How GPs Can Meet ESG Integration Goals by Choosing Decision-Useful Sustainability Metrics

Share:

The Private Equity (PE) market has seen greater adoption of Environment, Social, & Governance (ESG) in the past four years than ever before. Factors such as changing investor priorities and rising pressure from regulators have fueled this shift and, while the tide has not unilaterally turned, sustainability is no longer a fringe concern.

In this article for GPs, we address the two major ESG pain points experienced by Mid-Market PE firms, namely:

- Choosing which ESG metrics to prioritize and report at all levels, and

- How to collect complete, consistent, and reliable ESG data

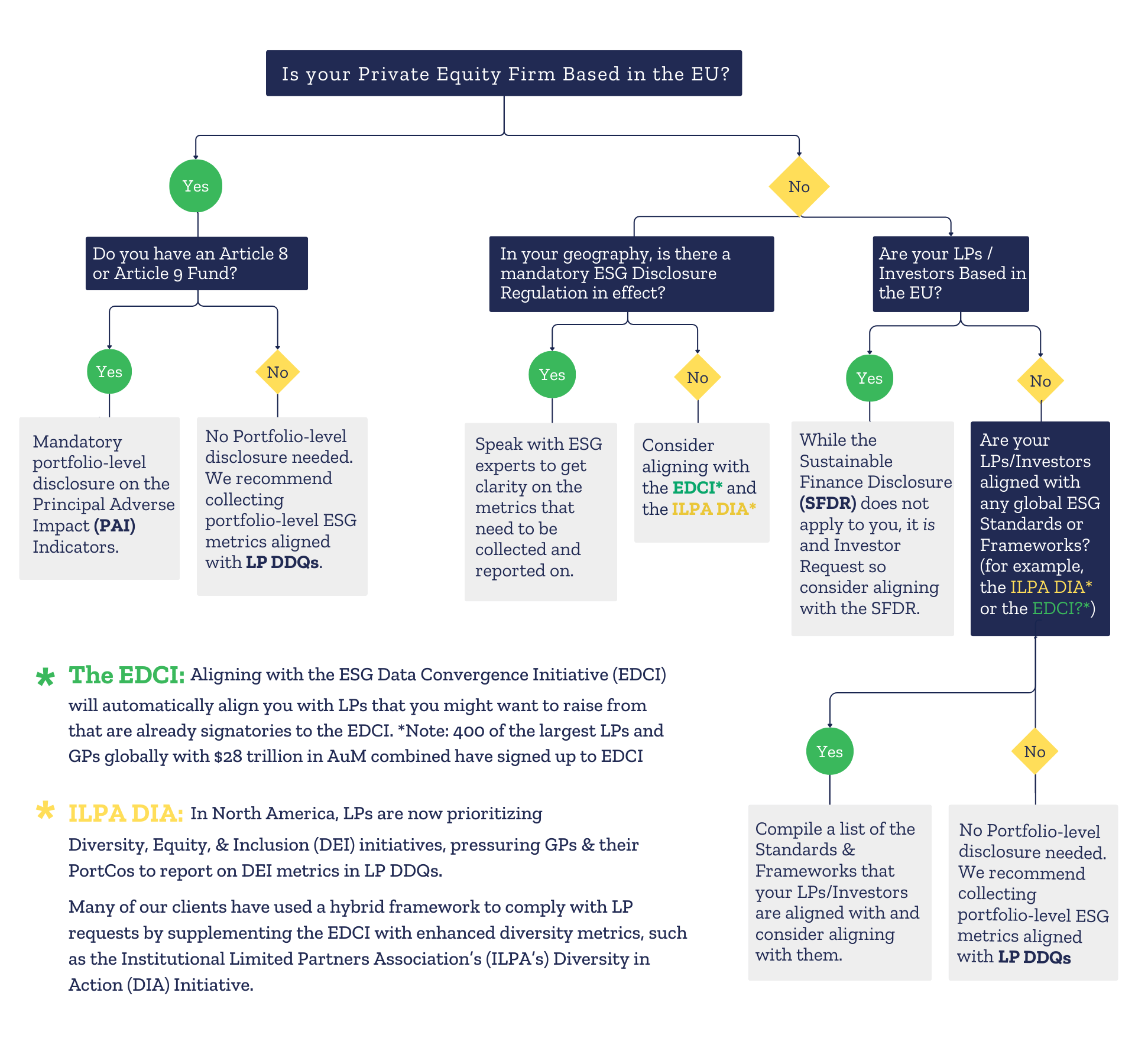

We’ve also embedded a Decision Tree below to help GPs assess which regulations and sustainability standards apply to their specific use-case.

Choosing Decision-Useful Sustainability Metrics to Meet Your ESG Goals

A. What the Market has Shown Us:

- ESG encompasses a wide array of topics, from climate change and sustainability to diversity, human rights, consumer protection, and corporate governance. Depending on specific circumstances, certain ESG factors may greatly influence PortCos and funds, while others may not. Because of this, GPs struggle to prioritize which ESG metrics to report on at all levels (The Metrics Working Group – SMI Private Equity Task Force).

- Meanwhile, Limited Partner (LP) priorities and regulatory requirements are putting pressure on PE firms to build more sophisticated data collection and reporting capabilities. This can be an overwhelming process for GPs of mid-market PE firms, who consistently report lacking internal resources for handling ESG data collection and needing guidance around ESG data collection methods (read our Industry Report on GP Sentiments around LP Data Requests to learn more). In short, mid-market PE firms (specifically those with < $1 Billion in AUM) struggle to collect complete, consistent, and reliable ESG data.

B. Why Does it Matter?

Identifying the type of ESG data that needs to be collected is critical to investment analysis and PortCo management. Today, ESG metrics have become highly relevant because:

- LPs now use them to monitor progress on ESG for invested funds and underlying PortCos,

- PE Firms (GPs) need them for compliance with evolving sustainability regulations and LP demands

- Deal Teams now rely on them (along with financial and operational metrics) during Due Diligence for investment decisions, and

- PortCos use them to drive action and become more transparent among their stakeholders (customers, boards, GPs). Since PortCos are usually the main source of data for most ESG metrics, a major point of interest for GPs is maximizing ESG data coverage from their PortCos. However, materiality factors such as geography and regulation, ownership and influence, and investor data requests makes this acomplex goal to achieve.

What Can You do?

Step 1: Conduct the Preliminary Assessments in CSF Part 2 (Steps 2-3)

- During this assessment phase, GPs should look into how Geography & Regulation will influence the ESG metrics they select for their firm and PortCos. Unfortunately, this can be a challenging task for Mid-Market PE firms; according to a 2024 Accenture Survey, most GPs did not feel ready to meet many of the new regulatory requirements. This, along with the fact that GPs globally are expecting an increase in mandatory disclosures over the next three years, builds a strong case for PE firms to prioritize understanding the impact of existing and emerging mandates across their value chain.

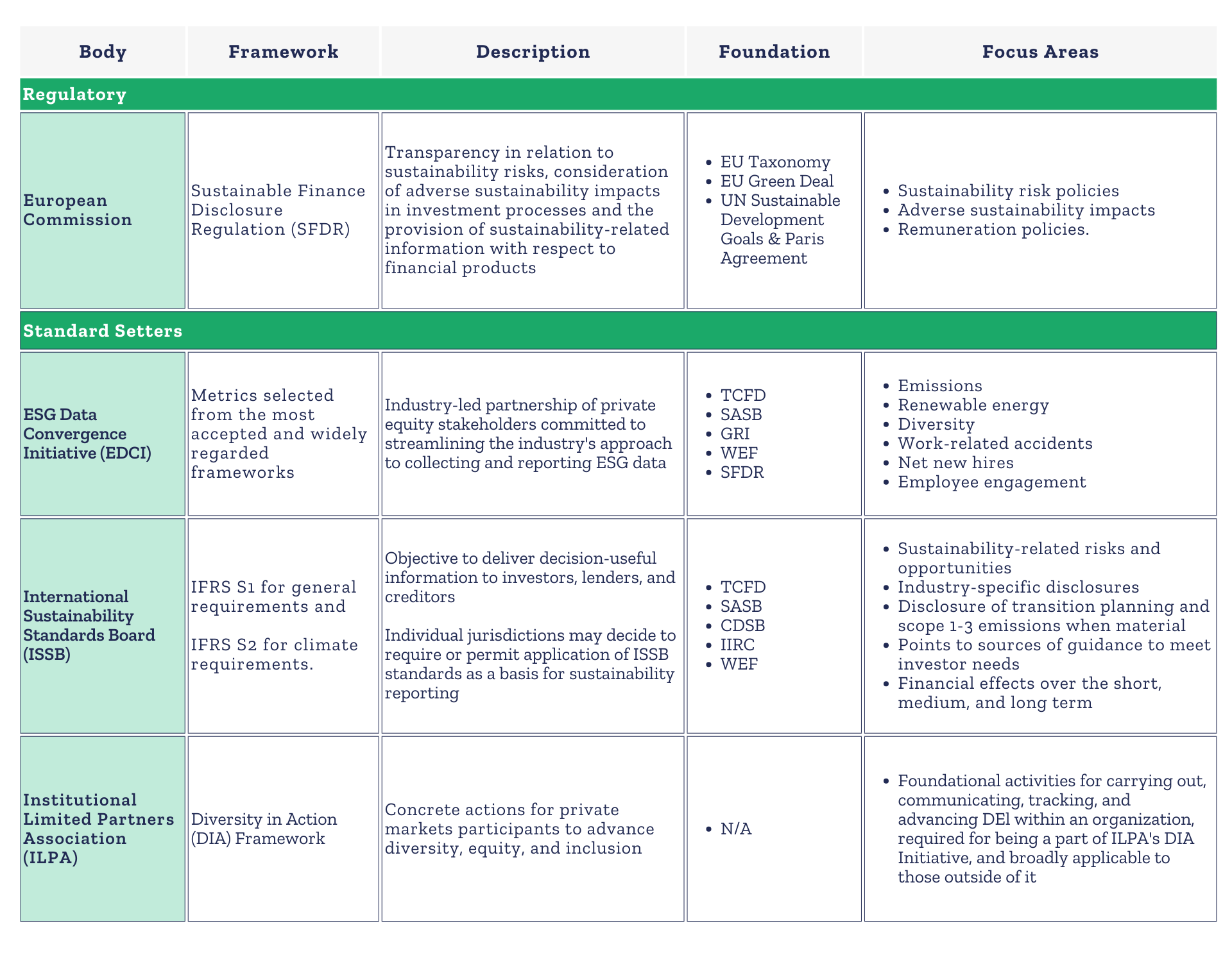

- Our table below does exactly that, providing an overview of the most relevant ESG disclosure regulations and standards for Private Markets, as of 2024.

Step 2: Choose ESG Metrics Specific to Your Use-Case by Using Our Decision Tree Below:

In parallel, consider aligning your firm and PortCos with the global baseline for sustainability reporting, i.e. the IFRS ISSB Sustainability Disclosure Standards. These Standards also contain the SASB Materiality Finder that can further help you identify decision-useful and industry-specific ESG metrics for reporting.

While Steps 1-2 are useful to GPs who are starting their ESG journey, they are just one part of the equation. GPs can have a solid understanding of the ESG metrics material to their use-case and still not be equipped to operationalize ESG reporting. This is what most PE firms struggle with (Accenture). According to an Accenture Survey, most executives feel ill prepared to meet upcoming reporting and compliance requirements, with only one out of three European investment managers and one out of five North American investment managers reporting being confident about ESG integration in their fund’s practices and policies. To tackle the conundrum of operationalization, you can:

Step 3: Invest in ESG Resources for Best-in-Class ESG Reporting and Compliance

Normally, smaller PE firms don’t have a designated Head of ESG, so ESG is often housed under Finance, Compliance, or Investor Relations. Even in cases where PE firms have a Head of ESG, they will be supported by at least one resource tasked with manually creating templates for ESG KPIs, sending those KPIs to PortCos, liaising with them, trying to get data back, version control, and then making sense of this data. As LP and regulatory requests get more sophisticated and complex, these manual processes become untenable. One of the ways that this can be solved without increasing headcount is by automating this process with a technology platform that offers implementation support at the PortCo level.

To learn more about operationalizing sustainability for firm-wide ESG integration, read our CSF part #4

SFDR Reporting Solution for Financial Institutions

Guiding Financial Institutions on the Path to Net Zero

ESGTree Expands Core Capabilities to Tackle EU SFDR Reporting for Financial Institutions

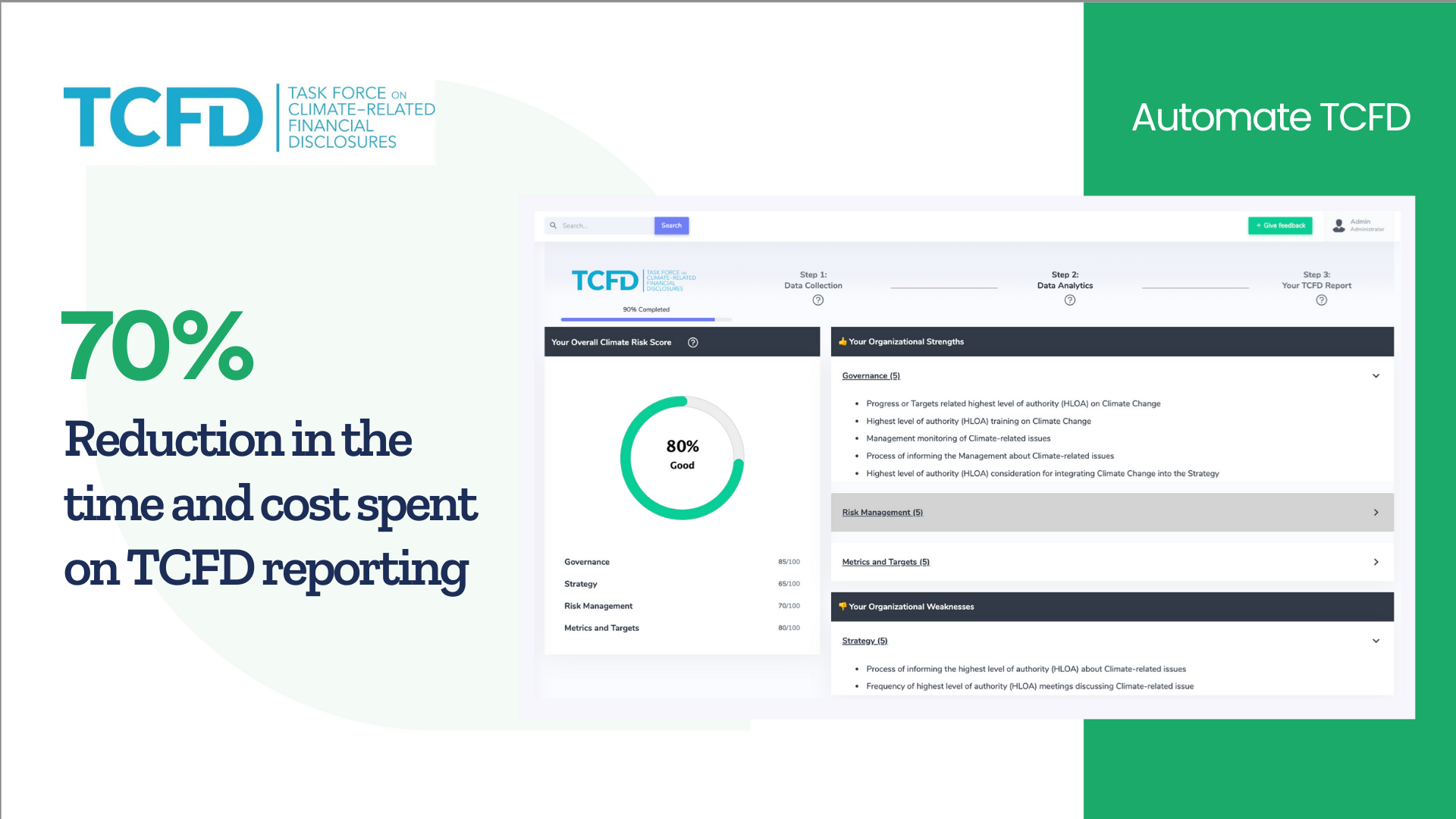

ESGTree Elevates Financial Institutions’ Climate Resilience with TCFD Reporting SaaS Solution

Contact Us

Office Addresses

Canada: ESGTree, CPA 4th Floor, 140 West mount Rd N, Waterloo,

ON N2L 3G6, Canada

United Kingdom: ESGTree, 33 Queen Street, London EC4R 1AP, United Kingdom