Guiding Financial Institutions on the Path to Net Zero

Share:

ESGTree is a cloud-based Environment, Social and Governance (ESG) data management and reporting platform for financial institutions. Our Carbon Calculator and automated climate reporting software are just some of the many features of our fully integrated platform. Our customizable technology, paired with industry-leading advisory services, provide our clients with the necessary tools to become leaders in the transition to net zero.

The Challenge For Financial Institutions

As ESG legislation tightens globally, financial firms are pushed to go beyond simply reviewing the greenhouse gas (GHG) emissions they generate. This means measuring, disclosing, and minimizing the emissions generated by portfolio companies, suppliers, properties and investments. Financial institutions will now have to contend with large spreads of data in an ever-evolving regulatory landscape.

ESGTrees’s 360° Carbon Footprint and Climate Disclosure Solution

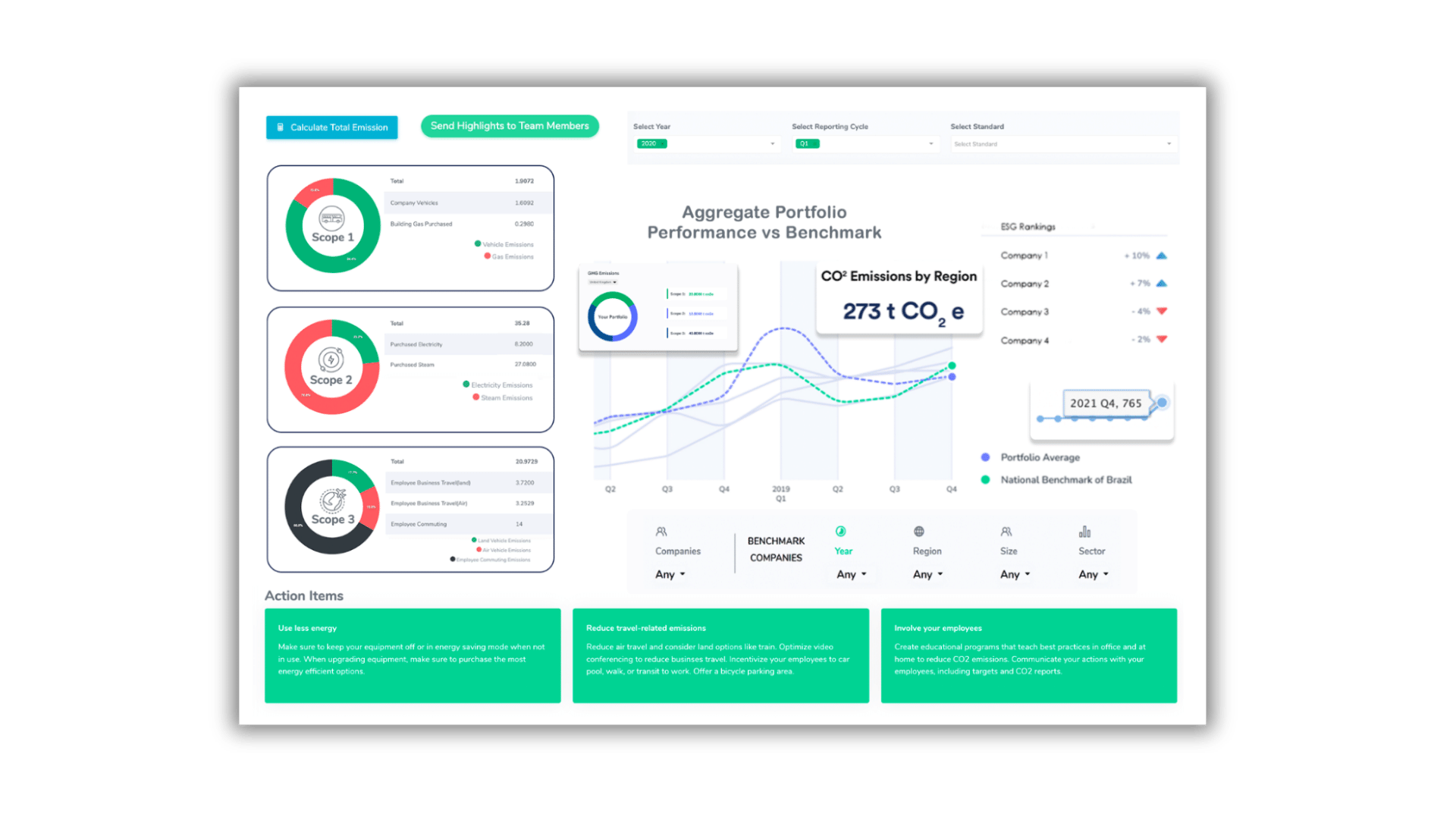

ESGTree is purpose-built to solve these pressing challenges. Our globally recognised technology platform has enabled some of the largest businesses in the world to measure, manage, report, and minimize their environmental footprint across their value chain. Turn theory into practice with our proprietary Carbon Calculator and numerous automated ESG reporting frameworks, including:

ESGTree Features

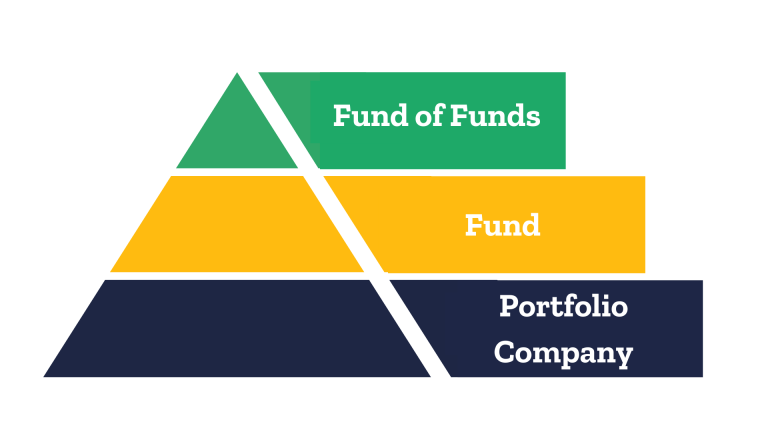

Multi-Level Data Governance

Our platform allows for data governance at three levels, so whether you’re a Fund of Funds, a Fund, or a Portfolio Company, you will have access to the dashboards and analytics that are relevant to you.

Map Carbon Emissions Across the Entire Value Chain

Our Carbon Calculator enables users to map out Scope 1, 2, and 3 GHG emissions for their firms and portfolio companies. Small and Medium sized-Enterprises (SMEs) especially appreciate our seamless Carbon Calculator as it reduces calculation time by 70%, making it a frontrunner in the market for carbon calculation. This, along with our built-in step-by-step reporting guides, collaboration tools, intelligent notifications and comprehensive industry benchmarks, transforms an ESG reporting burden into a value-creation endeavour across the entire value chain

Industry Leading Frameworks and Standards

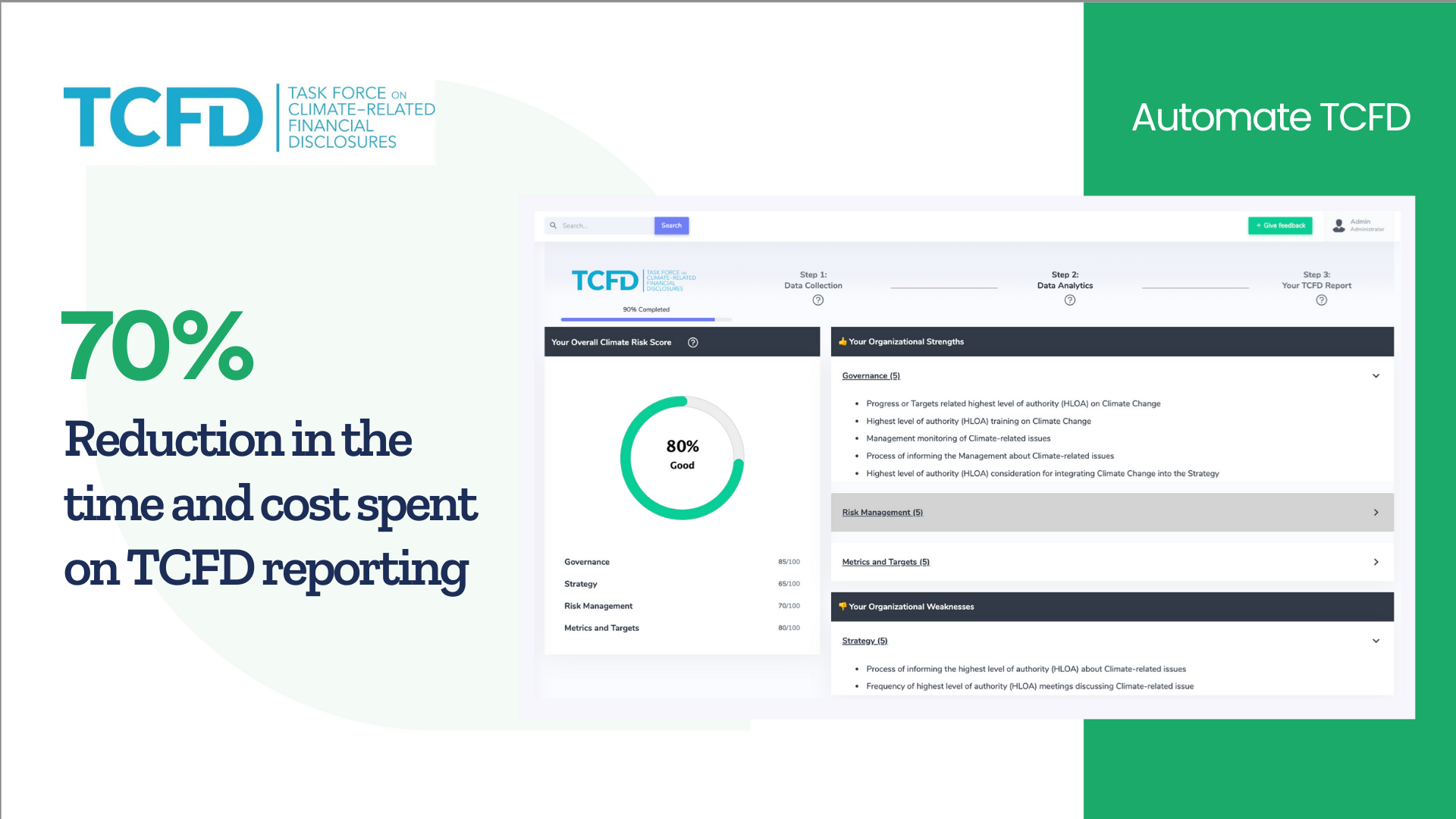

In addition to our Carbon Calculator, our platform automates climate disclosure frameworks such as TCFD (Task Force on Climate-Related Financial Disclosure) and PCAF (Partnership for Carbon Accounting Financials).

- TCFD: allows organizations to understand and report on their climate-related risks and opportunities. Regulators worldwide are increasingly calling to mandate TCFD-aligned disclosures.

- PCAF: enables financial institutions to standardize the collection, assessment and reporting of GHG emissions associated with their loans and investments

ESGTree is the only platform globally to have automated narrative TCFD report generation into a seamless process based on answering 40 multiple-choice questions.

Chart the Path to Net Zero

With ESGTree, you save the time and cost of ESG reporting by harnessing the power of the cloud, streamlining ESG data collection, analysis and disclosure, and availing our Advisory Services to guide you every step of the way.

- Conduct comprehensive carbon footprint assessments

- Develop our clients’ internal capacities

- Identify emission reduction opportunities with our Net Zero Roadmaps, and

- Determine the feasibility of implementing these opportunities

Our analytics dashboard then ensures measurable progress towards the client’s ESG goals.

Given the international buy-in and legislative action around TCFD, we strongly advise adding the TCFD framework to your climate action plan. By acting now, you can stay ahead of the regulatory curve and minimize transition risk as the world moves towards a lower carbon economy.

The ESGTree Difference

Understanding Data Challenges

Our clients range from large institutions with $200B+ in assets under management, to SMEs and impact investors. This diversity allows us to solve a wide range of data-related challenges, keeping us on the frontline of innovation in the industry.

“ESGTree is great at helping to bring management teams on the same page. We view the ESGTree system and team as more of an extension of our company rather than a Software provider.”

Director, Investor Relationships at ICV Partners

ESGTree Features:

- Automated data collection with portfolio-level access & aggregation capabilities

- Company-specific ESG scorecards to provide value creation for portfolio companies

- Simplified greenhouse gas emissions calculator

- Multi-level trends analysis and visualizations by indicator, framework, and reporting periods

- Client success support from ESG experts

- Ready-to-implement framework automation including SASB, IRIS+, TCFD, EDCI, PCAF, SFDR and DEI.

- Industry benchmarking against a dataset of 10,000+ companies

- Purpose-built to streamline ESG reporting and collaboration for Limited Partners (LPs), General Partners (GPs) and portfolio companies.

Our Clients

We have helped a number of financial institutions automate their ESG and carbon emissions data monitoring through our cloud-based system. Today, our system analyzes data for over 2,000 corporations on their way to Net Zero.

Reach out to us today at [email protected] to accelerate your journey to net zero.

ESGTree provides powerful data solutions to help private equity (PE) and venture capital (VC) firms gather, collect, analyze, benchmark and report their ESG data and that of their portfolio companies. Our carbon calculator, customizable and automated ESG frameworks, multi-level report viewing, trends analysis dashboard, and other features aimed to make ESG a value creation tool rather than a reporting burden.

With ESGTree, save the time and cost of ESG reporting by harnessing the power of the cloud and streamlining ESG data collection, analysis and disclosure.

For more information on the ESGTree’s ESG Reporting Solution, please contact us at :

or

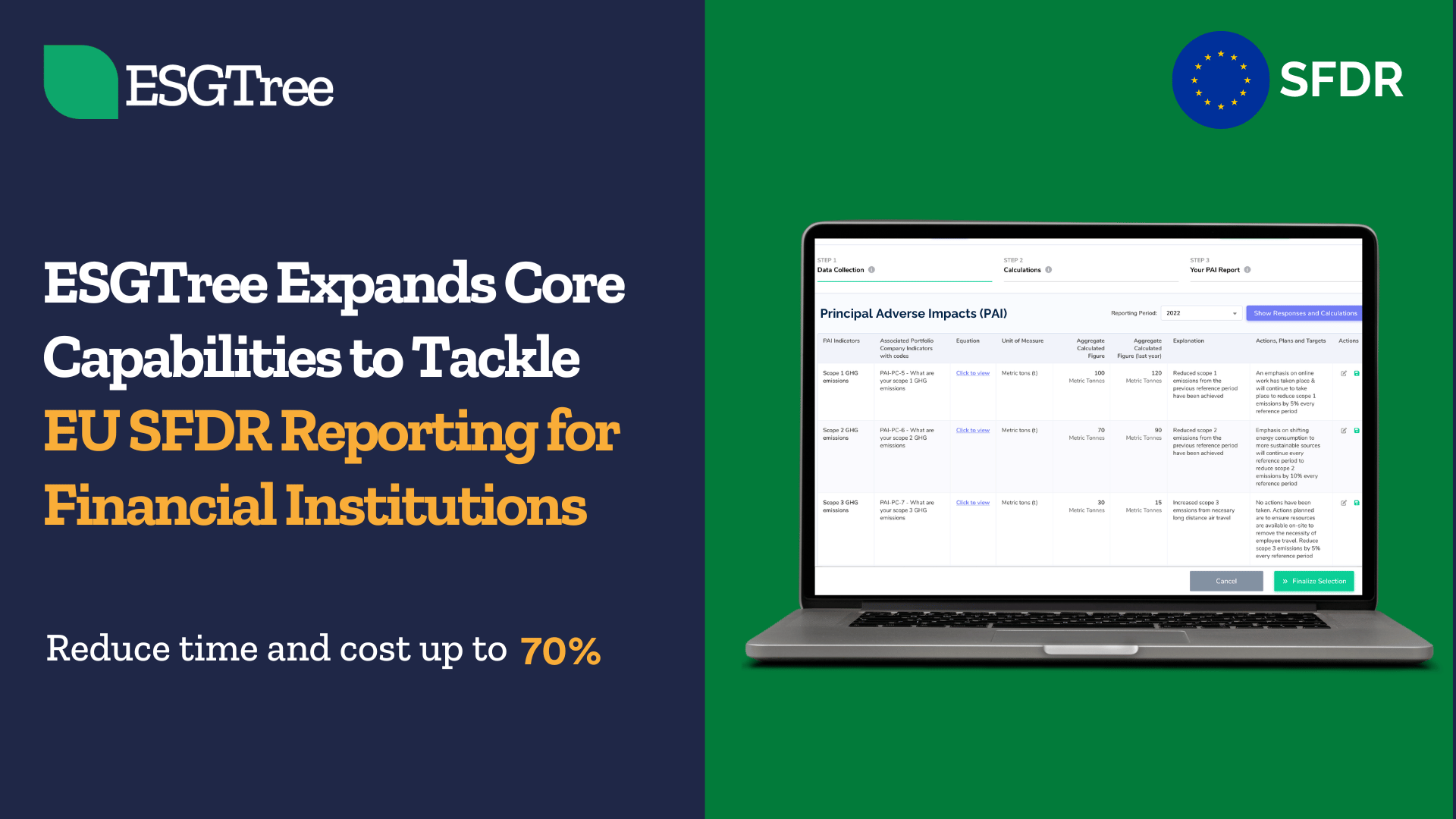

SFDR Reporting Solution for Financial Institutions

Guiding Financial Institutions on the Path to Net Zero

ESGTree Expands Core Capabilities to Tackle EU SFDR Reporting for Financial Institutions

ESGTree Elevates Financial Institutions’ Climate Resilience with TCFD Reporting SaaS Solution

Contact Us

Office Addresses

Canada: ESGTree, CPA 4th Floor, 140 West mount Rd N, Waterloo,

ON N2L 3G6, Canada

United Kingdom: ESGTree, 33 Queen Street, London EC4R 1AP, United Kingdom