Critical Factors Driving ESG Integration in Private Equity

Share:

The Private Equity (PE) Market has seen greater adoption for Environment, Social, & Governance (ESG) in these past four years than ever before. Factors such as changing investor priorities and rising pressure from regulators have fueled this paradigm shift and, while the tide has not unilaterally turned, sustainability is no longer a fringe concern. Today, PE firms are highly motivated to integrate ESG considerations at the firm & portfolio company (PortCo) levels, primarily because of:

Factor 1: Investor (LP) Priorities - ESG Reporting & ESG Integration:

What the Market has Shown Us:

- GPs globally are reporting a rise in Limited Partner (LP) requests for ESG data in Due Diligence Questionnaires (DDQs) as it provides crucial insight into how a company is responding to emerging societal and climate risks.

- According to a report from the Principles for Responsible Investment (PRI), over 80% of Private Equity Investors (i.e. LPs) now consider ESG factors central to their investment decisions; in 2021 alone, half of the total fundraising flowed into firms with formal ESG policies, underscoring its growing importance in private markets. In fact, our experience with PE clients has confirmed that LPs are now applying sophisticated scoring mechanisms to score current & potential fund manager’s performance on ESG, further influencing future fundraising allocations.

- GPs are now seeing entire acquisitions fall through because the PortCo that they were exiting from did not have an ESG Policy at par with market standards. The fact that more than 70% of mergers and acquisitions (M&A) leaders (Deloitte) and 93% of LPs (Bain) report withdrawing from potential acquisition deals over ESG and sustainability concerns, further substantiates this.

- In some cases, LPs are even placing ESG data collection conditions on their investment commitments, leaving GPs with no choice but to comply. Our PE clients are sharing that a frequent LP requirement during fundraising is the commitment for portfolio level ESG data collection by the GP.

- According to a PwC Survey, LPs are willing to absorb between 5% and 9% in management fees if there are quality improvements in their GPs’ ESG data reporting practices. ‘Quality improvements’ encompass: 1) improvements in a PE firms’ and its PortCos’ data coverage & data accuracy, 2) access to trends & visualizations for analysis at both the firm and PortCo levels, and 3) benchmarked ESG data to evaluate performance against a set sustainability metrics relative to peers.

Factor 2: Evolving Regulatory Requirements - ESG Compliance & ESG Integration:

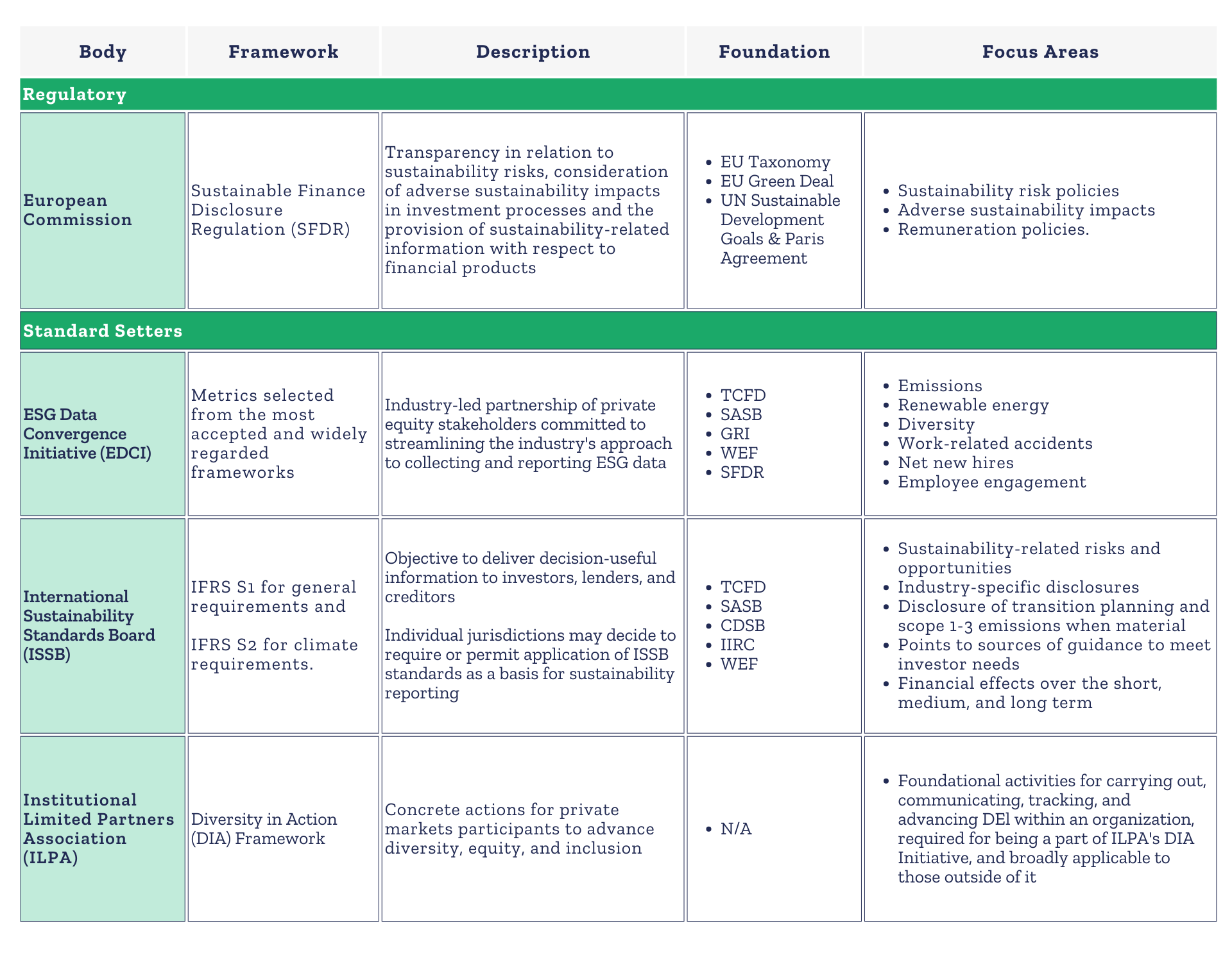

Globally, regulators are demanding greater transparency around how companies and funds incorporate ESG considerations and address sustainability concerns and, in response, GPs are exploring how to report on new requirements from regulations such as the Sustainable Finance Disclosure Regulation (SFDR) and the Corporate Sustainability Reporting Directive (CSRD). Despite their efforts, GPs continue to feel the pressure of the evolving regulatory landscape; according to a 2024 Accenture Survey, most respondents did not yet feel ready to meet many of the new regulatory requirements, with only 22% reporting being well prepared to disclose on climate-related risks and opportunities, and only 10% reporting being well prepared to meet these reporting requirements in all sustainability areas such as resource use and circularity. This, along with the fact that GPs globally are expecting an increase in mandatory disclosures over the next three years, builds a strong case for PE firms to prioritize:

- Understanding the impact of existing and emerging mandates across their value chain, and

- Taking the critical steps required for effective firm-wide ESG integration, ESG reporting, & ESG compliance. (See table 1 below for a snapshot of the most relevant ESG Regulations & Standards for PE firms today):

Challenges to ESG Integration

Evidently, LPs and GPs recognize sustainability as a strong value driver but, despite evolutions in regulation and investor priorities, sustainability still isn’t mainstream. This is because:

- ESG encompasses a wide array of topics, from climate change and sustainability to diversity, human rights, consumer protection, and corporate governance. Depending on specific circumstances, certain ESG factors may greatly influence PortCos and funds, while others may not. Because of this, GPs struggle to prioritize which ESG metrics to report on at all levels (The Metrics Working Group – SMI Private Equity Task Force).

- Mid-market PE firms with less than $1 Billion in AuM have limited data collection, analysis, and aggregation capabilities at the Fund Level: LPs are requesting for ESG data at multiple levels, including the PE firm itself, its PortCos aggregated data, and individual PortCo level data. Additionally, this data becomes difficult to compare if all industries and companies are placed in the same peer group.(The Metrics Working Group – SMI Private Equity Task Force).

- It is difficult for PE firms to collect complete, consistent, and reliable ESG data: GPs must commit valuable time and resources to obtain and measure ESG data from PortCos. The ability to collect ESG data is driven by whether the PortCo has the ability to prepare requested data, as well as the PE firm’s influence and degree of control over the PortCo. Even having a controlling interest does not mean the PE firm controls the day-to-day activities of a PortCo or has direct access to the required information. (The Metrics Working Group – SMI Private Equity Task Force).

Take the first step to tackling these challenges by reading Part 2 of our Critical Success Factors Series for ESG Integration in PE Firms

To learn more about how you can effectively address these challenges and what resources you can use for best-in-class ESG reporting & compliance, sign-up for our newsletter below and read our 4-Part Critical Success Factor Series for ESG Integration in Mid-Market PE Firms.

About ESGTree

ESGTree provides powerful data solutions to help private equity (PE) and venture capital (VC) firms gather, collect, analyze, benchmark and report their ESG data and that of their portfolio companies. Our carbon calculator, customizable and automated ESG frameworks, multi-level report viewing, trends analysis dashboard, and other features aimed to make ESG a value creation tool rather than a reporting burden.

With ESGTree, save the time and cost of ESG reporting by harnessing the power of the cloud and streamlining ESG data collection, analysis and disclosure.

For more information on the ESGTree’s ESG Reporting Solution, please contact us at :

or

SFDR Reporting Solution for Financial Institutions

Guiding Financial Institutions on the Path to Net Zero

ESGTree Expands Core Capabilities to Tackle EU SFDR Reporting for Financial Institutions

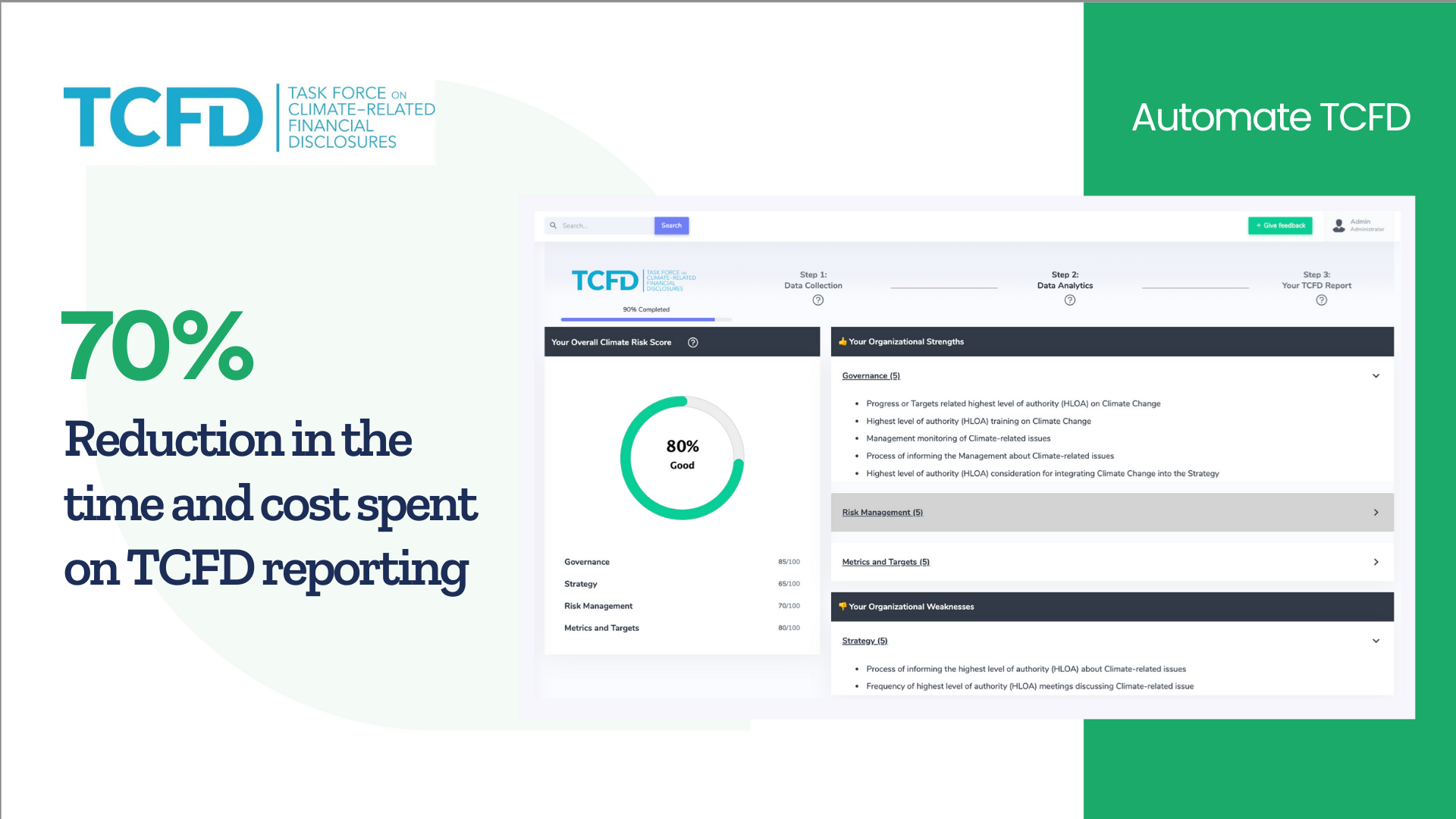

ESGTree Elevates Financial Institutions’ Climate Resilience with TCFD Reporting SaaS Solution

Contact Us

Office Addresses

Canada: ESGTree, CPA 4th Floor, 140 West mount Rd N, Waterloo,

ON N2L 3G6, Canada

United Kingdom: ESGTree, 33 Queen Street, London EC4R 1AP, United Kingdom