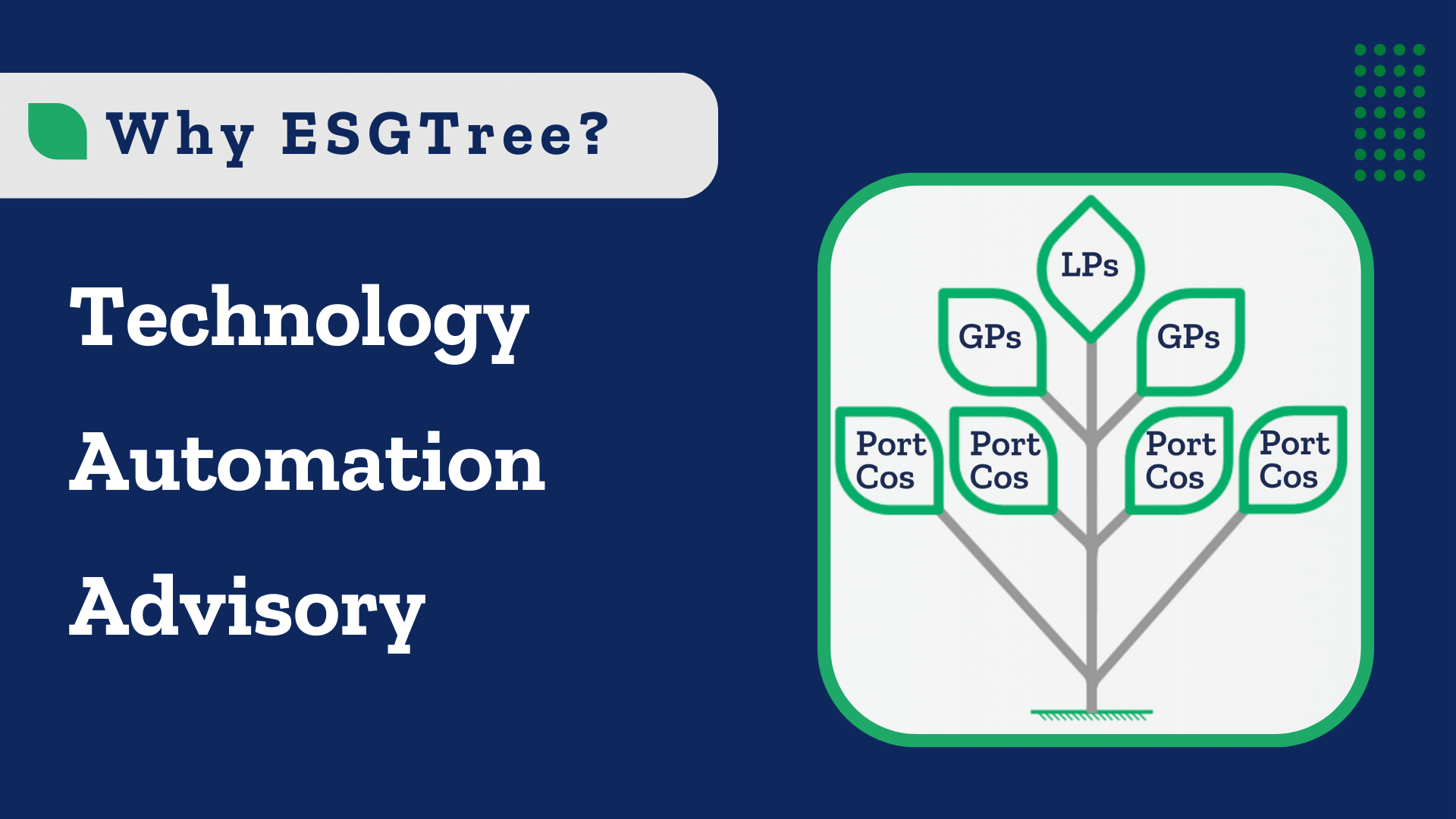

Over the past four years, one of the most common questions we get is: What differentiates ESGTree from its competitors? A stellar product and relentless drive to improve customer experience may sound like cliched answers, so we’ve put together three additional core features that set us apart from our competitors:

1. Purpose built for private market investors:

Our entire tech stack and back-end/front-end is purpose-built for the private investor use case e.g., our three-tier database structure allows seamless data aggregation and analytics upwards from portfolio companies to General Partners (GPs) to Limited Partners (LPs) in real-time without any customization required. This platform also provides access, as needed, to Environment, Social, and governance (ESG) teams, deal teams, and partners at the firm level to ensure alignment at all levels. This is just one example of our ‘built for purpose’ approach.

2. Seasoned ESG & Impact Founding Team:

Our Founding team collectively has over 20 years of experience working with over two dozen Private Equity (PE) firms on ESG/impact strategy and reporting prior to launching ESGTree. We are seasoned ESG professionals who decided to build technology for solutions we had been implementing for many years. Owing to our ESG and impact backgrounds, we are familiar with the developments and nuances of ESG’s evolution since the early 2000s.

3. Continuous engagement and innovation to meet industry needs:

As a company that was built organically with a product, customer, and revenue focus, we are already profitable and debt-free in our fourth year of operation. We are not under pressure to scale and sell assembly line / off-the-shelf products. We have the time and interest to customize our solutions in a way that they provide real solutions for real problems. ESG needs are slowly converging onto major standards, but firms still have unique needs driven by boards, management, LPs and compliance needs, which are particular to their business. We are not only okay with addressing these nuances but are passionate about them as they contribute towards the continuous growth and innovation of our platform.

ESGTree Features:

Our unique ESG scorecards, benchmarking tool, and carbon calculation software serve a diverse set of private equity firms. Thanks to the Platform Features below, we have been able to position ESG as a value-creation exercise rather than a reporting burden:

- Automated data collection with portfolio-level access & aggregation capabilities

- Company-specific ESG scorecards to provide value creation for portfolio companies

- Simplified greenhouse gas emissions calculator

- Multi-level trends analysis and visualizations by indicator, framework, and reporting periods

- Client success support from ESG experts

- Ready-to-implement framework automation including SASB, IRIS+, TCFD, EDCI, PCAF, SFDR and DEI.

- Industry benchmarking against a dataset of 10,000+ companies

- Purpose-built to streamline ESG reporting and collaboration for Limited Partners (LPs), General Partners (GPs) and portfolio companies.

Our Clients

We have helped a number of financial institutions automate their ESG and carbon emissions data monitoring through our cloud-based system. Today, our system analyzes data for over 2,000 corporations on their way to Net Zero.

Reach out to us today at [email protected] to accelerate your journey to net zero.

“ESGTree is great at helping to bring management teams on the same page. We view the ESGTree system and team as more of an extension of our company rather than a Software provider.“

Director, Investor Relationships at ICV Partners

ESGTree provides powerful data solutions to help private equity (PE) and venture capital (VC) firms gather, collect, analyze, benchmark and report their ESG data and that of their portfolio companies. Our carbon calculator, customizable and automated ESG frameworks, multi-level report viewing, trends analysis dashboard, and other features aimed to make ESG a value creation tool rather than a reporting burden.

With ESGTree, save the time and cost of ESG reporting by harnessing the power of the cloud and streamlining ESG data collection, analysis and disclosure.

For more information on the ESGTree’s ESG Reporting Solution, please contact us at :

or

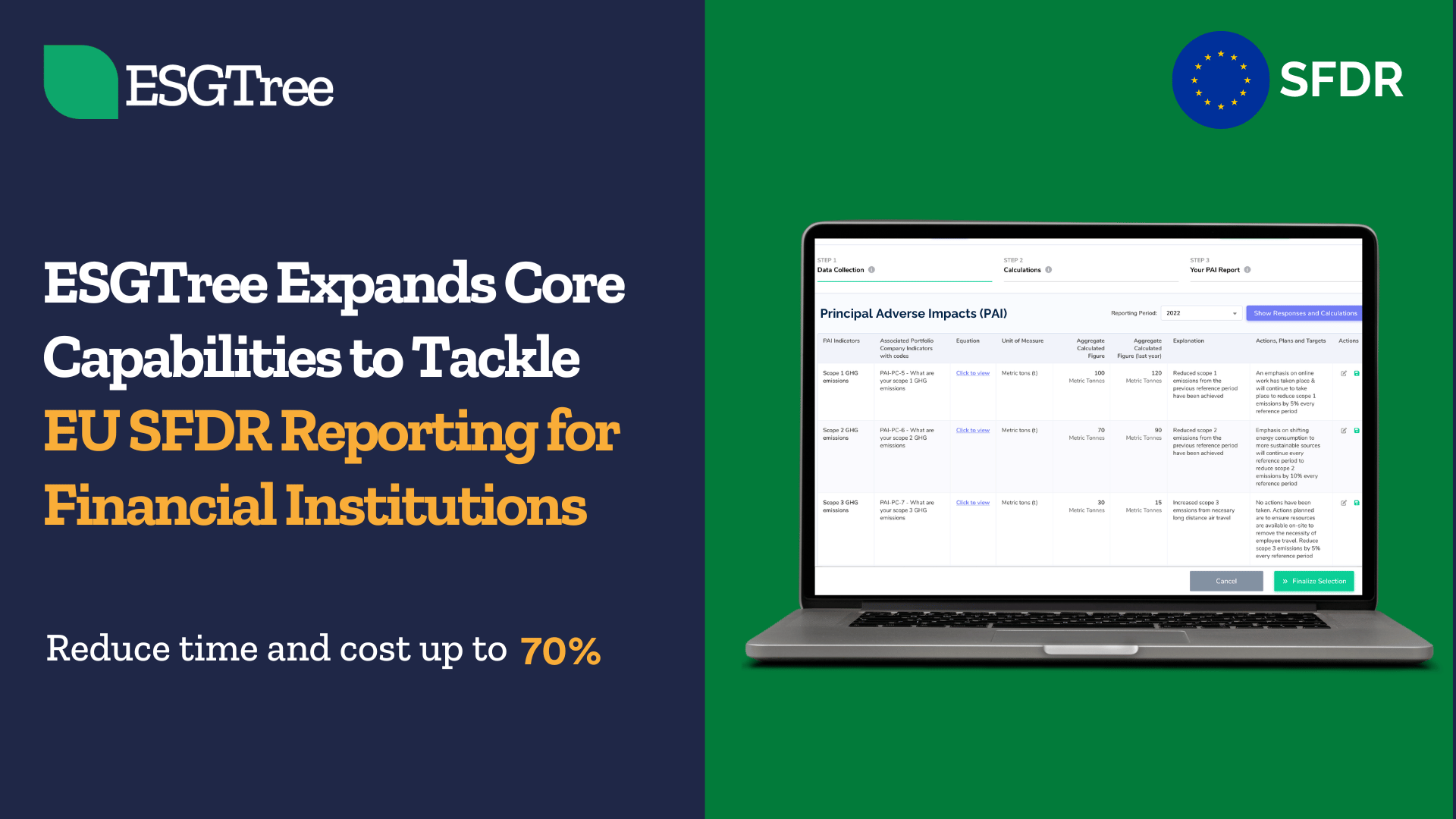

SFDR Reporting Solution for Financial Institutions

Podcast: Winning ESG Integration Strategies for GPs

Guiding Financial Institutions on the Path to Net Zero

ESGTree Expands Core Capabilities to Tackle EU SFDR Reporting for Financial Institutions

Contact Us

Office Addresses

Canada: ESGTree, CPA 4th Floor, 140 West mount Rd N, Waterloo,

ON N2L 3G6, Canada

United Kingdom: ESGTree, 33 Queen Street, London EC4R 1AP, United Kingdom